Get the free Note Secured by Deed of Trust

Show details

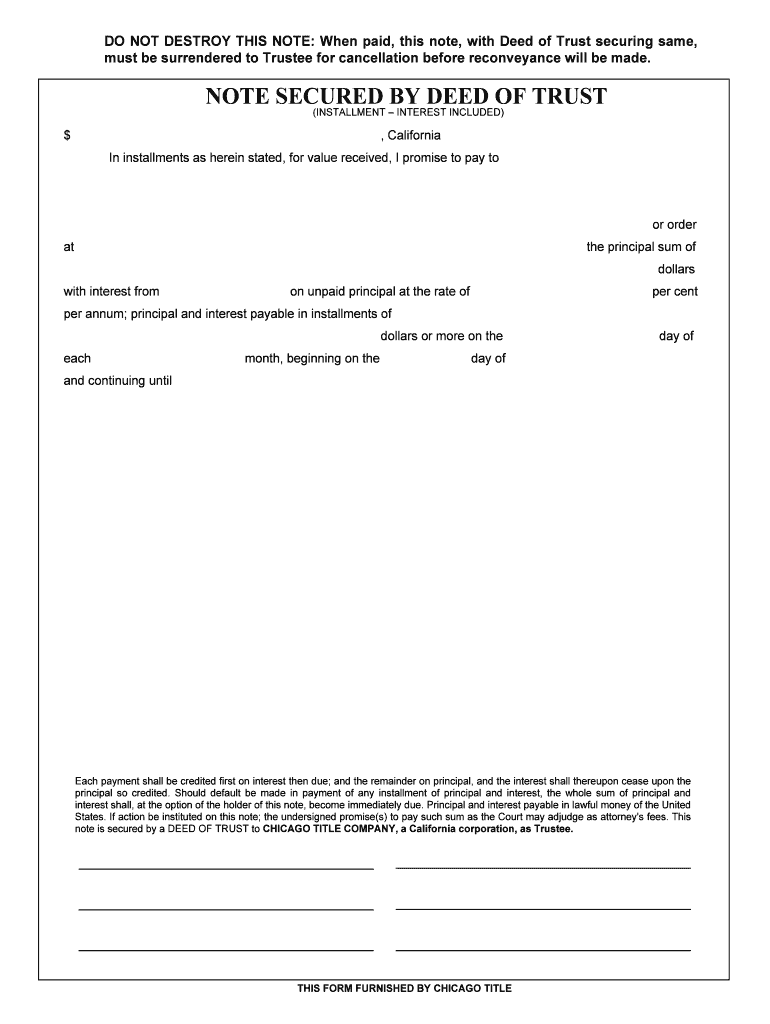

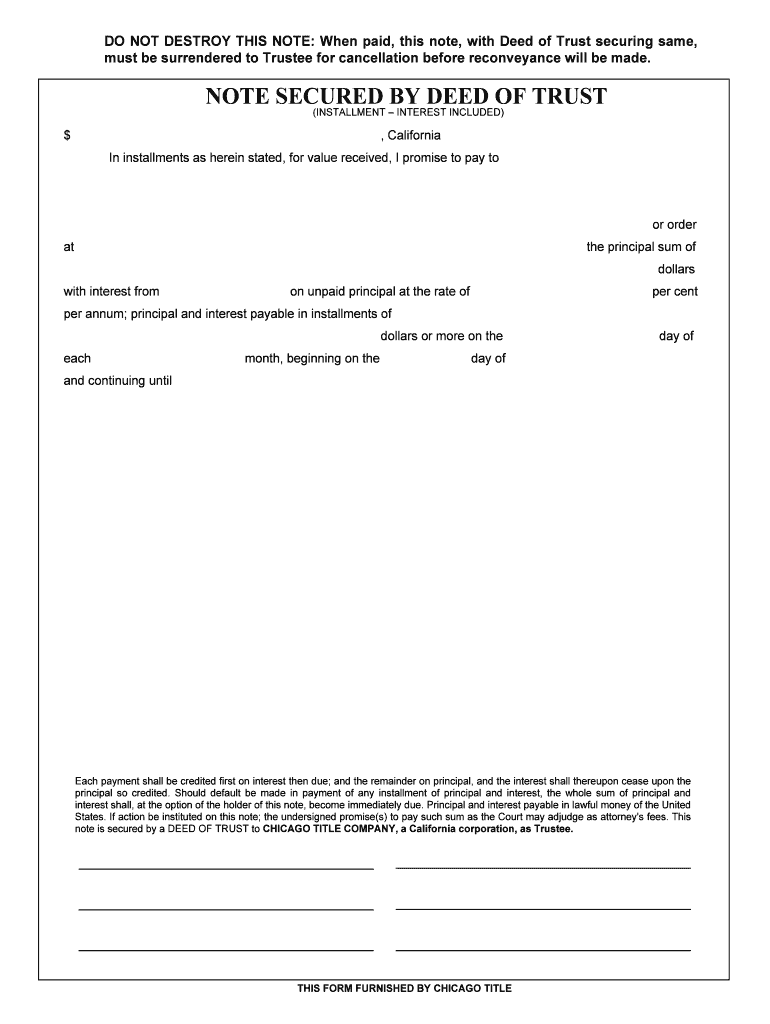

This document outlines the terms of a loan secured by a deed of trust, detailing the payment schedule, interest rates, and consequences of default.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign note secured by deed

Edit your note secured by deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your note secured by deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing note secured by deed online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit note secured by deed. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out note secured by deed

How to fill out Note Secured by Deed of Trust

01

Begin by entering the date at the top of the document.

02

Write the names and addresses of the borrower(s) and lender.

03

Specify the loan amount in both numeric and written form.

04

Indicate the interest rate on the loan.

05

State the repayment terms, including the due date for payments.

06

Include any late fees or penalties for missed payments.

07

Mention any prepayment options or clauses.

08

Detail the collateral being secured by the deed of trust, typically real estate.

09

Sign and date the document, ensuring all parties involved do so.

10

Have the document notarized to make it legally binding, if required.

Who needs Note Secured by Deed of Trust?

01

Individuals or businesses borrowing money to purchase real estate.

02

Lenders providing mortgage loans to secure their assets.

03

Title insurance companies for documentation purposes.

04

Real estate agents involved in property transactions.

05

Investors looking to secure loans against their properties.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a promissory note and a deed of trust?

The deed of trust is what secures the promissory note. The promissory note includes the interest rate, the payment amounts and terms, and the buyer's promise to pay the lender the amount borrowed plus interest.

What is the purpose of a trust deed?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

What is the disadvantage of a trust deed?

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure. Late payments should be avoided to prevent escalation and property loss.

Is a deed of trust the same as a title?

