Get the free Internal Revenue Bulletin 2001-12 - irs ustreas

Show details

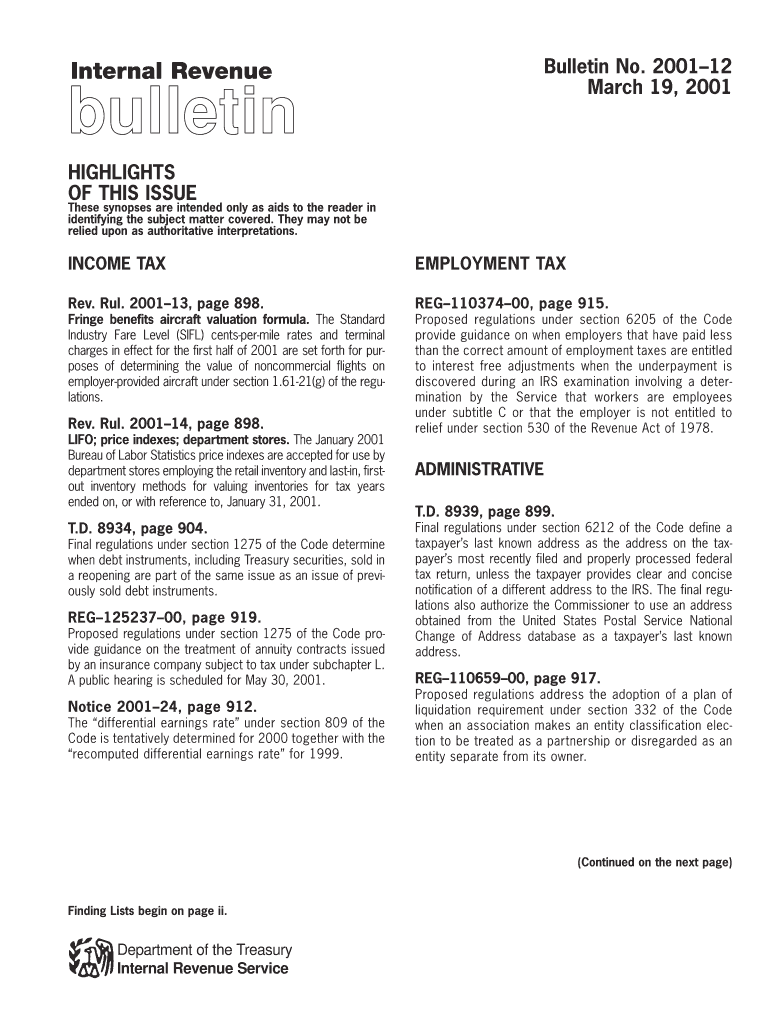

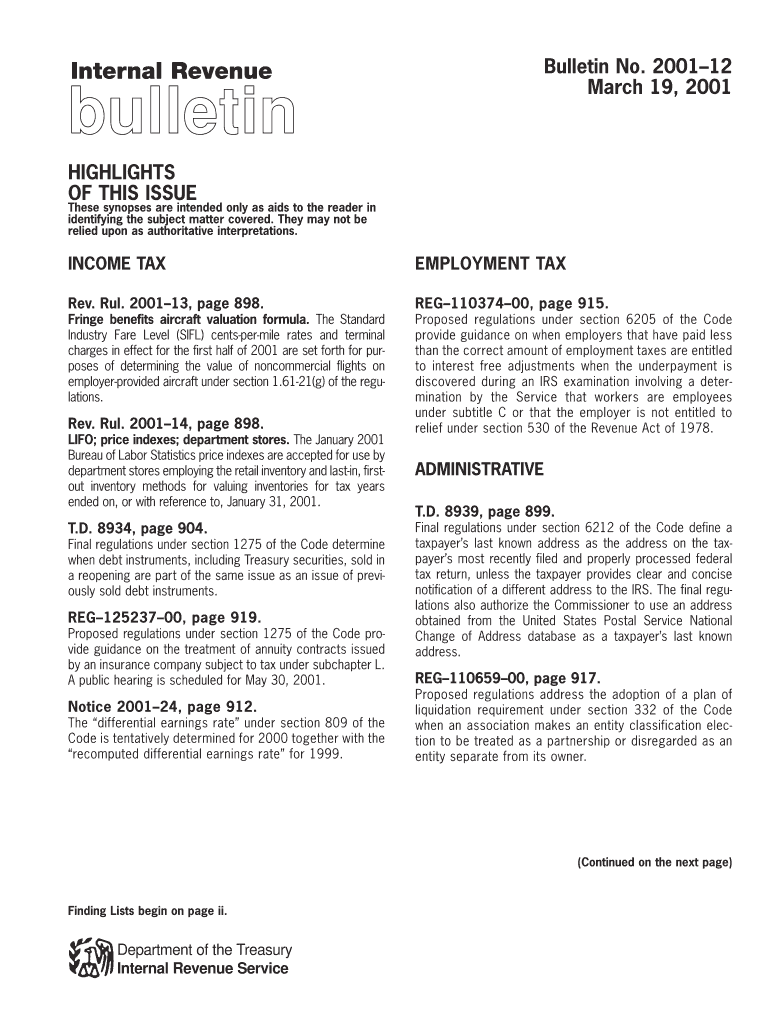

The Internal Revenue Bulletin serves as the authoritative instrument of the IRS for announcing official rulings, procedures, and tax-related notices including details about income tax and administrative

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internal revenue bulletin 2001-12

Edit your internal revenue bulletin 2001-12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue bulletin 2001-12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing internal revenue bulletin 2001-12 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit internal revenue bulletin 2001-12. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue bulletin 2001-12

How to fill out Internal Revenue Bulletin 2001-12

01

Obtain the Internal Revenue Bulletin 2001-12 from the IRS website or relevant resources.

02

Review the instructions provided within the bulletin to understand its purpose.

03

Gather all necessary financial documents and information needed to complete the relevant forms or applications mentioned.

04

Follow the step-by-step guide in the bulletin to fill out any specific forms, ensuring accuracy.

05

Double-check all entries for completeness and compliance with IRS regulations.

06

Submit the completed forms as directed, either electronically or via mail, before any deadlines.

Who needs Internal Revenue Bulletin 2001-12?

01

Tax professionals looking for guidance on IRS policies from 2001.

02

Businesses or individuals needing clarification on specific IRS rulings.

03

Accountants preparing tax returns related to the issues addressed in the bulletin.

04

Researchers studying historical tax regulation and its implications.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find IRS revenue procedures?

Revenue rulings are published in the Internal Revenue Bulletin for the information of and guidance to taxpayers, IRS personnel and tax professionals.

Are revenue rulings binding on the IRS?

A revenue ruling is a public decree issued by the Internal Revenue Service (IRS) that essentially has the force of law. A revenue ruling outlines the IRS's interpretation of the tax laws and is binding on all IRS employees and public taxpayers.

Where can I find tax rules?

Treasury (tax) regulations Treasury regulation sections can be found in Title 26 of the Code of Federal Regulations (26 CFR). An electronic version of the current Code of Federal Regulations is made available to the public by the National Archives and Records Administration (NARA) and the GPO.

