Get the free Form 8734 - Support Schedule for Advance Ruling Period - irs ustreas

Show details

This IRS form is used by organizations to report their financial data and support for the advance ruling period, needed to maintain their tax-exempt status. It assists in determining public support

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8734 - support

Edit your form 8734 - support form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8734 - support form via URL. You can also download, print, or export forms to your preferred cloud storage service.

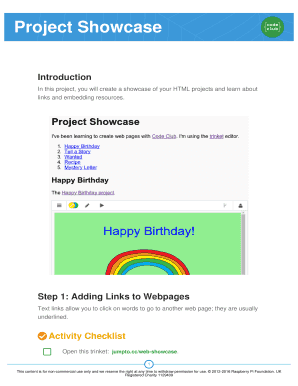

How to edit form 8734 - support online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8734 - support. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8734 - support

How to fill out Form 8734 - Support Schedule for Advance Ruling Period

01

Obtain Form 8734 from the IRS website or the relevant tax authority.

02

Read the instructions carefully to ensure understanding of the requirements.

03

Fill out the organization’s name and address at the top of the form.

04

Provide the Employer Identification Number (EIN) of the organization.

05

Indicate the tax year for which you are requesting the advance ruling.

06

Complete the sections detailing the organization's activities and finances for the advance ruling period.

07

Report the total support received during the period, including cash and non-cash contributions.

08

Include schedules or attachments as required to support the information provided.

09

Review the form for accuracy and completeness before submission.

10

Submit the completed Form 8734 to the appropriate IRS address as indicated in the instructions.

Who needs Form 8734 - Support Schedule for Advance Ruling Period?

01

Organizations seeking a determination of their qualification for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code during the advance ruling period.

Fill

form

: Try Risk Free

People Also Ask about

What is the 27 month rule for 501c3?

In general, an organization must file its exemption application within 27 months from the end of the month in which it was formed. If it does so, it may be recognized as exempt back to the date of formation.

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

What is Form 1066 Schedule Q?

Abstract: Form 1066 and Schedule Q (Form 1066) are used by a real estate mortgage investment conduit (REMIC) to figure its tax liability and income and other tax-related information to pass through to its residual holders.

What is an IRS advance ruling?

Advance ruling: A ruling or determination letter may be issued in advance of operations if your organization can describe its proposed operations in enough detail to permit a conclusion that it will clearly meet the particular requirements of the section under which it is claiming exemption.

What is form 8734?

Use Form 8734, Support Schedule for. If you are not sure about when your. listed as a private foundation. Advance Ruling Period, at the end of. advance ruling period began and.

What is an IRS advance ruling?

Advance ruling: A ruling or determination letter may be issued in advance of operations if your organization can describe its proposed operations in enough detail to permit a conclusion that it will clearly meet the particular requirements of the section under which it is claiming exemption.

When did the advance ruling end?

On September 9, 2008, the IRS eliminated the advanced ruling process for 501(c)(3) organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8734 - Support Schedule for Advance Ruling Period?

Form 8734 is a document used by organizations seeking tax-exempt status to provide information about their expected sources of support during the advance ruling period.

Who is required to file Form 8734 - Support Schedule for Advance Ruling Period?

Organizations applying for recognition as tax-exempt under section 501(c)(3) of the Internal Revenue Code are required to file Form 8734.

How to fill out Form 8734 - Support Schedule for Advance Ruling Period?

To fill out Form 8734, organizations must provide detailed information about their funding sources, income projections, and the anticipated support they expect to receive during the advance ruling period.

What is the purpose of Form 8734 - Support Schedule for Advance Ruling Period?

The purpose of Form 8734 is to demonstrate that an organization is likely to receive sufficient support to maintain its tax-exempt status during the initial period after it is recognized as tax-exempt.

What information must be reported on Form 8734 - Support Schedule for Advance Ruling Period?

Organizations must report information such as expected contributions, grants, membership dues, and other support they anticipate receiving during the advance ruling period.

Fill out your form 8734 - support online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8734 - Support is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.