Get the free Form 5434 - irs ustreas

Show details

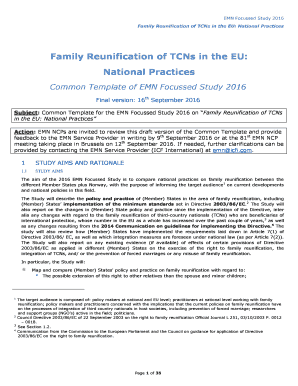

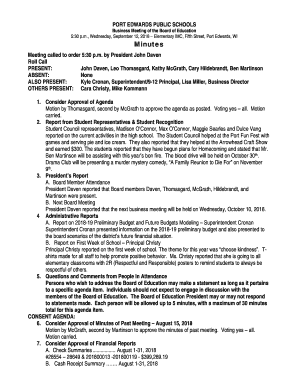

This document is an application form for individuals seeking to enroll as actuaries with the Joint Board for the Enrollment of Actuaries, including sections for personal information, employment history,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 5434 - irs

Edit your form 5434 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5434 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 5434 - irs online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 5434 - irs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 5434 - irs

How to fill out Form 5434

01

Obtain a copy of Form 5434 from the official website or authorized sources.

02

Begin with the header section and provide your name and contact information.

03

Fill in the required fields, including the purpose of the form.

04

Follow the instructions for any specific documents required to be attached.

05

Review your entries for accuracy and completeness.

06

Sign and date the form at the designated space.

07

Submit the form as instructed (either electronically or by mail).

Who needs Form 5434?

01

Individuals or organizations that are required to report specific transactions or situations as stipulated by regulations related to Form 5434.

Fill

form

: Try Risk Free

People Also Ask about

What to say to an army sponsor?

Your Role as the Incoming Servicemember Make certain to communicate with your sponsor before your move. Let him or her know a little bit about your family, the ages of your children, whether you're bringing pets, and any specific questions you have about your new duty station.

Who does the Total Army sponsorship Program provide sponsorship assistance to?

The Total Army Sponsorship Program, or TASP, mission is to help Soldiers, civilian employees and their families better integrate into the U.S. Army, and to assist them when they transition to different units.

How long does it take to get command sponsorship?

The entire application process can take 3 weeks to 3 months, from completing the required forms and family EFMP screenings (and enrollments if needed) to the review of your completed application.

What is a 5434?

DA Form 5434 is used to transmit sponsorship requirements to gaining commands. It is completed by the departing Soldier during initial reassignment interview or by the civilian employee following selection notification and acceptance of a position.

What are the continuing education requirements for JBEA?

About the JBEA Rules Under the JBEA rules, explains Wielobob, enrolled actuaries must complete 36 qualifying CE hours over a three-year period, triennially. As with the qualification standards, a qualifying hour of CE is 50 minutes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 5434?

Form 5434 is a tax form used for reporting specific financial information to the tax authorities.

Who is required to file Form 5434?

Individuals or entities who meet certain financial thresholds or activities that require reporting as stipulated by tax regulations must file Form 5434.

How to fill out Form 5434?

To fill out Form 5434, you should gather the required financial data, complete each section of the form accurately, and ensure to attach any necessary supporting documents before submission.

What is the purpose of Form 5434?

The purpose of Form 5434 is to ensure transparency and compliance with tax regulations by collecting relevant financial information from individuals or entities.

What information must be reported on Form 5434?

Form 5434 typically requires reporting of financial details including income, expenses, assets, and any other relevant financial data as specified by the tax authority.

Fill out your form 5434 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5434 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.