Is a Deed of Trust the Same as a Title? Deed of Trust and Title are both terms you'll likely hear when purchasing property, but they actually are different in purpose and meaning. A Deed of Trust is the loan on the property, and a Title expresses the actual ownership of a property.

What is a deed of trust in English?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

What is a secured note in real estate?

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

What is a note secured by a deed of trust?

The deed of trust outlines the terms of the loan. The borrower accepts the deed of trust by signing the promissory note. The promissory note is a document that outlines the terms of the loan and the following procedure should the terms not be met. It also includes language of the borrower's promise to pay the loan.

What is a deed of trust in simple terms?

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Note Secured by Deed of Trust?

A Note Secured by Deed of Trust is a legal document that represents a loan made by a lender to a borrower, secured by real estate. It outlines the terms of the loan including the repayment schedule and interest rate, while the deed of trust secures the loan with the property as collateral.

Who is required to file Note Secured by Deed of Trust?

Typically, the lender or the trustee is required to file the Note Secured by Deed of Trust. It is a formal process to record the lien against the property in order to protect the lender's interest.

How to fill out Note Secured by Deed of Trust?

To fill out a Note Secured by Deed of Trust, include the names of the borrower and lender, the property address, the loan amount, interest rate, repayment terms, and any other specific conditions. Ensure all parties sign and date the document.

What is the purpose of Note Secured by Deed of Trust?

The purpose of a Note Secured by Deed of Trust is to provide a legal framework for the loan agreement and to secure the lender's interest in the property, enabling them to potentially foreclose on the property if the borrower defaults on the loan.

What information must be reported on Note Secured by Deed of Trust?

The information that must be reported includes the names of the borrower and lender, property description, loan amount, interest rate, repayment schedule, terms of default, and any other relevant clauses or requirements.

Fill out your note secured by deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Note Secured By Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.