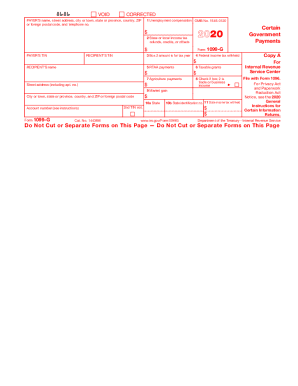

Get the free 1099 g california form - edd ca

Get, Create, Make and Sign 1099 g california form

How to edit 1099 g california form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1099 g california form

How to fill out 1099 G California form:

Who needs 1099 G California form:

Instructions and Help about 1099 g california form

Hi I'm mark for attacks comm there's a chance you'll need to report the information listed on a form 1099 — G should you receive one from a government agency typically the 1099 — G is used to report compensation from unemployment benefits along with tax refunds issued by the state or local government if you receive compensation from unemployment you are required to pay taxes on the income you can find the total amount of money paid to you throughout the year in box one of the 1099

People Also Ask about

Why did I get a 1099-G from state of California?

How do I get my 1099-G California?

What is a 1099-G tax form?

What is 1099G California state refund?

How do I get my 1099-G from California?

Why am I being asked for a 1099-G?

What is 1099-G from state of California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 1099 g california form?

Can I create an eSignature for the 1099 g california form in Gmail?

How do I fill out 1099 g california form using my mobile device?

What is 1099 g california form?

Who is required to file 1099 g california form?

How to fill out 1099 g california form?

What is the purpose of 1099 g california form?

What information must be reported on 1099 g california form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.