Get the free Form 17

Show details

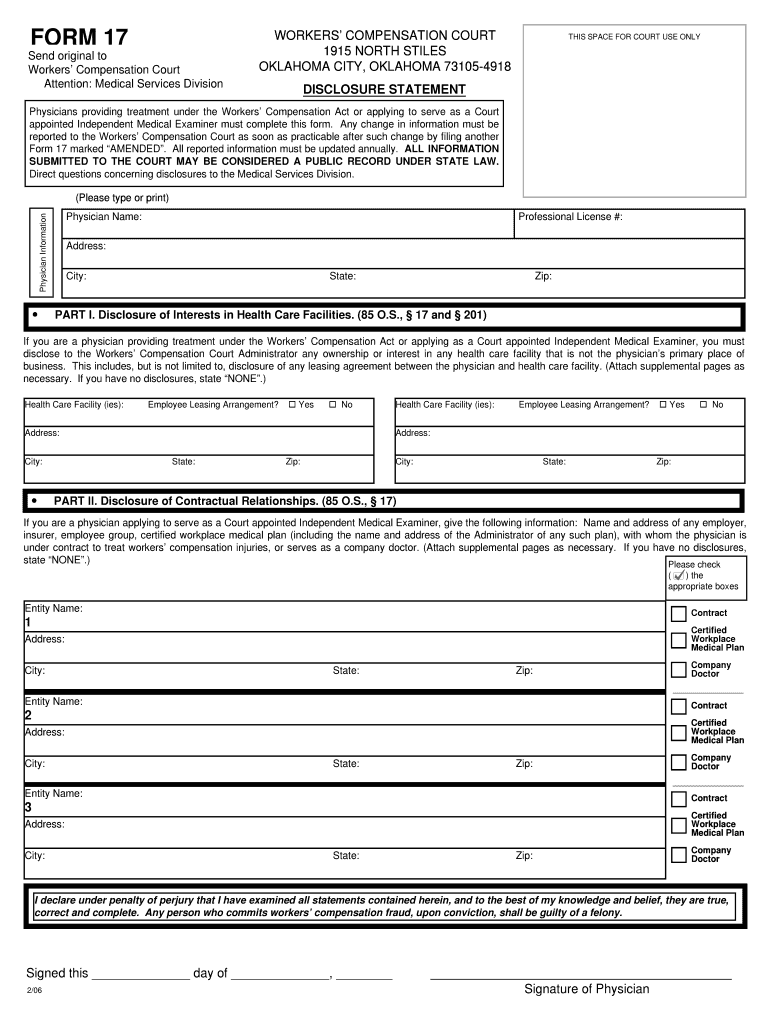

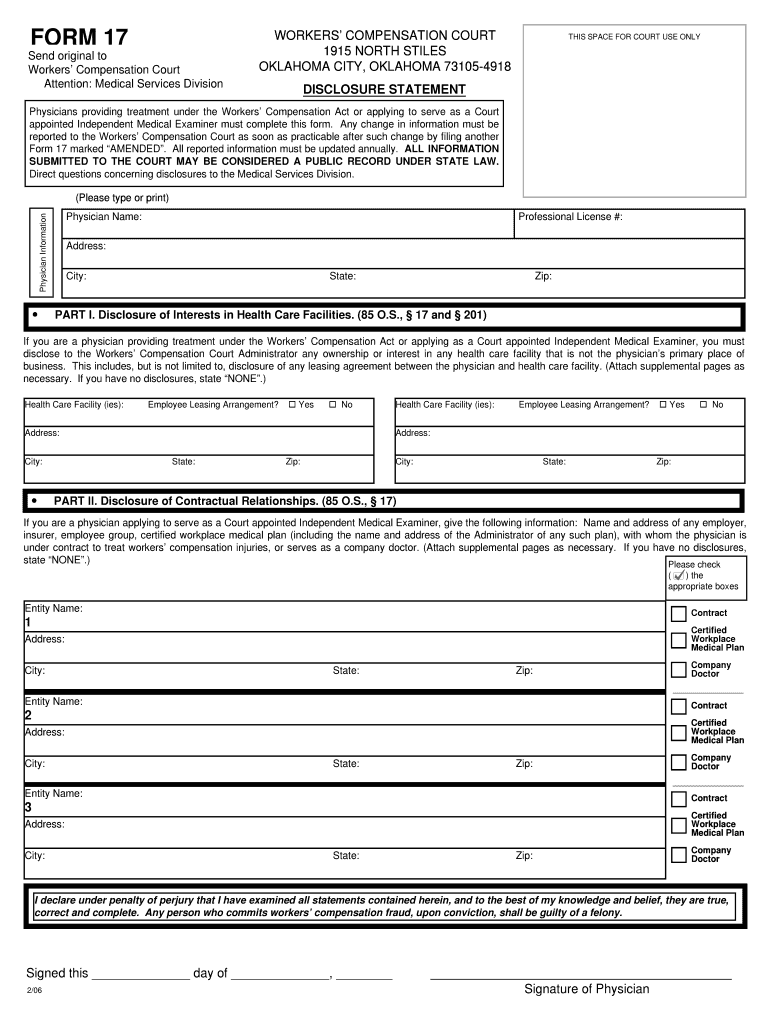

Form required for physicians providing treatment under the Workers' Compensation Act to disclose any ownership interests or contractual relationships with healthcare facilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 17

Edit your form 17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 17 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 17. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 17

How to fill out Form 17

01

Obtain Form 17 from the official website or relevant authority.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal details in the appropriate sections, including your name, address, and contact information.

04

Provide the details of the transaction or information that the form requires.

05

Double-check all entered information for accuracy.

06

Sign and date the form where required.

07

Submit the filled-out form as per the given instructions, either online or via mail.

Who needs Form 17?

01

Individuals or entities involved in certain transactions that require disclosure.

02

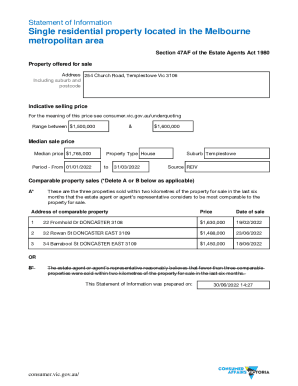

Real estate professionals handling property transactions.

03

Organizations that need to report specific information to regulatory bodies.

Fill

form

: Try Risk Free

People Also Ask about

What does line 17 mean on 1040?

Schedule A asks you to list and tally up all your itemized deductions to figure out your Total Itemized Deductions amount (line 17 of Schedule A), which are then subtracted from your adjusted gross income (AGI) to determine your total taxable income.

What is tax form 17?

Form 17-Reconciliation of Income Tax Withheld and W-2/1099-NEC Transmittal. General Instructions: A Reconciliation of Income Tax Withheld is required to be filed on or before the last day of February following the calendar year in which employee withholding deductions have been made by an employer.

What is a CA 17 form used for?

The CA-17 was designed to provide the doctor with an accurate description of the physical work requirements of the injured letter carrier. The CA-17 is a legal document that determines both an injured worker's medical restrictions and entitlement to wage-loss compensation benefits.

