Get the free Agency Information Collection Procedures and Security for Government Financing Activ...

Show details

This document notifies about the agency's collection of information for assessing contractor performance and customer satisfaction related to the Department of Veterans Affairs.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agency information collection procedures

Edit your agency information collection procedures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agency information collection procedures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit agency information collection procedures online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit agency information collection procedures. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agency information collection procedures

How to fill out Agency Information Collection Procedures and Security for Government Financing Activities

01

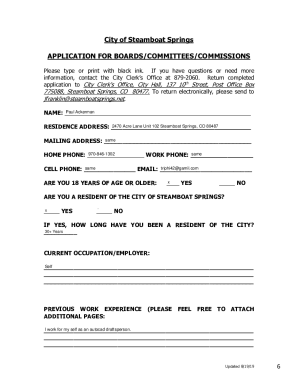

Begin by gathering all necessary organizational and contact information, including the agency name and address.

02

Identify the specific government financing activities that require documentation.

03

Review the guidelines provided by the government for Agency Information Collection Procedures.

04

Fill in the relevant sections, ensuring that all required fields are completed accurately.

05

Outline the security measures in place for the protection of information collected during the financing activities.

06

Specify the methods of information collection and the types of data that will be gathered.

07

Include the duration for which the data will be retained and the policies for data destruction.

08

Compile any relevant supporting documents that verify the procedures and security measures.

09

Review the completed document for accuracy and compliance with government standards.

10

Submit the form to the appropriate governmental authority as instructed.

Who needs Agency Information Collection Procedures and Security for Government Financing Activities?

01

Any agency or organization involved in government financing activities that require data collection and management.

02

Personnel responsible for compliance with federal regulations regarding information collection and security.

03

Government officials and auditors who review agency adherence to financial and data security protocols.

Fill

form

: Try Risk Free

People Also Ask about

What information is protected by the GLBA?

Privacy and Security The Gramm-Leach-Bliley Act requires financial institutions – companies that offer consumers financial products or services like loans, financial or investment advice, or insurance – to explain their information-sharing practices to their customers and to safeguard sensitive data.

What information does the Gramm-Leach-Bliley Act protect?

Privacy and Security The Gramm-Leach-Bliley Act requires financial institutions – companies that offer consumers financial products or services like loans, financial or investment advice, or insurance – to explain their information-sharing practices to their customers and to safeguard sensitive data.

What is the FTC information security program?

The FTC Safeguards Rule requires covered companies to develop, implement, and maintain an information security program with administrative, technical, and physical safeguards designed to protect customer information.

What is not covered by the GLB Act?

The Gramm–Leach–Bliley Act (GLBA) and its implementing regulations impose privacy requirements when financial institutions collect “nonpublic personal information about individuals who obtain financial products or services primarily for personal, family, or household purposes.”[1] GLBA does not apply, however, when a

What type of data is covered by GLBA?

GLBA nonpublic personal information It includes: Any list, description, or other grouping of consumers (and publicly available information pertaining to them) that is derived using any personally identifiable financial information that is not publicly available.

What information is protected under GLBA?

The GLBA's privacy provisions mandate privacy notices and place limitations on the sharing of nonpublic personal information (NPI), defined as “personally identifiable financial information (i) provided by a consumer to a financial institution, (ii) resulting from a transaction or any service performed for the consumer

What regulates the US federal government collection use and disclosure of information?

The Privacy Act of 1974, as amended, 5 U.S.C. § 552a , establishes a code of fair information practices that governs the collection, maintenance, use, and dissemination of information about individuals that is maintained in systems of records by federal agencies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Agency Information Collection Procedures and Security for Government Financing Activities?

Agency Information Collection Procedures and Security for Government Financing Activities refers to standardized processes and protocols set in place by government agencies to collect, manage, and protect information related to financing activities. This ensures compliance with federal regulations and the proper handling of sensitive data.

Who is required to file Agency Information Collection Procedures and Security for Government Financing Activities?

Agencies that engage in government financing activities and collect information from the public or stakeholders are required to file Agency Information Collection Procedures and Security for Government Financing Activities.

How to fill out Agency Information Collection Procedures and Security for Government Financing Activities?

To fill out the Agency Information Collection Procedures and Security for Government Financing Activities, one should gather all relevant data, ensure compliance with guidelines, complete all required sections accurately, and submit it through the designated government portal or in accordance with the agency's submission procedures.

What is the purpose of Agency Information Collection Procedures and Security for Government Financing Activities?

The purpose of Agency Information Collection Procedures and Security for Government Financing Activities is to standardize the collection of information, ensure the protection of sensitive data, and provide transparency and accountability in government financing operations.

What information must be reported on Agency Information Collection Procedures and Security for Government Financing Activities?

Information that must be reported includes types of data collected, purpose of data collection, methods of data handling, security measures in place, and compliance with applicable regulations and standards.

Fill out your agency information collection procedures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agency Information Collection Procedures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.