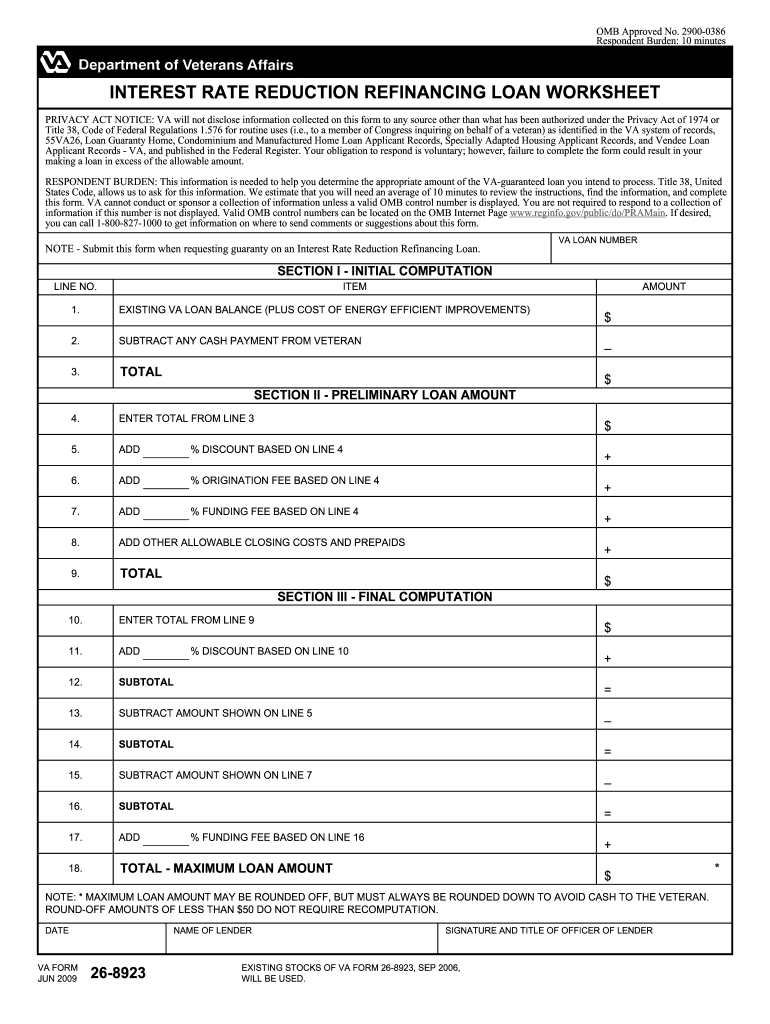

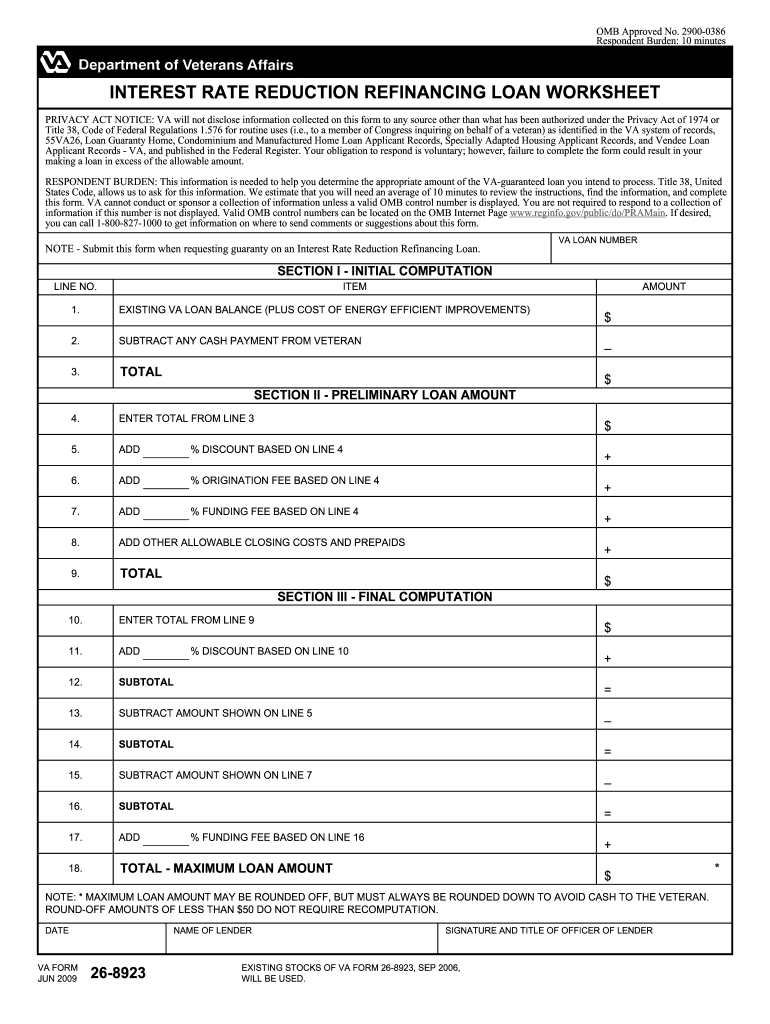

VA 26-8923 2009 free printable template

Get, Create, Make and Sign VA 26-8923

Editing VA 26-8923 online

Uncompromising security for your PDF editing and eSignature needs

VA 26-8923 Form Versions

How to fill out VA 26-8923

How to fill out VA 26-8923

Who needs VA 26-8923?

Instructions and Help about VA 26-8923

Hello and thanks for watching this quick tutorial today about the VA IR r l worksheet also known as the VA Earl worksheet or the VA streamline worksheet now what's interesting is we're doing this video because we have found many people are searching the web or googling for lack of a better term these three words VAR l worksheet, so we know there's a lot of people interested in this topic, but it's interesting because veterans and consumers probably would never come up with these terms that said if you're coming across this video hopefully you find it educational and eye-opening this is kind of what your vehicle worksheet will look like and this is a form intended to be completed by a VA underwriter now I'm not talking about somebody working for the Department of Veterans Affairs as we've talked about other trainings and videos the VA does not make mortgages they don't lend money VA lenders bank's mortgage companies credit unions those that have been authorized by the VA to make underwriting decisions or lending decisions would be using this form ok this is a form intended to be completed by an underwriter now this form is used to calculate the maximum VA loan amount on a VA Earl or a VA streamline refinance I know it's blurry here but right here the very, very bottom of the Earl worksheet says total maximum loan amount and this entire spreadsheet or form is used to derive a number right here now does a veteran need to be able to complete a v8 Earl worksheet well as I stated no