Get the free APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH - boe ca

Show details

This document is used by counties to apply for a changed assessment of property taxes in California. It serves as a guideline for counties to continue using the previously approved application form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for changed assessment

Edit your application for changed assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for changed assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for changed assessment online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for changed assessment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for changed assessment

How to fill out APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH

01

Obtain the APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH from the appropriate local government or tax assessor's office.

02

Carefully read the instructions provided with the form to ensure understanding of the requirements.

03

Fill out the applicant's information, including name, address, and contact details.

04

Provide the property information for which the assessment is being changed, including parcel number or address.

05

State the reason for the request and provide any supporting documentation or evidence.

06

Review the completed application for accuracy and completeness.

07

Sign and date the application form.

08

Submit the application to the appropriate local government department as instructed, either in-person or via mail.

Who needs APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH?

01

Property owners who believe their property assessment is incorrect.

02

Individuals seeking a reassessment due to changes in property conditions or market value.

03

Taxpayer organizations representing property owners' interests.

Fill

form

: Try Risk Free

People Also Ask about

What is the remedy of a property owner who disagree with the assessment value of his property as issued by the local assessor?

Property owners have the right to file a formal appeal with the Assessment Appeals Board, which acts as an impartial third party in disputes between the property owner and Assessor.

How do I challenge a property tax assessment in California?

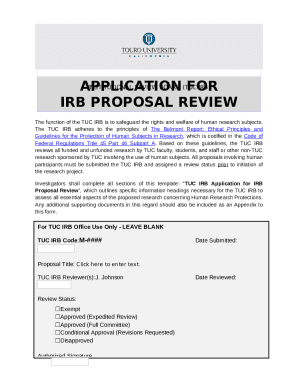

You must file an Assessment Appeal Application, form BOE-305-AH, obtained from the clerk of the board of the county where your property is located. Some counties have this form available on the website of either the clerk of the board or the county assessor, or both.

What is the remedy of a property owner who disagrees with the assessment value of his property as issued by the local assessor?

Property owners have the right to file a formal appeal with the Assessment Appeals Board, which acts as an impartial third party in disputes between the property owner and Assessor.

What is one reason a property owner may protest the assessment of their property?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

How to win a property assessment appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

What is the success rate of property tax appeals?

– 40% to 60% of appeals result in a reduction in assessed value, with potential tax savings ranging from 10% to 15%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH?

The APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH is a legal document used to request a change in the assessed value of a property for tax purposes. It is submitted to the Board of Equalization for review.

Who is required to file APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH?

Property owners who believe that their property's assessed value is incorrect or unfair are required to file the APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH.

How to fill out APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH?

To fill out the APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH, property owners must provide their personal information, property details, the current assessed value, the requested value, and any supporting documentation that justifies the request.

What is the purpose of APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH?

The purpose of the APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH is to allow property owners to formally contest and seek a reduction in their property's assessed value, thereby potentially lowering their property tax bill.

What information must be reported on APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH?

The APPLICATION FOR CHANGED ASSESSMENT FORM BOE-305-AH must report information such as the property owner's name, mailing address, property identification number, current assessed value, requested assessed value, and reasons for the value change request.

Fill out your application for changed assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Changed Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.