Get the free Diesel Fuel and Kerosene Excise Tax Regulations - irs ustreas

Show details

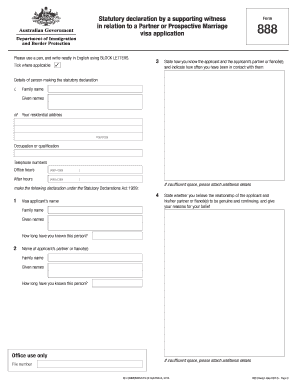

This document contains regulations related to the diesel fuel and kerosene excise tax and outlines the mechanical dye injection systems required for certain fuel usages.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign diesel fuel and kerosene

Edit your diesel fuel and kerosene form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your diesel fuel and kerosene form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit diesel fuel and kerosene online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit diesel fuel and kerosene. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out diesel fuel and kerosene

How to fill out Diesel Fuel and Kerosene Excise Tax Regulations

01

Gather necessary documents related to the diesel fuel and kerosene transactions.

02

Identify the applicable tax rates for diesel fuel and kerosene as specified in the regulations.

03

Complete the required forms with accurate details including quantities, dates, and supplier information.

04

Calculate the total excise tax owed based on the amounts filled in the forms.

05

Submit the completed forms along with any payments to the appropriate tax authority before the deadline.

Who needs Diesel Fuel and Kerosene Excise Tax Regulations?

01

Businesses that purchase or sell diesel fuel and kerosene.

02

Transport companies that utilize diesel fuel for their vehicles.

03

Distributors of diesel fuel and kerosene.

04

Individuals or entities involved in the production of diesel fuel and kerosene.

Fill

form

: Try Risk Free

People Also Ask about

What vehicles are exempt from excise tax?

Automobile truck bodies and chassis with a gross vehicle weight of 33,000 lb. or less, truck trailer and semi-trailer bodies and chassis for use with a trailer or semi-trailer having a gross vehicle weight of 26,000 lb. or less, and tractors mainly used for highway transportation with a trailer or semi-trailer having a

Who qualifies for the fuel tax credit?

Businesses get a refundable credit for fuel used in a specific work-related activity with the Fuel Tax Credit. To qualify, you must: Own or operate a business. Meet certain requirements, such as running a farm or purchasing aviation gasoline.

What is the kerosene tax?

A kerosene tax would work in the same way that fuel duty is levied on petrol and diesel. It is simple to understand and easy to administer as there is already a duty present on jet fuel which is currently zero rated.

Why am I paying excise tax?

Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers, and vary depending on the specific tax. Excise taxes may be imposed at the time of: Entry into the United States, or sale or use after importation.

What is the federal excise tax on diesel fuel?

Federal and state excise taxes. The federal excise tax on diesel is currently 24.4 cents ($0.244) per gallon. The state diesel fuel excise tax (July 1, 2023, through June 30, 2024) is 44.1 cents ($0.441) per gallon. For current rates, please see Tax Rates—Special Taxes and Fees on our website.

Which state has the highest fuel tax?

What Is the Tax Torpedo? The tax torpedo is the sharp rise and then sharp fall in middle-income house- holds' marginal tax rates as their income rises. The tax torpedo is caused by the taxation of Social Security benefits. A marginal tax rate is the additional taxes paid on each additional dollar of income.

Why is kerosene tax free?

Thus, tax is not imposed on kerosene that (1) the IRS determines is destined for a nontaxable use (such as for heating), (2) is indelibly dyed in ance with IRS regulations, and (3) meets any marking requirements that may be prescribed in regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Diesel Fuel and Kerosene Excise Tax Regulations?

Diesel Fuel and Kerosene Excise Tax Regulations are laws that impose a tax on the consumption of diesel fuel and kerosene, applying to the production, distribution, and use of these fuels for various purposes.

Who is required to file Diesel Fuel and Kerosene Excise Tax Regulations?

Entities involved in the production, distribution, and sale of diesel fuel and kerosene are required to file, which includes manufacturers, distributors, and retailers.

How to fill out Diesel Fuel and Kerosene Excise Tax Regulations?

To fill out the regulations, taxpayers must complete the designated forms, accurately report fuel quantities, calculate the tax owed based on applicable rates, and submit the forms by the specified deadlines.

What is the purpose of Diesel Fuel and Kerosene Excise Tax Regulations?

The purpose of these regulations is to generate revenue for government programs, promote energy efficiency, and encourage the use of alternative fuels.

What information must be reported on Diesel Fuel and Kerosene Excise Tax Regulations?

Taxpayers must report information such as the total volume of diesel and kerosene used, the taxable amount, any exemptions claimed, and relevant identification details of the entities involved in the transaction.

Fill out your diesel fuel and kerosene online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Diesel Fuel And Kerosene is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.