Get the free Model form for pre-payment disclosures - federalreserve

Show details

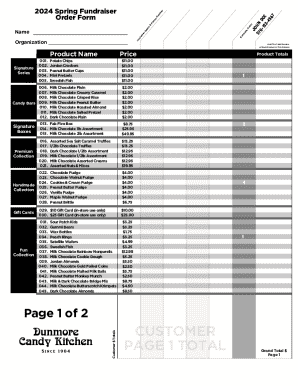

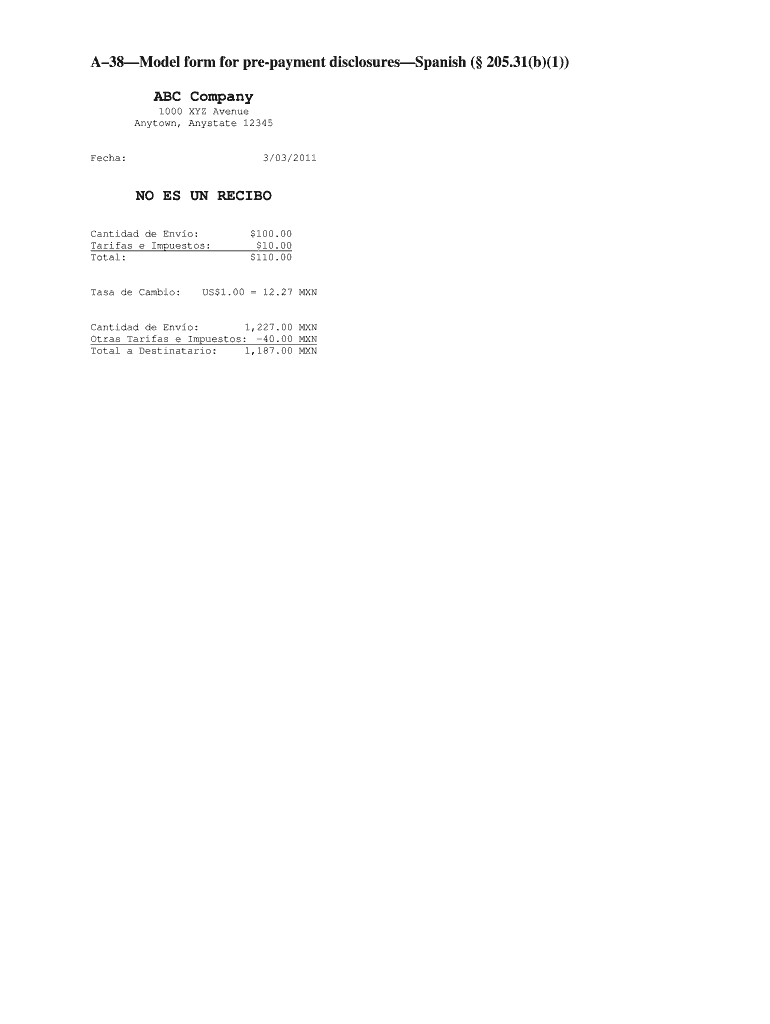

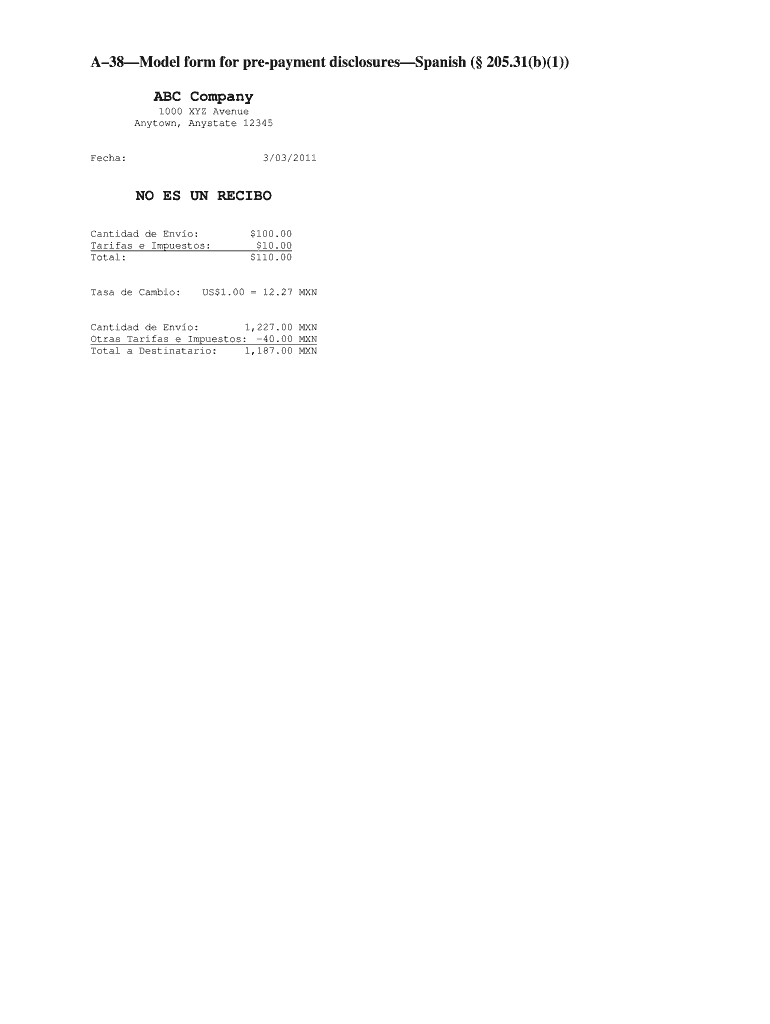

This document is a model form used for pre-payment disclosures, detailing shipping amounts, fees, total costs, and exchange rates for transactions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign model form for pre-payment

