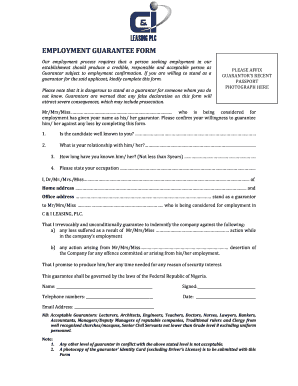

Get the free guarantor form

Show details

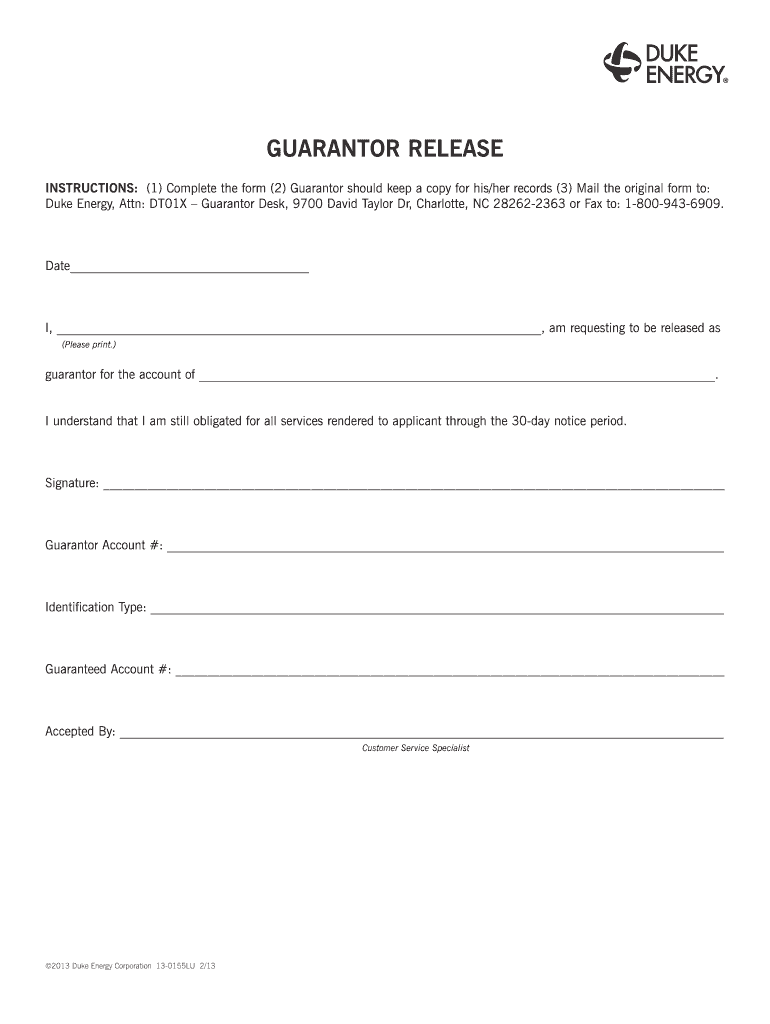

INSTRUCTIONS: (1) Complete the form (2) Guarantor should keep a copy for his/ her records (3) Mail the original form to: Duke Energy, Attn: DT01X Guarantor ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guarantor meaning form

Edit your guarantor form for loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guarantor form template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guarantor form sample online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guarantor form for sales girl. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

01

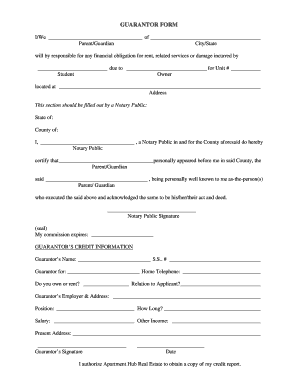

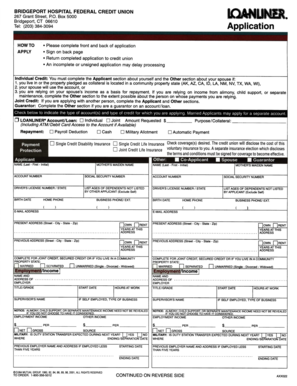

To fill out a guarantor form, you must first gather all necessary documentation and information. This typically includes personal identification, proof of income, and a list of assets and liabilities.

02

Next, carefully read and understand the instructions provided on the form. Make sure you are aware of the specific requirements and obligations associated with being a guarantor.

03

Begin by entering your personal details in the designated sections of the form, such as your full name, address, contact information, and social security number.

04

Provide detailed information about your employment status, including your current occupation, employer's details, and length of employment. You may be required to provide income verification, such as recent pay stubs or tax returns.

05

Include information about your financial status, such as your monthly income, expenses, assets (such as property or investments), and liabilities (such as loans or debts). This helps the lender assess your financial capability to act as a guarantor.

06

If required, provide references who can vouch for your character and financial reliability. These references are typically individuals who have known you for a significant period and can verify your ability to fulfill the responsibilities of a guarantor.

07

Review the completed form thoroughly to ensure accuracy and completeness. Make sure all required sections have been filled out correctly and any necessary supporting documentation has been included.

08

Once you are satisfied with the form's contents, sign and date it in the designated area. Depending on the requirements, you may need to have your signature witnessed or notarized.

09

Finally, submit the completed form to the appropriate recipient or organization. Keep a copy of the form for your records and be prepared to provide any additional documentation or information if requested.

