Get the free 55/25 Retirement Plan - nycers

Show details

Este folleto describe los beneficios del Plan de Jubilación 55/25 para los miembros de Tier 4.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 5525 retirement plan

Edit your 5525 retirement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5525 retirement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 5525 retirement plan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 5525 retirement plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 5525 retirement plan

How to fill out 55/25 Retirement Plan

01

Determine your eligibility: Ensure that you meet the age and employment requirements for the 55/25 Retirement Plan.

02

Gather necessary documentation: Collect your employment history, salary information, and any other required personal information.

03

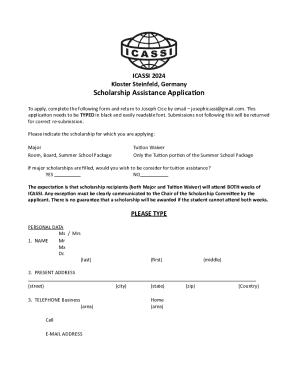

Complete the application form: Fill out the official 55/25 Retirement Plan application, providing all required details accurately.

04

Submit your application: Send the completed application to the appropriate retirement plan administrator or HR department.

05

Review the plan options: Understand the benefits and choices available under the plan to maximize your retirement savings.

06

Regularly update your information: Keep your personal and financial information current with the retirement plan provider.

Who needs 55/25 Retirement Plan?

01

Individuals aged 55 and older who are looking to retire soon.

02

Employees with at least 25 years of service in their current employment.

03

Workers who want to ensure a stable income during retirement.

04

People seeking to maximize their retirement benefits through specialized planning options.

Fill

form

: Try Risk Free

People Also Ask about

How does 55/25 work?

Under the rules of the Plan, 55/25 Rule employees are pensioners age 55 and over with at least 25 years of pension credit from the Plan who apply for and receive advance approval from their SMART local union and the Board of Trustees of the Plan to return to work for an unlimited number of hours in sales or safety for

What is the 55 25 program?

Under the rules of the Plan, 55/25 Rule employees are pensioners age 55 and over with at least 25 years of pension credit from the Plan who apply for and receive advance approval from their SMART local union and the Board of Trustees of the Plan to return to work for an unlimited number of hours in sales or safety for

Can I retire at 55 with 25 years of service?

You can retire at age 55 with at least five years of service credit. Members under CalSTRS 2% at 60 also have the option to retire at age 50 with at least 30 years of service credit. In addition, if you took a refund and then reinstated, you must have performed at least one year of service after the most recent refund.

What is the best retirement plan for a 55 year old?

Use employer-sponsored plans like 401(k)s with matching contributions and open an IRA to maximize annual contributions based on your tax bracket. Use an HSA to save for retirement while benefiting from tax deductions and tax-free withdrawals for qualified medical expenses.

Can I retire at 55 and collect social security?

You will be eligible for a service retirement benefit when you reach age 55 and have five or more years of credited member service. If you are a Tier 3 member, you may retire under Article 14 or Article 15. However, your benefit, in most cases, will be greater under Article 15.

What is the rule of 55 retirement loophole?

This is where the rule of 55 comes in. If you turn 55 (or older) during the calendar year you lose or leave your job, you can begin taking distributions from your 401(k) without paying the early withdrawal penalty. However, you must still pay taxes on your withdrawals.

How many years do you have to work for NY state to get a pension?

You will be eligible for a service retirement benefit when you reach age 55 and have five or more years of credited member service. If you are a Tier 3 member, you may retire under Article 14 or Article 15. However, your benefit, in most cases, will be greater under Article 15.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 55/25 Retirement Plan?

The 55/25 Retirement Plan is a retirement savings strategy that allows individuals to withdraw funds from their retirement accounts without facing early withdrawal penalties once they reach the age of 55, provided they have been enrolled in the plan for at least 25 years.

Who is required to file 55/25 Retirement Plan?

Individuals who wish to access their retirement funds under the 55/25 Retirement Plan provisions must file the appropriate forms, demonstrating they meet the age and service requirements.

How to fill out 55/25 Retirement Plan?

To fill out the 55/25 Retirement Plan, individuals must complete the designated application forms provided by their retirement plan administrator, including personal identification, employment history, and confirmation of eligibility criteria.

What is the purpose of 55/25 Retirement Plan?

The purpose of the 55/25 Retirement Plan is to provide a financial option for individuals nearing retirement age to access their retirement savings while minimizing penalty fees, enabling them to transition into retirement more comfortably.

What information must be reported on 55/25 Retirement Plan?

The information that must be reported on the 55/25 Retirement Plan includes personal details, employment history, years of service, amount of retirement funds to be withdrawn, and supporting documents verifying eligibility.

Fill out your 5525 retirement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

5525 Retirement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.