Where can I get an IRS instruction booklet?

Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

Are IRS private letter rulings public?

A PLR may not be relied on as precedent by other taxpayers or IRS personnel. PLRs are generally made public after all information has been removed that could identify the taxpayer to whom it was issued.

What is published in the Internal Revenue Bulletin?

The Internal Revenue Bulletin (IRB) is the authoritative instrument for announcing official rulings and procedures of the IRS and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest.

Where can I look up revenue rulings?

Revenue rulings are published in the Internal Revenue Bulletin & Cumulative Internal Revenue Bulletin.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Internal Revenue Bulletin 2001-12?

Internal Revenue Bulletin 2001-12 is a publication issued by the IRS that contains guidance on tax-related matters, including announcements of new tax laws, regulations, and other official positions taken by the IRS.

Who is required to file Internal Revenue Bulletin 2001-12?

Entities and individuals who are affected by the guidance provided in Internal Revenue Bulletin 2001-12, such as taxpayers and practitioners in the field of taxation, are required to comply with the rules and regulations mentioned therein.

How to fill out Internal Revenue Bulletin 2001-12?

To comply with Internal Revenue Bulletin 2001-12, taxpayers should carefully review the guidelines and instructions provided within the bulletin and ensure that their filings align with the requirements stated, including providing accurate information and adhering to any specified formats.

What is the purpose of Internal Revenue Bulletin 2001-12?

The purpose of Internal Revenue Bulletin 2001-12 is to inform taxpayers and tax professionals about current legal interpretations, processes, and changes in tax law to ensure compliance and understanding of tax obligations.

What information must be reported on Internal Revenue Bulletin 2001-12?

Information that must be reported on Internal Revenue Bulletin 2001-12 includes details pertinent to new tax laws, IRS notices, and guidance that could impact taxpayer obligations or filing requirements.

Fill out your internal revenue bulletin 2001-12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Bulletin 2001-12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.