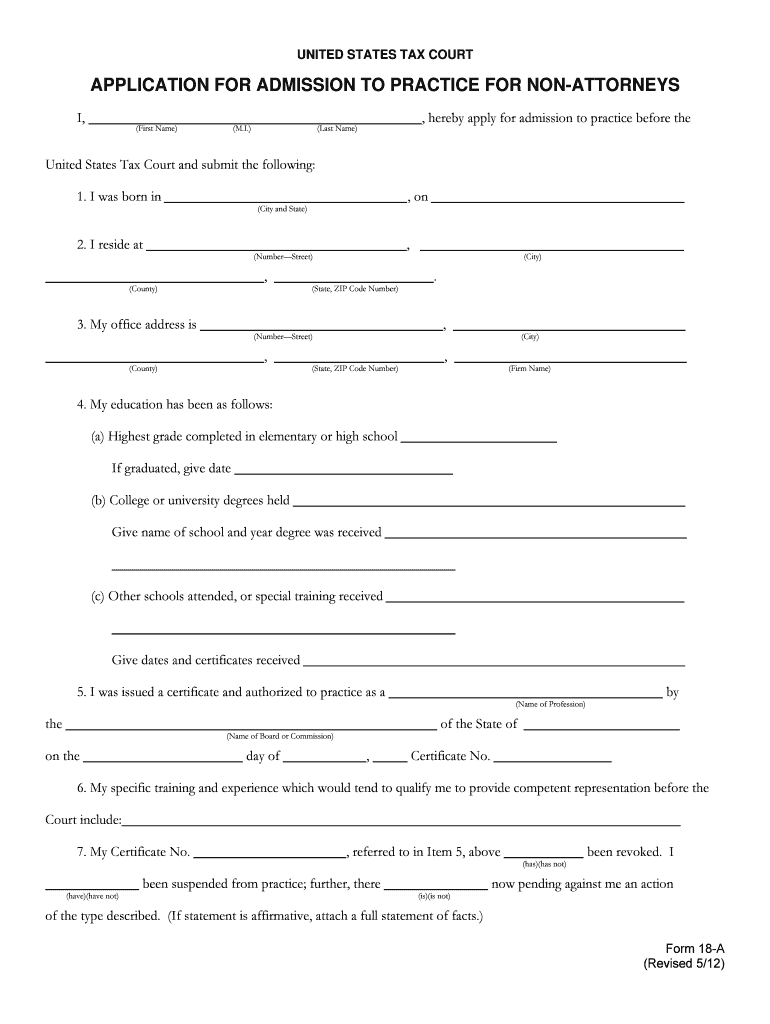

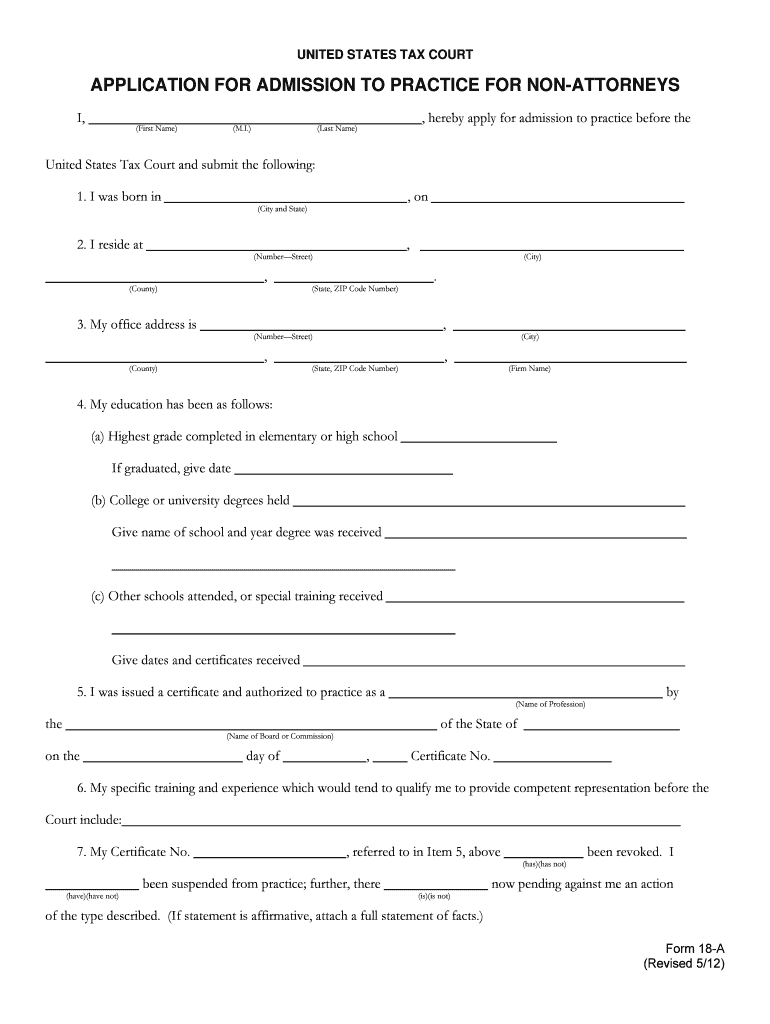

Get the free Application for Admission to Practice for Non-Attorneys - ustaxcourt

