Get the free Rev. Proc. 2006-9 - irs ustreas

Show details

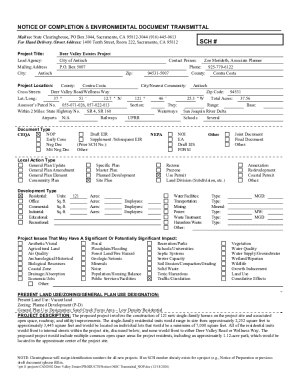

This revenue procedure explains the process for requesting an advance pricing agreement (APA) from the IRS, detailing how such requests are processed and administered under Internal Revenue Code §

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 2006-9

Edit your rev proc 2006-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 2006-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rev proc 2006-9 online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rev proc 2006-9. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 2006-9

How to fill out Rev. Proc. 2006-9

01

Obtain a copy of Rev. Proc. 2006-9 from the IRS website.

02

Review the instructions associated with the procedure to understand its purpose.

03

Identify the type of entity you are filing for (individual, corporation, etc.).

04

Gather necessary information and documentation required for the filing process.

05

Complete the necessary forms specified in the procedure.

06

Double-check all entries for accuracy and completeness.

07

Ensure that your filing complies with any applicable deadlines.

08

Submit the completed forms to the appropriate IRS address.

Who needs Rev. Proc. 2006-9?

01

Taxpayers who wish to qualify for a late election or revocation of an election under the tax code.

02

Professionals assisting clients with tax compliance and elections.

03

Entities that need to formally request a change in accounting method.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a revenue ruling and a revenue procedure?

Revenue rulings are different from Revenue Procedures. A revenue procedure is an official statement of a procedure that affects the rights or duties of taxpayers under the law, while a revenue ruling is the conclusion of the IRS on how the law is applied to a specific set of facts.

What is the difference between a Tam and a PLR?

When a TAM is made public, which happens on a regular basis, all personally identifiable information about the particular taxpayer is removed. Private Letter Ruling (PLR)– A PLR is a written statement issued to a particular taxpayer regarding that taxpayer's situation.

Do revenue rulings and revenue procedures carry the same authoritative weight as Treasury regulations?

Taxpayers may rely on revenue procedures when their facts are substantially the same as those described in the revenue procedure. Like revenue rulings, revenue procedures do not have the same level of authority as Treasury regulations.

Where can I find IRS revenue procedures?

Revenue rulings are published in the Internal Revenue Bulletin for the information of and guidance to taxpayers, IRS personnel and tax professionals.

What does Rev proc stand for?

Definition: REV. PROC. is an abbreviation for REVENUE PROCEDURE. REVENUE PROCEDURE is a set of guidelines issued by the Internal Revenue Service (IRS) that provides instructions and procedures for taxpayers to follow when complying with tax laws.

Are revenue rulings legally binding?

A letter ruling binds only the IRS and the requesting taxpayer, so it may not be cited or relied on for precedent. The IRS does have the option of redacting the text of a private ruling and issuing it as a revenue ruling, which may become binding on all taxpayers and the IRS.

What is the APA tax agreement?

What is an Advance Pricing Agreement (APA)? An APA is an agreement between a tax payer and tax authority determining the transfer pricing methodology for pricing the tax payer's international transactions for future years.

What is the revenue procedure for taxes?

Revenue Procedures deal with the internal practice and procedures of the IRS in the administration of the tax laws. They are official statements of procedures relating to sections of the Internal Revenue Code, related statutes, tax treaties, and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rev. Proc. 2006-9?

Rev. Proc. 2006-9 is a revenue procedure issued by the IRS that provides guidance to taxpayers regarding the submission of requests for tax relief related to the Safe Harbor for minor repairs under the de minimis safe harbor for expensing repairs.

Who is required to file Rev. Proc. 2006-9?

Taxpayers who wish to apply the de minimis safe harbor for expensing repairs and maintenance costs must file Rev. Proc. 2006-9.

How to fill out Rev. Proc. 2006-9?

To fill out Rev. Proc. 2006-9, taxpayers should follow the instructions provided in the procedure, including detailing the expenses being claimed under the de minimis safe harbor and ensuring compliance with all eligibility criteria.

What is the purpose of Rev. Proc. 2006-9?

The purpose of Rev. Proc. 2006-9 is to simplify the process for taxpayers to expense certain repair and maintenance costs, allowing them to deduct minor costs without needing to capitalize them.

What information must be reported on Rev. Proc. 2006-9?

Taxpayers must report information regarding the taxpayer's name, address, taxpayer identification number, and details of the expenses being claimed under the safe harbor provisions.

Fill out your rev proc 2006-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 2006-9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.