a veteran does not need to be able to complete that worksheet this is a lender form okay so if somebody's looking for help completing this hopefully you work at a mortgage company or bank, or you're just trying to become more educated on the top so if you're trying to complete the Earl worksheet who should you contact if you need help well I can think of no one better than us lo VA rates give us a call our toll-free number is 866 5698 272 now if you're a competitor of ours if you're another industry employee if you're someone that works in the mortgage world or happy to help you out give us a call we've got enough knowledge to go around you can reach us at 866 5698 272 or simply visit us online at lo VA rates com now I am going to walk you through it this time the VA or a worksheet so here we are notice again this is a forum intended for lenders, but I'm going to scroll through it quickly, and I'm not going to do an actual loan calculation, but you'll notice on line one here's where you put in the balance on your existing VA loan as we know a VA Earl is used to refinance an existing VA loan right now we're taking people that are in the low fours or high threes down into the low twos on some of these VA URLs ok now we very rarely see a cash payment from the veteran but if there is going to be a cash payment from the veteran at the closing of the early you would put that number in here, and then you just start working your way down these would be any discount points being...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete VA 26-8923 online?

Can I sign the VA 26-8923 electronically in Chrome?

How do I fill out VA 26-8923 on an Android device?

What is VA 26-8923?

Who is required to file VA 26-8923?

How to fill out VA 26-8923?

What is the purpose of VA 26-8923?

What information must be reported on VA 26-8923?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.