Get the free IRS Notice CP13 - irs

Show details

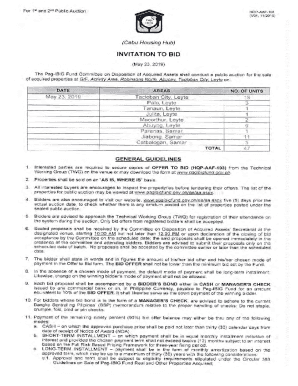

This document is a notice from the Internal Revenue Service (IRS) regarding changes made to a taxpayer's return, indicating that there are no outstanding amounts due or refunds necessary.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs notice cp13

Edit your irs notice cp13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs notice cp13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs notice cp13 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs notice cp13. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs notice cp13

How to fill out IRS Notice CP13

01

Read the notice carefully to understand the issue it addresses.

02

Gather all necessary tax documents related to the tax year in question.

03

Identify any discrepancies or mistakes noted in the notice.

04

Follow the instructions provided in the notice regarding the steps you need to take.

05

Complete any forms or schedules as necessary and provide supporting documents.

06

Double-check your calculations to ensure accuracy.

07

Return the notice along with any requested documents to the address specified in the notice.

08

Keep a copy of the notice and your response for your records.

Who needs IRS Notice CP13?

01

Individuals who have received the IRS Notice CP13 indicating a correction or change to their tax return.

02

Taxpayers who need to respond to an adjustment made by the IRS affecting their tax refund or liability.

03

Anyone who must clarify or dispute the information outlined in the notice.

Fill

form

: Try Risk Free

People Also Ask about

What does CP stand for in IRS notices?

CP stands for “computer paragraph,” and these notices alert taxpayers about potential discrepancies on their tax returns. CP Notices are triggered by certain actions or balances due and sent out by the Service's automated notice system.

What is CP 13?

The IRS sends CP13 when the IRS made changes to your original return because of an error, resulting in a zero balance.

What is a CP 5 letter from the IRS?

The CP05 notice is mailed to taxpayers to notify them that the IRS needs more time to verify your income, income tax withholding, tax credits and/or business income.

What does CP stand for in tax?

“CP” stands for Computer Paragraph. This refers to an automated notice the IRS sends when its systems identify a specific issue with your tax account. These notices are not written by a person but are generated automatically based on the data in your tax filings.

Why would the IRS hold my refund for review?

There are many reasons why the IRS may be holding your refund. You have unfiled or missing tax returns for prior tax years. The check was held or returned due to a problem with the name or address. You elected to apply the refund toward your estimated tax liability for next year.

What does CP13 mean from IRS?

CP 13 notices indicate the IRS made changes to your return because they believe there's a miscalculation on the return. You're not due a refund nor does the IRS owe an additional amount because of the changes. Your account balance is zero.

Why did I get a CP14 notice when I paid my taxes?

You received a CP14 notice because the IRS indicates you owe taxes, potentially due to unprocessed payments, errors in your tax filings, or inconsistencies in reported income. It is advisable to review your tax records to address the issue promptly.

How do I respond to an IRS CP11 notice?

If you disagree, contact us by the date shown on your notice. You can call us or mail your response indicating disagreement. Call us at the toll-free number shown in the “What to do if you disagree with our changes” section of your notice. The fastest way to resolve many return errors is by telephone.

What is CP 13?

The IRS sends CP13 when the IRS made changes to your original return because of an error, resulting in a zero balance.

What does CP mean in IRS notices?

CP stands for “computer paragraph,” and these notices alert taxpayers about potential discrepancies on their tax returns. CP Notices are triggered by certain actions or balances due and sent out by the Service's automated notice system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Notice CP13?

IRS Notice CP13 is a notification sent by the IRS to taxpayers to inform them that changes have been made to their tax return, resulting in a potential increase in their refund or a decrease in their tax owed.

Who is required to file IRS Notice CP13?

Taxpayers who receive IRS Notice CP13 do not need to file it; instead, it serves as information regarding changes made by the IRS. There is no filing requirement for the notice itself.

How to fill out IRS Notice CP13?

IRS Notice CP13 does not require any filling out by taxpayers; it is an informational notice. Taxpayers should review it for details about the changes and adjustments made to their tax returns.

What is the purpose of IRS Notice CP13?

The purpose of IRS Notice CP13 is to communicate to taxpayers that their tax return has been adjusted by the IRS and to provide information about the resulting refund or tax reduction.

What information must be reported on IRS Notice CP13?

IRS Notice CP13 includes information such as the reason for the adjustment, the amount of the refund or tax reduction, and instructions on how to respond if the taxpayer disagrees with the changes.

Fill out your irs notice cp13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Notice cp13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.