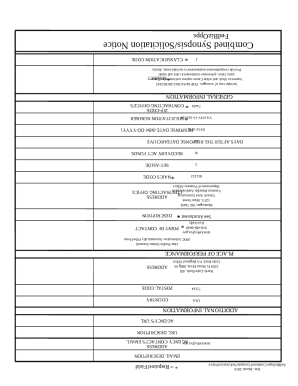

Get the free Form 1040NR - irs ustreas

Show details

This document serves as the income tax return for nonresident aliens in the United States, allowing for the reporting of income and deductions applicable for the tax year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1040nr - irs

Edit your form 1040nr - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1040nr - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1040nr - irs online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1040nr - irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1040nr - irs

How to fill out Form 1040NR

01

Gather all necessary documents, including your passport, visa, and any income statements.

02

Download Form 1040NR from the IRS website or obtain a paper copy.

03

Enter your name, address, and Social Security Number or ITIN on the top of the form.

04

Indicate your filing status by checking the appropriate box.

05

Report your income in the Income section, including wages, interest, dividends, and other income sources.

06

Calculate your adjustments to income, if applicable, in the Adjustments section.

07

Follow the instructions to claim deductions if you are eligible.

08

Enter your taxable income by subtracting deductions from your total income.

09

Calculate the tax owed using the tax tables provided by the IRS.

10

Fill out any additional forms or schedules if required, such as Schedule OI (Other Information).

11

Sign and date the form, and provide any necessary payment if you owe taxes.

12

Mail the completed form to the appropriate IRS address based on your residence.

Who needs Form 1040NR?

01

Non-resident aliens who earn income from U.S. sources.

02

Foreign students or scholars on F or J visas who have income.

03

Individuals who are not U.S. residents but have U.S. income that is subject to taxation.

Fill

form

: Try Risk Free

People Also Ask about

Can I use TurboTax for 1040NR?

TurboTax doesn't support IRS Form 1040-NR. However, we've partnered with Sprintax to offer 1040-NR tax preparation for international students, scholars, and nonresident foreign professionals. Go here for more info.

Can 1040NR be filed electronically?

You can file Form 1040NR, U.S. Nonresident Alien Income Tax Return, or extensions electronically with UltraTax CS in the same way as 1040 returns or extensions. The IRS doesn't let you e-file Form 1040NR-EZ or Dual status returns. You'll need to file these returns on paper.

Can I file form 1040NR electronically?

You can file Form 1040NR, U.S. Nonresident Alien Income Tax Return, or extensions electronically with UltraTax CS in the same way as 1040 returns or extensions. The IRS doesn't let you e-file Form 1040NR-EZ or Dual status returns. You'll need to file these returns on paper.

Can nonresident aliens file taxes online?

THE IRS DOES NOT ALLOW NON-RESIDENT ALIENS (for tax purposes), TO FILE ELECTRONICALLY. Where can I find the tax forms that I need? Tax forms are available when accessing GLACIER TAX PREP on-line and web sites listed below. What do I need to know about tax treaties?

What is Form 1040-NR used for?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign students, scholars, teachers, researchers and exchange visitors for more information.

How much does it cost to file 1040NR?

About Our Fees Expat, Resident, Nonresident Alien and Dual Status Tax Services Form 1040/1040NR & Form 1040NR/1040: Dual Status Returns $400 to $700 (With Low Income Discounts) Choice Between Dual Status and Joint Return $600 State Income Tax Returns $150 Local Tax Returns $10026 more rows

What is the penalty for filing a 1040-NR?

Penalties for Failure to File IRS Form 1040NR You may be subject to the failure to file penalty and the failure to pay penalty. Both penalties impose a fine that's 5% of your unpaid taxes, up to 25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1040NR?

Form 1040NR is a federal tax form used by non-resident aliens to report their U.S. income and calculate their tax liability.

Who is required to file Form 1040NR?

Non-resident aliens who have U.S. source income, or are engaged in a trade or business in the U.S., are required to file Form 1040NR.

How to fill out Form 1040NR?

To fill out Form 1040NR, you need to gather your income details, deductions, and credits, and follow the instructions on the form, ensuring you provide accurate information about your income and tax situation.

What is the purpose of Form 1040NR?

The purpose of Form 1040NR is to determine the tax liability of non-resident aliens in the U.S. and to ensure compliance with U.S. tax laws.

What information must be reported on Form 1040NR?

Form 1040NR requires reporting of U.S. source income, any deductions, credits, and other relevant financial information, including personal identification details such as name, address, and taxpayer identification number.

Fill out your form 1040nr - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1040nr - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.