What is a CA 7a form?

When an employee elects LWOP related to a work-related injury or illness they may file for wage loss compensation by completing Form CA-7, Claim for Compensation and Form CA-7a, Time Analysis Form (if LWOP is intermittent). Forms CA-7 & CA-7a should be completed bi-weekly in alignment with established pay periods.

What is the purpose of IRS publication 17?

Publication 17 covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet.

What is publication 17 in the IRS?

Publication 17 covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet.

What is tax form 17?

Form 17-Reconciliation of Income Tax Withheld and W-2/1099-NEC Transmittal. General Instructions: A Reconciliation of Income Tax Withheld is required to be filed on or before the last day of February following the calendar year in which employee withholding deductions have been made by an employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 17?

Form 17 is a tax document used in certain jurisdictions to report income from trusts, estates, or partnerships.

Who is required to file Form 17?

Form 17 is typically required to be filed by trustees, executors, or partnership representatives who manage income-generating assets within the respective entities.

How to fill out Form 17?

To fill out Form 17, individuals must provide detailed information regarding the income, deductions, and distributions related to the trust, estate, or partnership, following the specified guidelines provided by the tax authority.

What is the purpose of Form 17?

The purpose of Form 17 is to ensure that the tax authorities are informed about the income generated and distributed from trusts, estates, or partnerships for accurate tax assessment.

What information must be reported on Form 17?

Form 17 requires reporting of income received, expenses incurred, distributions made, and identifying information about the trust, estate, or partnership.

Fill out your form 17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 17 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.