Get the free Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refun...

Show details

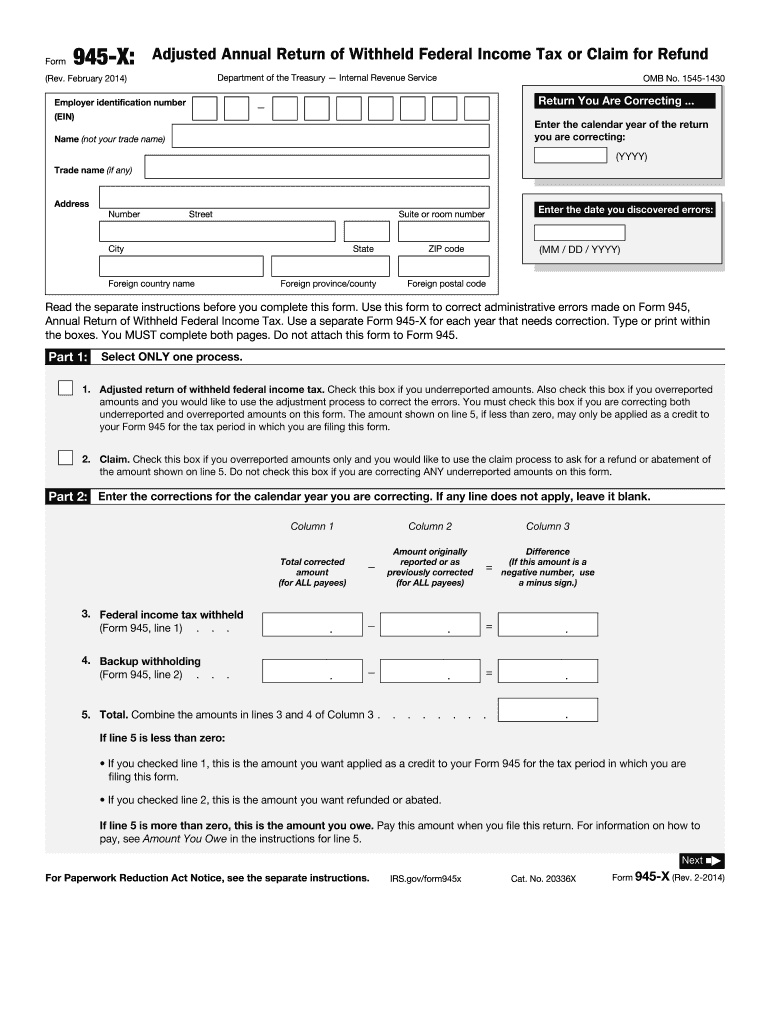

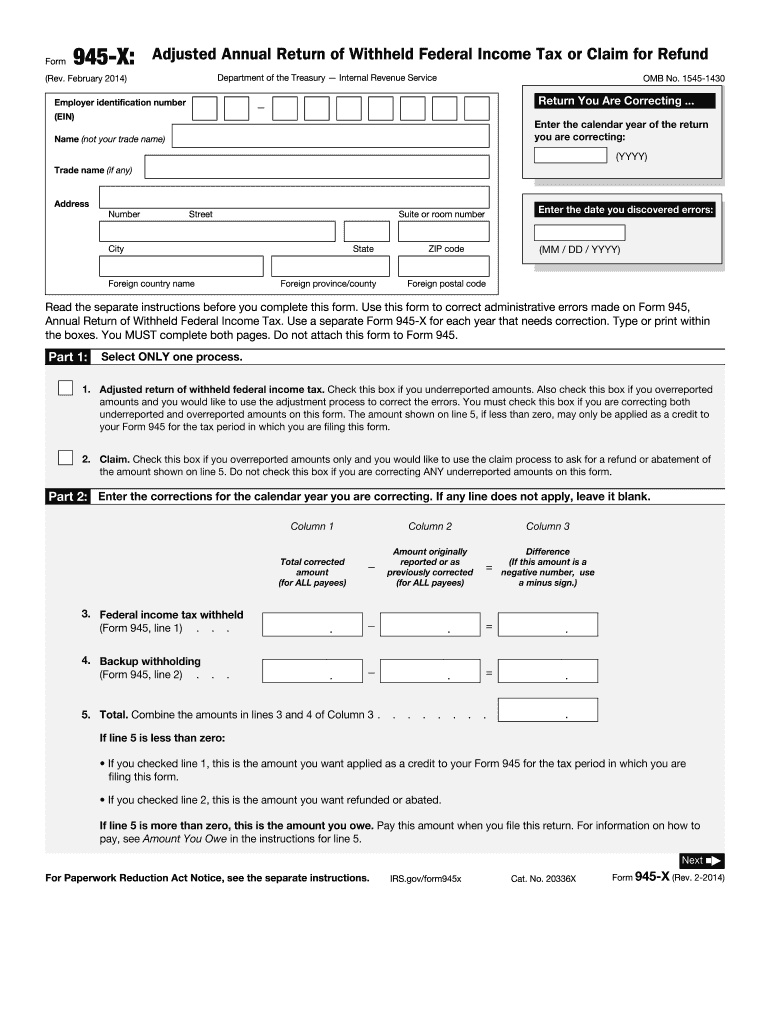

This form is utilized to correct errors made on the Form 945, concerning withheld federal income tax for employers. It allows for reporting of underreported or overreported amounts and seeks a refund

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 945-x adjusted annual

Edit your form 945-x adjusted annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 945-x adjusted annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 945-x adjusted annual online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 945-x adjusted annual. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 945-x adjusted annual

How to fill out Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund

01

Obtain a copy of Form 945-X from the IRS website or your tax professional.

02

Fill in your name, address, and Employer Identification Number (EIN) at the top of the form.

03

Indicate the tax year for which you are filing the adjusted return.

04

Complete the sections that apply to your adjustments, including the amounts withheld and any corrections.

05

Provide a detailed explanation of the reason for the adjustments in the designated area on the form.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Mail the completed Form 945-X to the address specified in the instructions or e-file if eligible.

Who needs Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund?

01

Employers who have withheld federal income tax from payments to contractors and need to adjust or correct the amounts reported.

02

Businesses that find discrepancies in their previously filed Form 945.

03

Tax-exempt organizations that need to claim a refund for over-withheld federal income tax.

Fill

form

: Try Risk Free

People Also Ask about

What is 945 for?

Form 945, Annual Return of Withheld Federal Income Tax, is a tax form used by businesses to report federal income taxes withheld from non-payroll payments to the IRS. This can include payments to independent contractors, 401(k) and pension payments, and more.

Is federal withholding the money you get back?

0:19 3:18 If your employer withholds too much money from your paychecks. You'll end up overpaying your taxes.MoreIf your employer withholds too much money from your paychecks. You'll end up overpaying your taxes. In this case. Yes you can get this extra money back when you file your tax.

How long does it take to get a firpta refund?

