Get the free Group Disability Insurance Application - insurance arkansas

Show details

This document serves as an application for group disability insurance, gathering personal and employment information from the applicant to assess eligibility and coverage options.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group disability insurance application

Edit your group disability insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group disability insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group disability insurance application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit group disability insurance application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

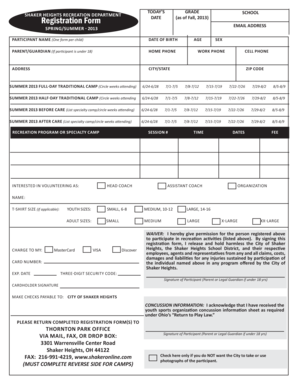

How to fill out group disability insurance application

How to fill out Group Disability Insurance Application

01

Begin by downloading the Group Disability Insurance Application form from your provider's website.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide your employment information, including your job title, employer's name, and length of employment.

04

Indicate any pre-existing conditions or medical history that may be relevant.

05

Review the coverage options and select the appropriate level of benefits.

06

Ensure you have the necessary documentation, such as proof of income and medical certificates.

07

Sign and date the application to certify that the information provided is accurate.

08

Submit the completed application to your insurance provider, either online or by mailing it to the specified address.

Who needs Group Disability Insurance Application?

01

Employees seeking financial protection in case of long-term disability.

02

Businesses that want to provide health benefits to workers.

03

Self-employed individuals looking for additional coverage.

04

Individuals who are currently part of a group plan or considering joining one.

Fill

form

: Try Risk Free

People Also Ask about

What do I write when applying for disability?

Talking About Your Disability Application: What, Why, and How. Before your doctor's appointment, be clear about why you want disability benefits. Explain how your medical condition makes it hard for you to work and do daily tasks. Give specific examples, like times when you had trouble lifting or walking.

What is a disadvantage of group disability plans?

Disadvantage Policy Provisions: As compared to individual coverage, group plans may have less favorable standards for receiving disability benefits. A group plan's definition of what constitutes a disability may be more vague or restrictive than that in an individual policy.

What does a group disability insurance usually involve?

Group disability plans typically provide a totally disabled covered employee with a benefit of up to 60% of their pre-disability income, to a specified maximum, such as $10,000 a month. It can help to cover personal expenses as well as provide business overhead protection.

Is it hard to get approved for LTD benefits?

The process of getting SSDI benefits is notably stringent. The initial application requires extensive documentation and can take months to complete – and about 2/3 of these claims are rejected4. While the initial decision can be appealed, the process can stretch out for years.

Is LTD insurance worth it?

Long-term disability is a good choice for most people because it reduces the risk of financial setbacks if you become disabled. If you don't have coverage, that period with no income could make it hard to pay bills, support your family, and save for retirement.

What is a disadvantage of group insurance?

A significant drawback of group insurance plans is the limited flexibility they offer employees. Because group plans are designed to cover a broad range of individuals with varying healthcare needs, they may not meet each employee's specific requirements.

What are the disadvantages of group disability insurance?

Disadvantages of Group Disability Insurance Group disability coverage is based on your employment – if you change or lose your job, the policy may not be transferable. If your group disability coverage is paid with pre-tax dollars, any benefit you receive is taxed, reducing your monthly benefit.

What are the cons of disability benefits?

Negatives of Getting Social Security Disability Pros of Social Security Disability Benefits. Proving Disability Can Be Challenging. Lengthy Application Process. High Rate of Initial Denials. Limited Benefits Based on Past Earnings. Ongoing Evaluations of Disability Status. Restricted Ability to Continue Working.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Disability Insurance Application?

Group Disability Insurance Application is a document used by organizations to enroll employees in a group disability insurance plan, which provides income replacement benefits in the event that an employee becomes disabled and is unable to work.

Who is required to file Group Disability Insurance Application?

Typically, employees who wish to participate in the group disability insurance plan offered by their employer are required to file a Group Disability Insurance Application.

How to fill out Group Disability Insurance Application?

To fill out a Group Disability Insurance Application, an employee should provide personal information, including their name, Social Security number, employment details, and any relevant medical history or conditions as required by the insurance provider.

What is the purpose of Group Disability Insurance Application?

The purpose of the Group Disability Insurance Application is to collect necessary information from employees to determine eligibility and to facilitate the enrollment process in a disability insurance plan that provides financial support during periods of disability.

What information must be reported on Group Disability Insurance Application?

The information that must be reported on the Group Disability Insurance Application generally includes personal details such as the employee's name, address, contact information, Social Security number, employment status, and relevant medical history or conditions affecting their ability to work.

Fill out your group disability insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Disability Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.