IRS 8050 2009 free printable template

Show details

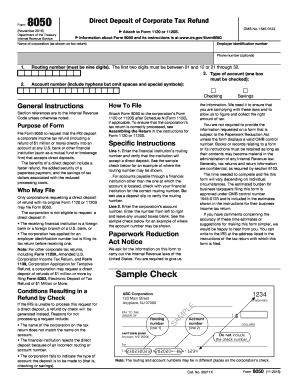

the instructions for Form 1120 or 1120S. Specific Instructions. Line 1. Enter the financial institution's routing number and verify that the institution will accept a ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8050

Edit your IRS 8050 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8050 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8050 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8050

How to fill out IRS 8050

01

Obtain Form 8050 (Request for Change of Address).

02

Fill in your personal information, including name, Social Security number, and address.

03

Indicate the new address you would like to use.

04

Specify the type of address change (individual or business).

05

Provide any additional information requested concerning the change.

06

Sign and date the form to authenticate the request.

07

Mail the completed form to the appropriate IRS address listed in the instructions.

Who needs IRS 8050?

01

Individuals or businesses who have changed their address and need to update their information with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I buy bonds with tax refund?

When you file your tax return, include IRS Form 8888. Complete Part 2 to tell the IRS you want to use part (or all) of your refund to purchase paper I bonds. Purchase amounts must be in $50 multiples and you can choose to have any remaining funds delivered to you either by direct deposit or by check.

How long does it take for HMRC to refund?

You'll be sent the money within 5 working days - it'll be in your UK account once your bank has processed the payment. If you do not claim your refund online within 21 days, HM Revenue and Customs ( HMRC ) will send you a cheque. You'll get this within 6 weeks of the date on your tax calculation letter.

What is Form 8888 used for?

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

What does Form 8888 total refund per computer mean?

Form 8888 allows a Taxpayer to split one refund in up to three accounts or Savings Bonds. If you didn't file the Form 8888 with your return, the 0.00 value is correct.

What is CRA direct deposit?

Direct deposit is fast, convenient and secure. Register for direct deposit today to ensure you get your payments on time in the event of an emergency or unforeseen circumstances! For more information and to find out how to update your account, please visit our Frequently asked questions about direct deposit.

What is direct deposit?

Direct deposit allows your employer to make deposits straight into your bank account instead of giving you a paper check to deposit yourself. This allows you to access your money more quickly and easily.

What is tax topic 152?

What is Tax Topic 152? Topic 152 is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. Unlike other codes that a taxpayer might encounter, Tax Topic 152 doesn't require any additional steps from the taxpayer.

When should I expect my tax refund 2022?

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return.

What is Form 8888 for?

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

Can you get a corporate tax refund?

If you own a pass-through business and your estimated tax payments and tax withholding exceed the tax due on your return, you can receive a tax refund. Only C corporations pay income taxes directly, so C corporations are the only businesses that can get a refund.

How long does it take to get your tax refund back direct deposit?

Most refunds will be issued in less than 21 days. You can start checking the status of your refund within 24 hours after you have e-filed your return. Remember, the fastest way to get your refund is to e-file and choose direct deposit.

How long does direct deposit take?

On average, it'll take one to three business days for a direct deposit to clear, but the timing can depend on the type of payroll software your employer or sender uses. With some employers and payroll processing services, your direct deposits can be available on your scheduled payday.

How long does it take to get corporate tax refund?

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it's possible your tax return may require additional review and take longer.

How do I check the status of my corporate tax refund?

Business Tax Return Information For refund information on federal tax returns other than Form 1040, U.S. Individual Income Tax Return, call, toll free, at 800-829-4933. From outside the U.S., call 267-941-1000. TTY/TDD: 800-829-4059. Where's My Refund?

What is Form 8888 total refund per computer?

Form 8888 allows a Taxpayer to split one refund in up to three accounts or Savings Bonds. If you didn't file the Form 8888 with your return, the 0.00 value is correct.

Can tax refunds be direct deposited?

The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts.

Can corporate refunds be direct deposited?

Corporations file this form to request that the IRS deposit a corporate income tax refund directly into an account at any U.S. bank or other financial institution that accepts direct deposits.

How do I submit a form 8888?

Instead, request direct deposit on your tax return. All Form 8888 deposits must be to accounts in your name, your spouse's name, or a joint account. You can't file Form 8888 if you file Form 8379 (Injured Spouse Allocation) or with an amended tax return. File Form 8888 electronically to get your refund faster.

What is direct deposit for refunds?

What is Direct Deposit? Direct Deposit is a free service for electronically transferring your tax refund from the Internal Revenue Service into your financial account. More than eight out of ten taxpayers use Direct Deposit to get their tax refunds. Direct Deposit is easy, safe and secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS 8050?

IRS 8050 is a form used for reporting certain tax information to the Internal Revenue Service (IRS).

Who is required to file IRS 8050?

Taxpayers who engage in specific transactions or have certain types of income may be required to file IRS 8050.

How to fill out IRS 8050?

To fill out IRS 8050, taxpayers should follow the instructions provided with the form, ensuring all required information is accurately completed.

What is the purpose of IRS 8050?

The purpose of IRS 8050 is to collect data necessary for tax compliance and to ensure proper reporting of income and transactions.

What information must be reported on IRS 8050?

The information required on IRS 8050 typically includes taxpayer identification details, transaction information, and any other relevant financial data.

Fill out your IRS 8050 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8050 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.