Get the free Guidance on Deposit-Related Products. Compliance/BSAConsumer ComplianceDepository Se...

Show details

El documento trata sobre la propuesta de orientación del Oficina del Contralor de la Moneda (OCC) para prácticas bancarias seguras y sólidas en relación con productos de crédito al consumidor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidance on deposit-related products

Edit your guidance on deposit-related products form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidance on deposit-related products form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guidance on deposit-related products online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guidance on deposit-related products. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidance on deposit-related products

Point by point, here is how to fill out guidance on deposit-related products:

01

Start by clearly stating the purpose of the guidance. Make sure to explain that it is intended to provide information and instructions on deposit-related products.

02

Include a section that outlines the different types of deposit-related products and their features. This can include savings accounts, fixed deposit accounts, certificates of deposit, etc. Provide details on interest rates, withdrawal options, and any applicable fees.

03

Explain the process of opening a deposit-related product. Provide step-by-step instructions on what documentation is required, how to complete the application form, and how to submit it to the financial institution.

04

Discuss the eligibility criteria for deposit-related products and any requirements that must be met. This can include age restrictions, minimum deposit amounts, and any specific terms and conditions.

05

Provide information on the risks associated with deposit-related products, such as the possibility of losing principal if the financial institution fails. Explain the importance of deposit insurance and how it protects consumers.

06

Include a section on maintenance and management of deposit-related products. Explain how to monitor account balances, update personal information, and make deposits or withdrawals. Provide information on accessing account statements and transaction history.

07

Address any special considerations or disclosures that are specific to certain types of deposit-related products. This can include early withdrawal penalties, interest calculation methods, and maturity dates.

Who needs guidance on deposit-related products?

01

Individuals who are new to banking and want to learn about different types of deposit accounts.

02

Customers who are considering opening a new deposit-related product and want to understand the process and requirements.

03

Existing customers who want to update their knowledge on deposit-related products or understand any changes in regulations or terms.

By following these points, you can effectively fill out guidance on deposit-related products and provide valuable information to those who need it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify guidance on deposit-related products without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your guidance on deposit-related products into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get guidance on deposit-related products?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific guidance on deposit-related products and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out guidance on deposit-related products on an Android device?

Complete guidance on deposit-related products and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

