Get the free Corporate Guarantee Form 1285 - kdheks

Show details

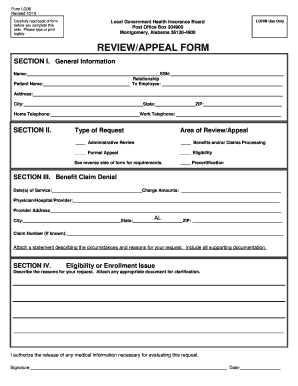

This document serves as a guarantee by a corporation for third party liability coverage for operations related to a Kansas solid waste disposal area or processing facility. It includes details on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate guarantee form 1285

Edit your corporate guarantee form 1285 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate guarantee form 1285 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate guarantee form 1285 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate guarantee form 1285. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate guarantee form 1285

How to fill out Corporate Guarantee Form 1285

01

Obtain the Corporate Guarantee Form 1285 from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in the corporate details such as the name, address, and registration number of the corporation.

04

Enter the names and titles of the guarantors who are authorized to sign the form.

05

Provide the details of the obligations or debts being guaranteed.

06

Include the date of the guarantee and ensure all relevant signatures are affixed.

07

Review the form for accuracy and completeness.

08

Submit the completed form to the designated recipient as instructed.

Who needs Corporate Guarantee Form 1285?

01

Companies that are seeking to guarantee obligations or debts of another party.

02

Businesses that need to secure loans or credit through a corporate guarantee.

03

Entities involved in contracts requiring financial assurance or backing.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of corporate guarantee?

Corporate Guarantee: A guarantee is a commitment by a third party to pay a debt if the borrower defaults. These are separate documents often used in conjunction with other security arrangement where other companies in the borrower's group guarantee to the lender performance of the borrower's obligations.

How do you provide corporate guarantee?

Steps to Draft a Corporate Guarantee Identify Parties: Clearly specify the lender, borrower, and guarantor in the document. This step ensures that all relevant entities are recognized and bound by the agreement. Define Obligations: Outline the specific debts or obligations the guarantor is securing.

What is the difference between a corporate guarantee and an indemnity?

An indemnity is a primary obligation that is independent of any other obligations. It is a promise to compensate for a loss. On the other hand, a guarantee is a secondary obligation, which comes into play if the primary obligation (i.e., the debt) is not fulfilled.

What is the difference between a guarantee and a corporate guarantee?

The difference between corporate and personal guarantees is quite simple. A personal guarantee is when an individual agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantee is when a guarantor is a corporation that takes on payment responsibilities.

What is corporate guarantee English law?

An all-monies guarantee and indemnity given by a corporate entity (the guarantor) in favour of a single lender (the beneficiary) in respect of obligations owed by a company (the borrower) to that lender.

What is the difference between a personal guarantee and a corporate guarantee?

The difference between corporate and personal guarantees is quite simple. A personal guarantee is when an individual agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantee is when a guarantor is a corporation that takes on payment responsibilities.

What is an example of a corporate guarantee?

Types of Corporate Guarantee For example, if there is a limit of $1,000,000 to be paid to the lender by the guarantor if the debtor goes bankrupt despite that $5,000,000 was borrowed initially. For an unlimited corporate guarantee, the guarantor is not limited by a particular amount of money to be repaid.

How do I fill out a letter of guarantee?

State what you will guarantee in your own words (like co-signing a lease). Explain why the guarantor letter may be needed in the first place. End the letter with a concise, detailed summary of what you're promising. Include any other information the company is requesting with your letter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporate Guarantee Form 1285?

Corporate Guarantee Form 1285 is a document used by corporations to guarantee financial obligations or liabilities, typically in relation to loans or other financial agreements.

Who is required to file Corporate Guarantee Form 1285?

Generally, corporations that are providing guarantees for loans or financial commitments on behalf of another entity are required to file Corporate Guarantee Form 1285.

How to fill out Corporate Guarantee Form 1285?

To fill out Corporate Guarantee Form 1285, the responsible corporate officer must provide details including the corporate name, address, description of the obligation being guaranteed, and the signatures of authorized representatives.

What is the purpose of Corporate Guarantee Form 1285?

The purpose of Corporate Guarantee Form 1285 is to legally bind a corporation to assume responsibility for the obligations of another entity, thereby enhancing the creditworthiness of the borrower.

What information must be reported on Corporate Guarantee Form 1285?

The information that must be reported includes the corporate name, address, details of the liability being guaranteed, names and titles of corporate officers responsible for signing the guarantee, and any relevant business registration numbers.

Fill out your corporate guarantee form 1285 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Guarantee Form 1285 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.