Get the free Los Angeles County Property Tax Claim for Refund - file lacounty

Show details

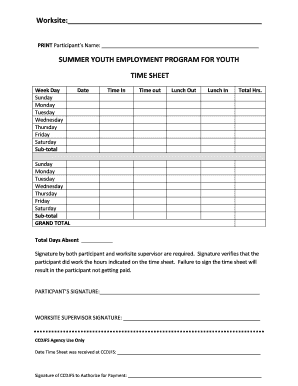

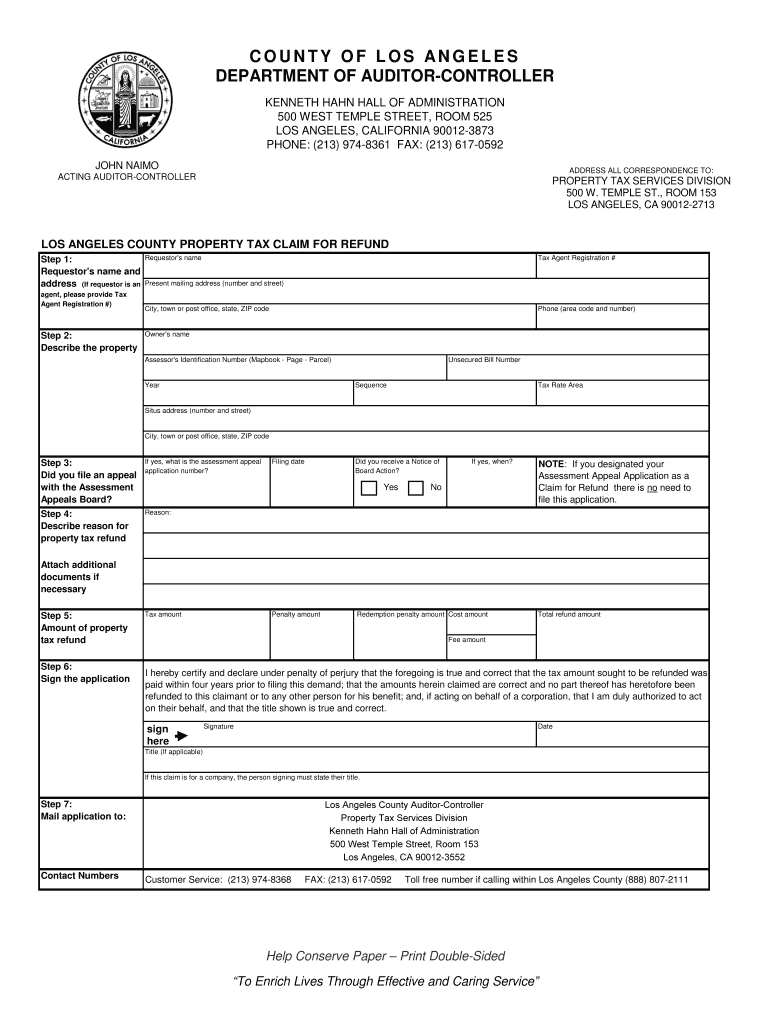

This document is a form used to request a refund for property taxes and/or penalties paid. It must be filed with the Auditor-Controller within four years of the date of payment. The form requires

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign los angeles county property

Edit your los angeles county property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your los angeles county property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit los angeles county property online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit los angeles county property. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out los angeles county property

How to fill out Los Angeles County Property Tax Claim for Refund

01

Obtain the Los Angeles County Property Tax Claim for Refund form from the county's website or your local assessor's office.

02

Fill out the property owner's information, including name, address, and contact details.

03

Provide the property information, including the parcel number and address of the property in question.

04

Indicate the tax year for which you are claiming a refund.

05

Explain the reason for the claim, detailing why you believe an excess payment was made.

06

Attach any supporting documents, such as proof of payment or appraisal reports, to substantiate your claim.

07

Sign and date the form to certify that all information provided is true and accurate.

08

Submit the completed form and attached documents to the appropriate Los Angeles County office by mail or in person.

Who needs Los Angeles County Property Tax Claim for Refund?

01

Property owners in Los Angeles County who believe they have overpaid their property taxes.

02

Individuals who have experienced changes in property valuation that may warrant a refund.

03

Owners of properties that have recently been reassessed or had errors in their tax calculations.

Fill

form

: Try Risk Free

People Also Ask about

What is the best way to win a property tax appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

How do I challenge a property tax assessment in NY?

If you own and live in a 1-, 2-, or 3-family home, you may appeal the Tax Commission's determination by filing a Small Claims Assessment Review Petition (SCARP) in New York State Supreme Court. SCARP forms are available at City County Clerk's offices, which are located inside the borough Supreme Court buildings.

Is a property tax refund taxable income?

If you receive a refund or rebate of real estate taxes this year for amounts you paid this year, you must reduce your real estate tax deduction by the amount refunded to you. If the refund or rebate was for real estate taxes paid for a prior year, you may have to include some or all of the refund in your income.

What is the best evidence to protest property taxes?

Collect Evidence: Gather evidence that supports your argument that the property's value is inflated. This could include data relating to recent property sales issues, the condition of your property, or other economic factors impacting property values.

How to get a tax refund in Los Angeles?

To file a claim for a refund, please follow the instructions below: Ensure that you are eligible for a refund. Complete Form #96.00(a) Refund Claim in the name of the claimant as it appears on the Tax Registration Certificate or Permit. Signature Requirements: Return signed form to:

What do you say when disputing property taxes?

List the account number or numbers you plan to protest. State the reason(s) for protesting. Common reasons for protests are that a property has been assessed more than once (called a double assessment), an assessed location has been recently closed, or the stated value is too high. Sign it and send it.

What to write when protesting property taxes?

Explain why you believe your property is overvalued, referencing the evidence you've gathered. Example: “Based on recent sales of comparable properties in my neighborhood, I believe the assessed value of my home is higher than its current market value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Los Angeles County Property Tax Claim for Refund?

It is a formal request submitted by a property owner to the Los Angeles County assessor's office seeking a refund for overpaid property taxes.

Who is required to file Los Angeles County Property Tax Claim for Refund?

Any property owner who believes they have overpaid property taxes due to incorrect assessments or exemptions may file a claim.

How to fill out Los Angeles County Property Tax Claim for Refund?

To fill out the claim, property owners must complete the designated form, providing required information such as property details, reasons for the claim, and an amount being claimed for refund.

What is the purpose of Los Angeles County Property Tax Claim for Refund?

The purpose is to allow property owners to recover excess taxes paid as a result of errors in property assessments or eligibility for tax exemptions.

What information must be reported on Los Angeles County Property Tax Claim for Refund?

The claim must include the property owner's information, parcel number, details of the tax year being contested, reasons for the refund request, and any supporting documentation.

Fill out your los angeles county property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Los Angeles County Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.