Get the free Guidance Necessary to Facilitate Business Electronic Filing - irs ustreas

Show details

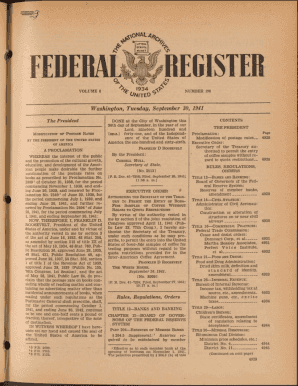

This document contains final regulations aimed at eliminating obstacles to the electronic filing of certain income tax returns and other forms for business taxpayers. It includes provisions for corporations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidance necessary to facilitate

Edit your guidance necessary to facilitate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidance necessary to facilitate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guidance necessary to facilitate online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guidance necessary to facilitate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidance necessary to facilitate

How to fill out Guidance Necessary to Facilitate Business Electronic Filing

01

Gather necessary information about the business, including legal name, Tax ID number, and address.

02

Review electronic filing requirements specific to your business type.

03

Access the electronic filing system designated by the governing body.

04

Create an account or log in to the existing account in the electronic filing system.

05

Follow the prompts to input business information accurately.

06

Upload any required documents such as financial statements or tax forms.

07

Review all information for accuracy before submitting.

08

Submit the electronic filing and save the confirmation receipt for your records.

Who needs Guidance Necessary to Facilitate Business Electronic Filing?

01

Businesses required to file taxes or official documents electronically.

02

Business owners seeking to comply with local, state, or federal electronic filing regulations.

03

Accountants and tax professionals assisting clients with electronic filings.

04

Organizations or entities in need of guidance for navigating electronic submissions.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between manual and electronic filing systems?

What are the differences between traditional and computerized filing systems? Traditional filing systems are generally paper-based and manually organized. Computerized systems, though, are digital, with documents organized and stored via a computer, as the name suggests.

What do you mean by electronic filing?

Electronic filing, or e-filing, refers to the process of filing one's taxes electronically, using online software approved by the relevant tax authority of the respective country. E-file is sometimes restricted to certain professionals and/or businesses with a minimum annual income cap.

Does the IRS require electronic filing?

As of tax year 2023, if you have 10 or more information returns, you must file them electronically. This includes Forms W-2, e-filed with the Social Security Administration. Find details on the final e-file regulations and requirements for Forms W-2.

What are the types of e-filing?

Types of e-Filing Option 1 - Use Digital Signature Certificate (DSC) to e-File. Option 2 - e-File without Digital Signature Certificate. Option 3 - e-File the Income Tax Return through an e-Return Intermediary (ERI) with or without Digital Signature Certificate (DSC).

What are the 4 tax filing status types?

(single, married filing jointly, married filing separately, head of household, and qualifying surviving spouse.

What do you mean by electronic filing system?

Electronic file management, or electronic document management, is the practice of importing, storing and managing documents and images as computer files. It includes the scanning and capturing of data from paper-based documents, digitizing files and allowing for the disposal of hard copies.

What is electronic filing in business?

Electronic file management, or electronic document management, is the practice of importing, storing and managing documents and images as computer files.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guidance Necessary to Facilitate Business Electronic Filing?

Guidance Necessary to Facilitate Business Electronic Filing refers to the set of instructions and best practices provided by regulatory agencies to help businesses comply with electronic filing requirements efficiently.

Who is required to file Guidance Necessary to Facilitate Business Electronic Filing?

Typically, all businesses that meet certain thresholds or engage in specific activities as defined by the relevant regulatory body are required to file electronic documents and reports.

How to fill out Guidance Necessary to Facilitate Business Electronic Filing?

To fill out the guidance, businesses should follow the prescribed forms and templates provided by the regulatory authority, ensuring all required fields are completed accurately and submitted through the designated electronic platform.

What is the purpose of Guidance Necessary to Facilitate Business Electronic Filing?

The purpose is to streamline the filing process, enhance data accuracy, reduce processing times, and ensure compliance with legal requirements for businesses.

What information must be reported on Guidance Necessary to Facilitate Business Electronic Filing?

Businesses must report essential information such as identification details, financial data, operational metrics, and any other specific disclosures required by the regulatory authority based on the nature of the filing.

Fill out your guidance necessary to facilitate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidance Necessary To Facilitate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.