Get the free NSP 80/20 Loan Program

Show details

This document outlines the policies and procedures for the NSP 80/20 Loan Program, a 30-year fixed rate mortgage designed for low-to-moderate income borrowers purchasing foreclosed or abandoned properties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nsp 8020 loan program

Edit your nsp 8020 loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nsp 8020 loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nsp 8020 loan program online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nsp 8020 loan program. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

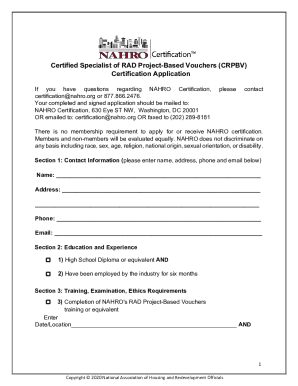

How to fill out nsp 8020 loan program

How to fill out NSP 80/20 Loan Program

01

Gather necessary documentation, including income verification and credit history.

02

Visit the official NSP website or contact your local housing agency.

03

Complete the application form provided, ensuring all sections are filled out accurately.

04

Submit the application along with required documents to the designated authority.

05

Await a confirmation of receipt of your application.

06

Attend an interview or information session if required.

07

Review the terms and conditions of the loan once approved.

08

Sign the necessary paperwork to finalize the loan agreement.

Who needs NSP 80/20 Loan Program?

01

Individuals or families looking to purchase their first home.

02

Low- to moderate-income households who may struggle to qualify for traditional loans.

03

Homebuyers in areas designated for revitalization under the NSP.

Fill

form

: Try Risk Free

People Also Ask about

How can I avoid PMI on my second mortgage?

Using the numbers from the example above, if the home you are buying costs $300,000, you would take the first mortgage for $240,000, make a $30,000 down payment and get a second mortgage for $30,000. This eliminates the need to pay PMI because the LTV ratio of the first mortgage is 80%.

How hard is it to get down payment assistance?

Down payment assistance qualifications The two most common down payment assistance requirements are a minimum credit score of 620 and not exceeding a certain income limit. Many programs also consider your debt-to-income ratio (DTI), which measures your monthly debt obligations against your gross monthly income.

How does an 80/20 mortgage work?

Our 80/20 loan program includes a first mortgage loan amount that is 80% of the purchase price, and a “piggyback” second mortgage for 20% of the purchase price. No down payment is required.

Can a 70 year old woman get a 30 year mortgage?

Can a 70-year-old choose between a 15- and a 30-year mortgage? Absolutely. The Equal Credit Opportunity Act's protections extend to your mortgage term. Mortgage lenders can't deny you a specific loan term on the basis of age.

What is the 80 20 rule for loans?

The 80-20 rule in mutual funds suggests that 20% of your investments will generate 80% of your returns. This highlights the importance of identifying and focusing on the most profitable funds. Why is the 80-20 rule important in investing?

Do banks still do 80/20 loans?

An 80-10-10 loan is a good option for people who are trying to buy a home but have not yet sold their existing home. In that scenario, they would use the HELOC to cover a portion of the down payment on the new home. They would pay off the HELOC when the old home sells.

What is the 80 20 rule for mortgages?

→ 80/20 piggyback loan: With this structure, the first mortgage finances 80% of the home price, and the second mortgage covers 20%, meaning you finance the entire purchase without making a down payment. 80/20 mortgages were popular in the early to mid-2000s, but are less common today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NSP 80/20 Loan Program?

The NSP 80/20 Loan Program is a financing initiative designed to assist low-income households by providing loans that cover 80% of the purchase price of a home, while requiring the borrower to cover the remaining 20% through other means, such as down payment assistance.

Who is required to file NSP 80/20 Loan Program?

Entities, such as local governments or nonprofit organizations, participating in the NSP 80/20 Loan Program are required to file. Additionally, homebuyers receiving assistance through this program must also complete necessary documentation.

How to fill out NSP 80/20 Loan Program?

To fill out the NSP 80/20 Loan Program application, applicants need to provide their personal information, details of the property being purchased, income verification, and any additional documentation required by the administering body.

What is the purpose of NSP 80/20 Loan Program?

The purpose of the NSP 80/20 Loan Program is to promote homeownership among low-income families by making housing more affordable and accessible through financial assistance.

What information must be reported on NSP 80/20 Loan Program?

Applicants must report personal identification information, household income details, employment status, information relating to the property being financed, and any other relevant financial data as required by the program guidelines.

Fill out your nsp 8020 loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nsp 8020 Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.