Get the free Group Life Insurance Application - insurance arkansas

Show details

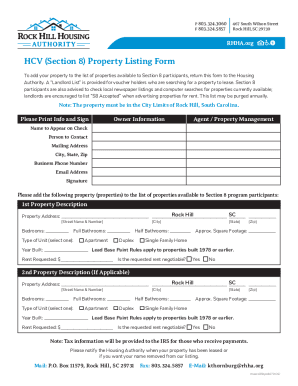

This document serves as an application for group life insurance coverage, outlining necessary information including employer details, employee and dependent information, health questions, and coverage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group life insurance application

Edit your group life insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group life insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group life insurance application online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group life insurance application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group life insurance application

How to fill out Group Life Insurance Application

01

Gather necessary documents and information, including personal identification and beneficiary details.

02

Complete the application form by providing personal information such as full name, address, date of birth, and social security number.

03

Indicate the amount of coverage you are applying for and any additional optional coverages if available.

04

Provide details of your employment, including your employer's name, address, and your job title.

05

Disclose your medical history and any pre-existing conditions as required by the application.

06

Review the application for accuracy and completeness before submission.

07

Submit the application along with any required fees or premiums.

Who needs Group Life Insurance Application?

01

Employees working for a company that offers group life insurance as part of their benefits.

02

Employers looking to provide financial protection to their employees' families in the event of untimely death.

03

Individuals seeking affordable life insurance coverage without the need for extensive medical underwriting.

Fill

form

: Try Risk Free

People Also Ask about

What should you not say when applying for life insurance?

Lying about anything on a life insurance application constitutes insurance fraud. Purposefully omitting or lying about your health information can lead to your life insurance application being denied — or much worse — your beneficiaries not receiving their death benefit after you pass away.

What not to say when applying for life insurance?

Qualifying for group policies is easy, with coverage guaranteed to all group members. Unlike individual policies, group insurance doesn't require a medical exam. However, low cost and convenience aren't everything.

How long does it take for a life insurance application to be approved?

A single policy that covers many people, most often provided by an employer or a group (like a union). Covers an individual for a certain amount of time only, in contrast to permanent insurance like whole life. Pays a lump sum to a deceased person's beneficiaries.

Is group life insurance easy to get?

Typically, it takes four to eight weeks for traditionally underwritten policies to be approved and issued. For instant life insurance policies that use accelerated underwriting, it's possible for coverage to go into effect on the same day.

What will disqualify me from life insurance?

Understanding Life Insurance Eligibility Pre-existing conditions, such as cancer, heart disease, and severe mental-nervous disorders, can potentially lead to the denial of life insurance coverage.

How honest should I be for life insurance?

When it comes to life insurance, don't lie. They will find your secret from a Facebook picture or something and then not pay a cent. If you are truthful, you may get denied or premiums raised, but they'll pay out if you speak truths.

What happens if insurance finds out you lied?

If you lie to your insurance company, the consequences can be severe, potentially leading to claim denial, policy cancellation, increased premiums, and even criminal charges for insurance fraud, depending on the extent of the lie and your location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Life Insurance Application?

A Group Life Insurance Application is a document used by organizations or employers to apply for life insurance coverage for a group of individuals, typically employees or members of a certain group.

Who is required to file Group Life Insurance Application?

The organization or employer seeking coverage for its members or employees is required to file the Group Life Insurance Application.

How to fill out Group Life Insurance Application?

To fill out the Group Life Insurance Application, the designated representative of the organization should provide accurate information regarding the group, including details about the members, their health, and any relevant company information.

What is the purpose of Group Life Insurance Application?

The purpose of the Group Life Insurance Application is to request life insurance coverage for a specified group, ensuring that all necessary details are submitted to underwriters for evaluation and approval.

What information must be reported on Group Life Insurance Application?

The information that must be reported includes the name of the organization, the number of members to be insured, details about each member (such as age, health status, and job title), and any existing insurance policies.

Fill out your group life insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Life Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.