Get the free Form 8275-R - irs ustreas

Show details

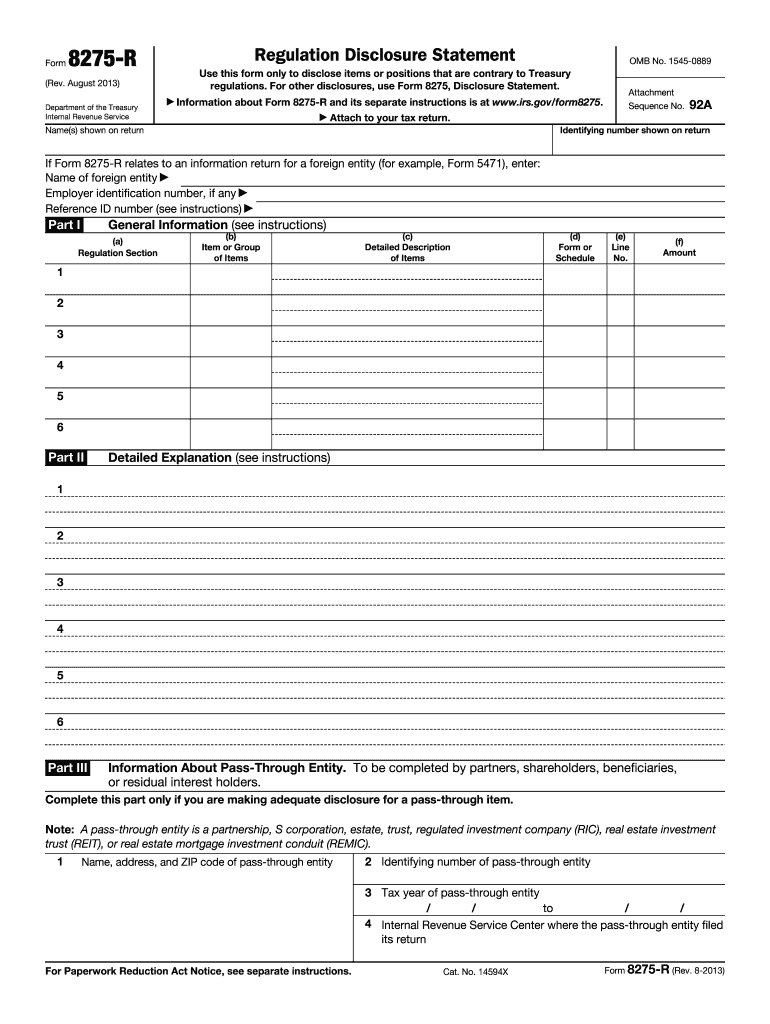

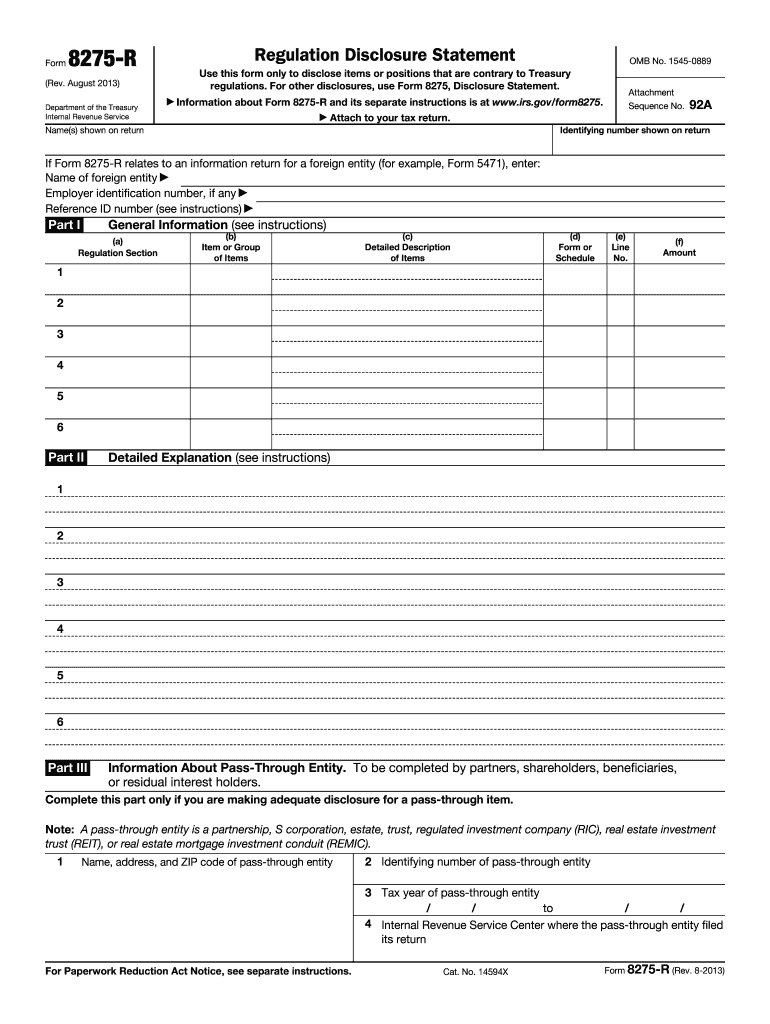

This form is used to disclose items or positions that are contrary to Treasury regulations specifically for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8275-r - irs

Edit your form 8275-r - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8275-r - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8275-r - irs online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8275-r - irs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8275-r - irs

How to fill out Form 8275-R

01

Begin by downloading Form 8275-R from the IRS website.

02

Provide your name, address, and social security number at the top of the form.

03

In Part I, state the tax return you are filing and the tax year.

04

In Part II, outline the relevant facts of the item or position you are disclosing.

05

In Part III, indicate the legal authority or references supporting your position.

06

Complete any applicable sections related to the specific issues you are addressing.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the form along with your tax return.

Who needs Form 8275-R?

01

Taxpayers who wish to disclose positions taken on their tax return that may be contrary to IRS regulations.

02

Taxpayers seeking to avoid penalties by proactively disclosing uncertainty regarding tax positions.

Fill

form

: Try Risk Free

People Also Ask about

Can form 8275 be filed electronically?

If you want to include the Form 8275 with your tax return, the return can only be printed and mailed, it cannot be e-filed.

Who must file the IRS form 8275?

Taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Who fills out form 8825?

Partnerships and S corporations use Form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts.

What is the difference between form 8275 and 8275 R?

Instead of Form 8275-R, use Form 8275, Disclosure Statement, for the disclosure of items or positions which are not contrary to regulations but which are not otherwise adequately disclosed. Form 8275-R is filed by individuals, corporations, pass-through entities, and tax return preparers.