Show details

This document outlines the process and requirements for non-attorneys seeking admission to practice before the United States Tax Court, including application procedures, examination details, and relevant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for admission to

Edit your application for admission to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for admission to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for admission to online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for admission to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for admission to

How to fill out Application for Admission to Practice for Non-Attorneys

01

Obtain the Application for Admission to Practice for Non-Attorneys from the relevant authority or website.

02

Carefully read the instructions provided with the application form.

03

Fill in your personal information accurately, including your name, address, and contact details.

04

Provide any required identification numbers, such as a social security number or tax ID.

05

Complete sections related to your educational background and professional experience as required.

06

Include any necessary supporting documents, such as transcripts or letters of recommendation.

07

Review the application for completeness and accuracy before submission.

08

Submit the completed application form according to the specified guidelines, either online or by mail.

09

Pay any associated application fees as required.

Who needs Application for Admission to Practice for Non-Attorneys?

01

Individuals seeking to practice in a legal capacity without being a licensed attorney.

02

Paralegals or legal professionals who want to assist with legal services.

03

Applicants required to submit the form for specific legal tasks or roles within an organization.

Fill

form

: Try Risk Free

People Also Ask about

Who can practice before the US tax court?

Even if you are not a member of any bar, it is still possible to practice before the Tax Court using the second path which is available to non-attorneys. This path requires submission of an application and a fee as well but also requires the applicant to take a test.

Can CPA practice before Tax Court?

Non-Attorney CPA Admission to the U.S. Tax Court Under the Tax Court Rules ofPractice and Procedure, non-attorneys can receive admission to practice before the Tax Court.

Can a CPA practice before the IRS?

Unlimited representation rights: Enrolled agents, certified public accountants, and attorneys have unlimited representation rights before the IRS. Tax professionals with these credentials may represent their clients on any matters including audits, payment/collection issues, and appeals.

Who can petition the Tax Court?

Who can file a petition with the Tax Court? Anyone can file a petition who has received: A notice of deficiency, A notice of determination, or.

Who can practice in a Tax Court?

Even if you are not a member of any bar, it is still possible to practice before the Tax Court using the second path which is available to non-attorneys. This path requires submission of an application and a fee as well but also requires the applicant to take a test.

Who can practice in US tax court?

USTCP US Tax Court Practitioners Non Attorney Enrolled Agents, along with Attorneys and CPAs, are the only tax professionals with unlimited representation rights, meaning they can represent any client on any matter before the IRS.

Can a CPA practice before the tax court?

Non-Attorney CPA Admission to the U.S. Tax Court Under the Tax Court Rules ofPractice and Procedure, non-attorneys can receive admission to practice before the Tax Court.

Who can represent in US tax court?

Trials are conducted before one judge, without a jury, and taxpayers are permitted to represent themselves if they desire. Taxpayers may be represented by practitioners admitted to the bar of the Tax Court. Most cases are settled by mutual agreement without trial.

Who can practice in front of the IRS?

Unlimited representation rights: Enrolled agents, certified public accountants, and attorneys have unlimited representation rights before the IRS. Tax professionals with these credentials may represent their clients on any matters including audits, payment/collection issues, and appeals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Admission to Practice for Non-Attorneys?

The Application for Admission to Practice for Non-Attorneys is a form required for individuals who wish to represent clients in legal matters without holding a law degree or being a licensed attorney.

Who is required to file Application for Admission to Practice for Non-Attorneys?

Individuals who are not licensed attorneys but seek to represent clients in specific legal proceedings or matters are required to file this application.

How to fill out Application for Admission to Practice for Non-Attorneys?

To fill out the Application for Admission to Practice for Non-Attorneys, applicants must provide personal information, disclose any previous legal or professional qualifications, and possibly submit supporting documentation as specified by the governing legal body.

What is the purpose of Application for Admission to Practice for Non-Attorneys?

The purpose of the Application for Admission to Practice for Non-Attorneys is to ensure that individuals representing clients in legal matters meet specific standards, thereby protecting the interests of the public and maintaining the integrity of the legal profession.

What information must be reported on Application for Admission to Practice for Non-Attorneys?

Applicants must report personal details such as name, contact information, previous legal experience, any disciplinary history, and other relevant qualifications that support their application to practice.

Fill out your application for admission to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Admission To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.