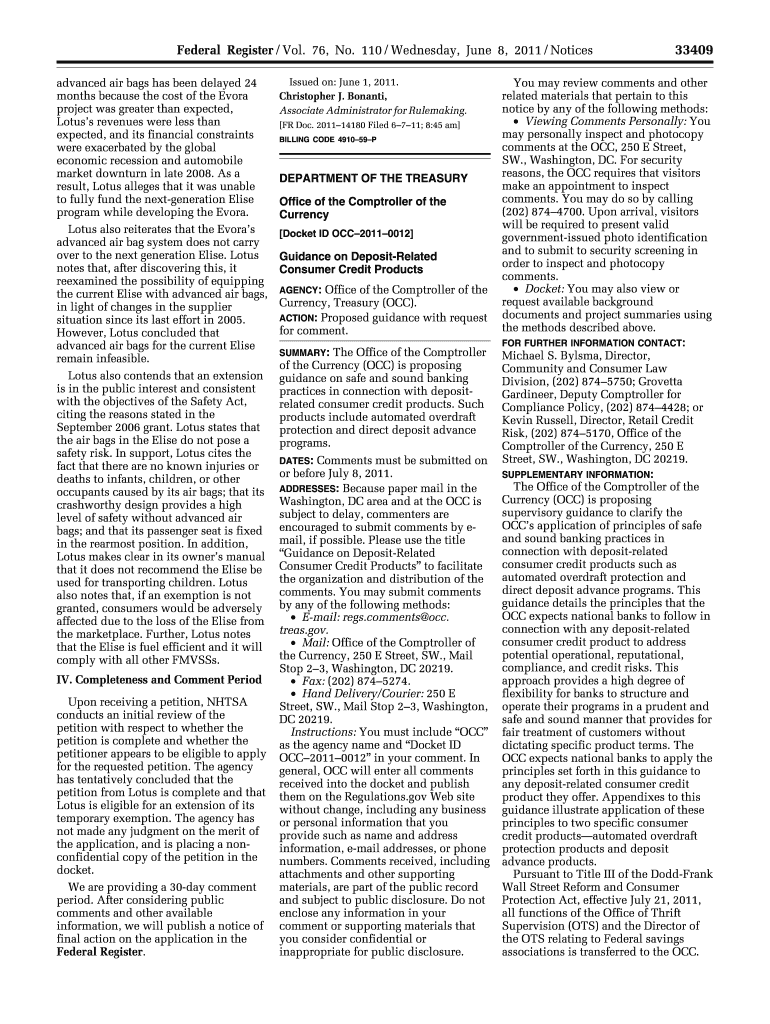

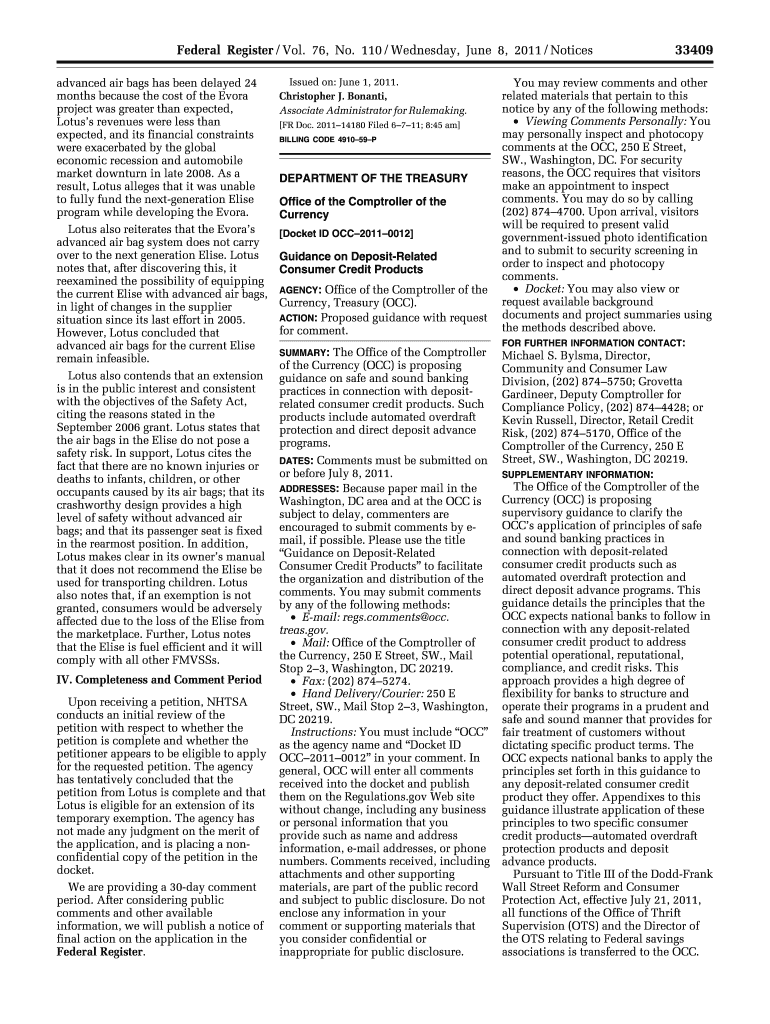

What is guidance on deposit-related products?

Guidance on deposit-related products is a set of instructions or recommendations provided by regulatory authorities to financial institutions regarding the offering, management, and reporting of deposit-related products.

Who is required to file guidance on deposit-related products?

Financial institutions such as banks, credit unions, and other deposit-taking institutions are required to file guidance on deposit-related products.

How to fill out guidance on deposit-related products?

The specific process of filling out guidance on deposit-related products may vary depending on the jurisdiction and regulatory authority. However, typically, financial institutions would need to provide detailed information about the types of deposit-related products they offer, their terms and conditions, reporting requirements, and any applicable regulations.

What is the purpose of guidance on deposit-related products?

The purpose of guidance on deposit-related products is to ensure that financial institutions comply with regulations and best practices in offering and managing these products. It aims to protect consumers, maintain stability in the financial system, and promote transparency and accountability.

What information must be reported on guidance on deposit-related products?

The information required to be reported on guidance on deposit-related products may include details about the types of products, interest rates, fees, minimum balance requirements, early withdrawal penalties, regulatory compliance requirements, and any other relevant information as mandated by the regulatory authority.

Fill out your guidance on deposit-related products online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidance On Deposit-Related Products is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.