Regarding who needs a guarantor form, individuals or entities seeking financial assistance, such as loans or leases, may require a guarantor. This is typically the case for individuals with limited credit history, low income, or unstable employment situations. The guarantor form serves as a contractual agreement between the borrower and the guarantor, ensuring that the guarantor will assume responsibility for the loan or lease if the borrower defaults on their obligations.

Fill

sample of guarantor form

: Try Risk Free

People Also Ask about loan guarantor form

How do I write guarantor form?

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

What are the requirements for guarantors?

Lenders have their own rules and guidelines, but usually guarantors will: be over 21 years old. have a good credit history. have a separate bank account to the borrower – you may be able to guarantee a loan for a spouse or partner, but only if you have separate bank accounts.

What is a guarantor form?

A guarantor form is a document that certifies a guarantor's decision to assume liability if a particular individual does not fulfill the terms of an agreement. It is to be completed by the guarantor who has agreed to take responsibility if an individual breaks the terms of an agreement.

Who can act as a guarantor UK?

Who can be a guarantor. Guarantors are usually a relative or close friend of the tenant, but they don't have to be. Guarantors usually need a good credit history and income or savings above a certain amount.

How do I become a guarantor in NYC?

Meet income requirements: The guarantor must be able to demonstrate that they can pay for the apartment, in the unfortunate event that the tenants do not pay. The standard NYC guarantor income requirement is that their salary is at least 80 - 100 times the rent.

Who else can be a guarantor?

Almost anyone can be a guarantor. It's often a parent or spouse (as long as you have separate bank accounts), but sometimes a friend or relative. However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for.

What is the purpose of a guarantor?

Some lenders will only provide a loan to borrowers if another person (for example, a friend or relative) guarantees to make the payments if the borrower does not, this other person is known as a guarantor.

Who is considered the guarantor?

A guarantor is a financial term describing an individual who promises to pay a borrower's debt in the event that the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans.

Who can pass as a guarantor?

Guarantors are usually a relative or close friend of the tenant, but they don't have to be. Guarantors usually need a good credit history and income or savings above a certain amount. A landlord might reject a guarantor or ask for more information if, for example, they: are retired.

What are the qualifications to be a guarantor?

Who can be a mortgage or loan guarantor? be over 21 years old. have a good credit history. have a separate bank account to the borrower – you may be able to guarantee a loan for a spouse or partner, but only if you have separate bank accounts.

How do you write a simple guarantor letter?

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

Who can be a guarantor?

Almost anyone can be a guarantor. It's often a parent or spouse (as long as you have separate bank accounts), but sometimes a friend or relative. However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for.

What is the meaning of guarantors form?

A guarantor form is a document that certifies a guarantor's decision to assume liability if a particular individual does not fulfill the terms of an agreement. It is to be completed by the guarantor who has agreed to take responsibility if an individual breaks the terms of an agreement.

What is an example of a guarantor?

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead. If your guarantor doesn't pay, your landlord can take them to court.

What is a guarantor's letter?

A guarantor letter is a legally binding document that commits a third-party cosigner to pay a future debt in case a person applying for credit defaults. The cosigner adds his creditworthiness and credentials to the transaction, buttressing the applicant's position so the transaction can be completed.

How much do you need to earn to be a guarantor?

How much money do you need to earn to be a guarantor? Usually guarantors are expected to be making at least three times the annual rent price of the property in order to be accepted by the letting agent or private landlord.

How do I become a guarantor for rent in NYC?

Meet income requirements: The guarantor must be able to demonstrate that they can pay for the apartment, in the unfortunate event that the tenants do not pay. The standard NYC guarantor income requirement is that their salary is at least 80 - 100 times the rent.

How do I write a guarantor letter for a loan?

I/We agree that I/We shall be bound by any acknowledgement of debt made by any or all of the Borrower(s) and I/We further agree that you shall be at a liberty without any way affecting this guarantee and discharging me/us from my/our liabilities hereunder, to postpone for any time or from time to time the exercise of

Does a guarantor have to have good credit?

A guarantor must have superior credentials which include an excellent credit score, and at least double the normally required income. A guarantor must fill out an application, provide income documentation, have their credit pulled, and sign your lease.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify simple guarantor form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your guarantor form sample pdf into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the loan guarantor form word in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your sample of guarantor form for employment in nigeria in minutes.

Can I edit guarantor form pdf on an Android device?

You can edit, sign, and distribute guarantor letter in nigeria on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is guarantor form?

A guarantor form is a document used to provide a guarantee, usually by a third party, to ensure the payment or obligation of another individual, often in situations like renting a property or securing a loan.

Who is required to file guarantor form?

Typically, a guarantor form is required to be filed by individuals who do not meet the necessary credit or income criteria to rent a property or secure a loan on their own, and therefore need a guarantor to support their application.

How to fill out guarantor form?

To fill out a guarantor form, the guarantor must provide personal information such as their name, address, contact details, employment information, income, and consent to guarantee the obligations of the primary applicant.

What is the purpose of guarantor form?

The purpose of a guarantor form is to reduce the risk for landlords or lenders by ensuring that there is an additional party responsible for the obligations, thereby providing a safety net in case the primary applicant fails to meet their commitments.

What information must be reported on guarantor form?

The guarantor form must report the guarantor's personal details, financial information including income and employment status, and may also require a credit check or additional documentation to verify the guarantor's ability to meet the obligations.

Fill out your guarantor form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guarantor Form For Employment is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill guarantor form

Related to nigerian guarantor form sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.