Wait for the Refund: The IRS will process your application and, if everything is in order, issue your refund. The processing time can vary, often taking several months depending on the workload and complexity of your case.

How do I get a refund from US withholding tax?

To request a refund of your withholdings for previous tax years, please contact the IRS at 1-800-829-1040 for Federal tax withholding refund and your State Revenue Office for state tax withholding refund. If we are not currently withholding State tax, you must call your State Tax office for a refund.

How do I claim US withholding tax?

Generally, the payee does this by filing Form W-8 BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding or W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) or Form 8233, Exemption from Withholding on Compensation for

What is the purpose of the 945 form?

Form 945, Annual Return of Withheld Federal Income Tax, is used to report withheld federal income tax from nonpayroll payments, including distributions from qualified retirement plans.

How do I claim federal tax withholding?

For federal tax withholding: Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund?

Form 945-X is used to correct errors on a previously filed Form 945, which reports withheld federal income tax from nonpayroll payments. It can also be used to claim a refund of any overreported tax.

Who is required to file Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund?

Any entity that has filed Form 945 incorrectly and needs to make adjustments or claim a refund of overpaid withheld federal income tax is required to file Form 945-X.

How to fill out Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund?

To fill out Form 945-X, you must provide your name, EIN, the tax year being corrected, the amount of errors to correct, and an explanation of the corrections. Follow the instructions provided for accurate completion.

What is the purpose of Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund?

The purpose of Form 945-X is to allow taxpayers to correct any mistakes made on Form 945 and to request refunds for overreported amounts of federal income tax withheld.

What information must be reported on Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund?

Form 945-X must report the taxpayer's identifying information, the tax year, amounts originally reported, corrected amounts, and any claimed refunds or balances due.

Fill out your form 945-x adjusted annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 945-X Adjusted Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.