Edit your model form for pre-payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your model form for pre-payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit model form for pre-payment online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit model form for pre-payment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out model form for pre-payment

How to fill out Model form for pre-payment disclosures

01

Obtain the Model form for pre-payment disclosures from the relevant authority or website.

02

Read the instructions provided with the form carefully.

03

Fill in the borrower's personal information including name, address, and contact details.

04

Provide details of the loan, including the total amount, interest rate, and repayment terms.

05

Clearly state any pre-payment penalties, if applicable.

06

Include the loan start date and expected payoff date.

07

Summarize the disclosure of any fees associated with pre-payment or other costs.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form where required.

Who needs Model form for pre-payment disclosures?

01

Borrowers who are applying for a loan and want to understand the terms related to pre-payment.

02

Lenders who are required to provide pre-payment disclosures to their clients as mandated by regulation.

03

Financial institutions that need to comply with regulatory requirements regarding consumer loan disclosures.

Fill

form

: Try Risk Free

People Also Ask about

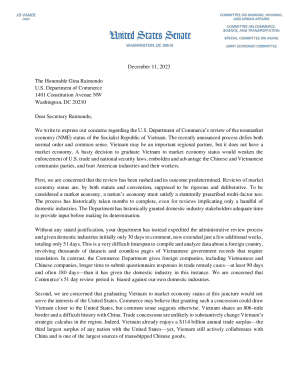

What is required on a remittance transfer receipt?

All receipt disclosures must be in a minimum of 8-point font, except for receipts provided via mobile phone or text message. Include the name of sender (customer). Include the name of beneficiary (recipient). The date of the transaction, which is the day the customer funds the money transmission.

What two forms are required by the CFPB?

Currently, borrowers receive two separate forms from their lender at the beginning of the transaction: the Good Faith Estimate (GFE), a form required under the Real Estate Settlement Procedures Act (RESPA), and the initial disclosure required under the Truth-in-Lending Act (TILA).

What is provided in CFPB guidance documents?

Such guidance documents include Consumer Financial Protection Circulars, Bulletins, Advisory Opinions, and Interpretive Rules. CFPB guidance documents have provided clarification on the best interpretations of the federal consumer financial laws for those tasked with enforcing them, as well as the courts.

Does the CFPB offer model forms?

Appendix B to 12 CFR part 1003 provides a data collection model form for collecting information concerning an applicant's ethnicity, race, and sex that complies with the requirements of § 1002.13(a)(1)(i)(B) and (ii). All forms contained in this appendix are models; their use by creditors is optional.

What are the requirements for remittance transfer disclosure?

This disclosure must list the amount of money to be transferred; the exchange rate; certain fees including those collected by the remittance transfer provider; taxes collected by the provider; and the amount of money expected to be delivered abroad, not including non-covered third-party fees or foreign taxes.

What is true of the model forms offered by the CFPB?

Answer:The model forms provided by the CFPB help lenders comply with regulatory requirements by providing standardized templates for notifying consumers about actions taken, such as credit application decisions.

What model forms are offered by the CFPB for notice of action taken?

Appendix C: Sample notification forms DescriptionEnglish C-3: Notice of Action Taken – Credit Score Download English PDF C-4: Notice of Action Taken - Counteroffer Download English PDF C-5: Disclosure of Right to Request Specific Reason for Credit Denial Download English PDF7 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Model form for pre-payment disclosures?

The Model form for pre-payment disclosures is a standardized template that lenders use to provide clear and concise information to borrowers about the terms and conditions of pre-payment options for a loan.

Who is required to file Model form for pre-payment disclosures?

Lenders that offer loans with pre-payment options are required to file the Model form for pre-payment disclosures as part of their compliance with consumer protection laws.

How to fill out Model form for pre-payment disclosures?

To fill out the Model form for pre-payment disclosures, lenders need to provide specific details such as the loan amount, interest rate, the terms of pre-payment provisions, and any fees associated with pre-payment of the loan.

What is the purpose of Model form for pre-payment disclosures?

The purpose of the Model form for pre-payment disclosures is to ensure borrowers are informed about their rights and obligations regarding pre-payments, thereby promoting transparency and helping them make informed decisions.

What information must be reported on Model form for pre-payment disclosures?

The information that must be reported includes the loan details, pre-payment terms, any penalties for pre-payment, and the process for making a pre-payment.

Fill out your model form for pre-payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Model Form For Pre-Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.