What is the purpose of the mandatory disclosure form?

Mandatory disclosure forms are legal documents that require individuals and entities to disclose certain information as required by law. These forms vary depending on the specific regulations governing the disclosure requirements as well as jurisdiction.

What is IRS form 8275 used for?

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Can federal gift tax returns be filed electronically?

You cannot e-file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. The Instructions for Form 709 direct you to mail it to the applicable address listed below.

What is the purpose of IRS form 8275?

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Who must file IRS form 8995?

Form 8995 is the IRS tax form that owners of pass-through entities—sole proprietorships, partnerships, LLCs, or S corporations—use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8275-R?

Form 8275-R is a document used by taxpayers to disclose their positions on certain tax issues to avoid penalties for underpayment or noncompliance.

Who is required to file Form 8275-R?

Taxpayers who have taken a tax position that could be challenged by the IRS, especially if this position is contrary to existing IRS regulations or guidelines, are required to file Form 8275-R.

How to fill out Form 8275-R?

To fill out Form 8275-R, taxpayers must provide their identifying information, describe the tax position being taken, explain why it is justified, and include any relevant facts supporting their position.

What is the purpose of Form 8275-R?

The purpose of Form 8275-R is to disclose information about certain tax positions taken by taxpayers in order to minimize penalties and protect against assertions of tax deficiencies by the IRS.

What information must be reported on Form 8275-R?

Form 8275-R requires taxpayers to report their name, address, taxpayer identification number, the specific tax issue, a detailed description of the tax position, and any supporting facts or legal authority.

Fill out your form 8275-r - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8275-R - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.