Get the free Form 10A

Show details

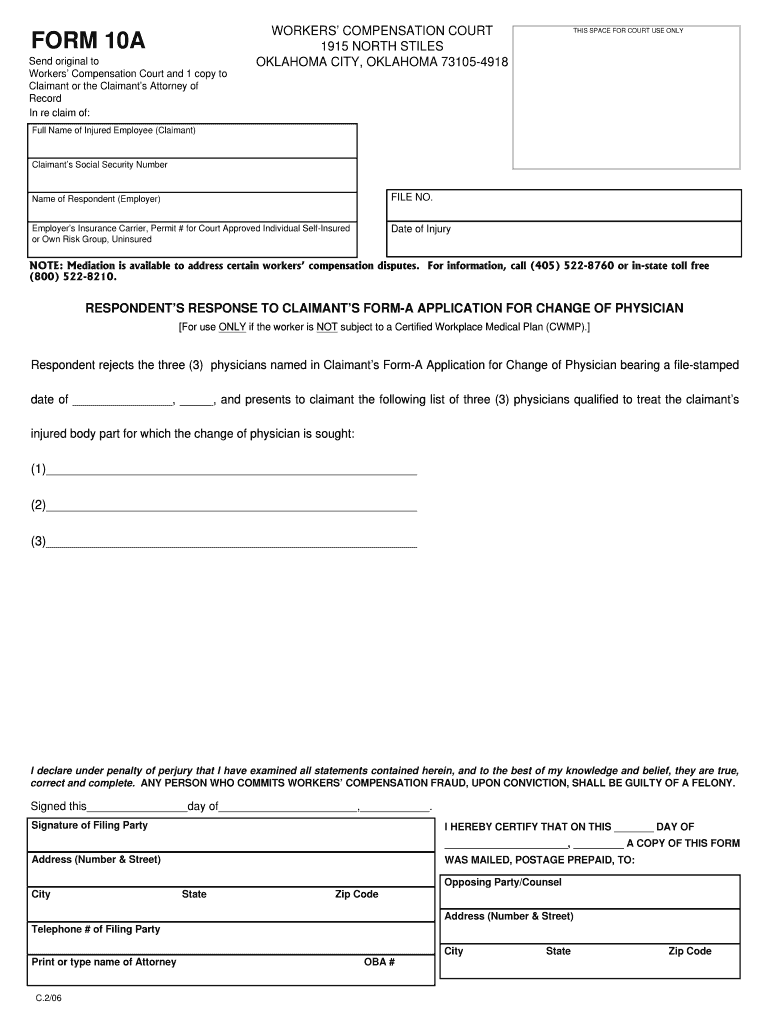

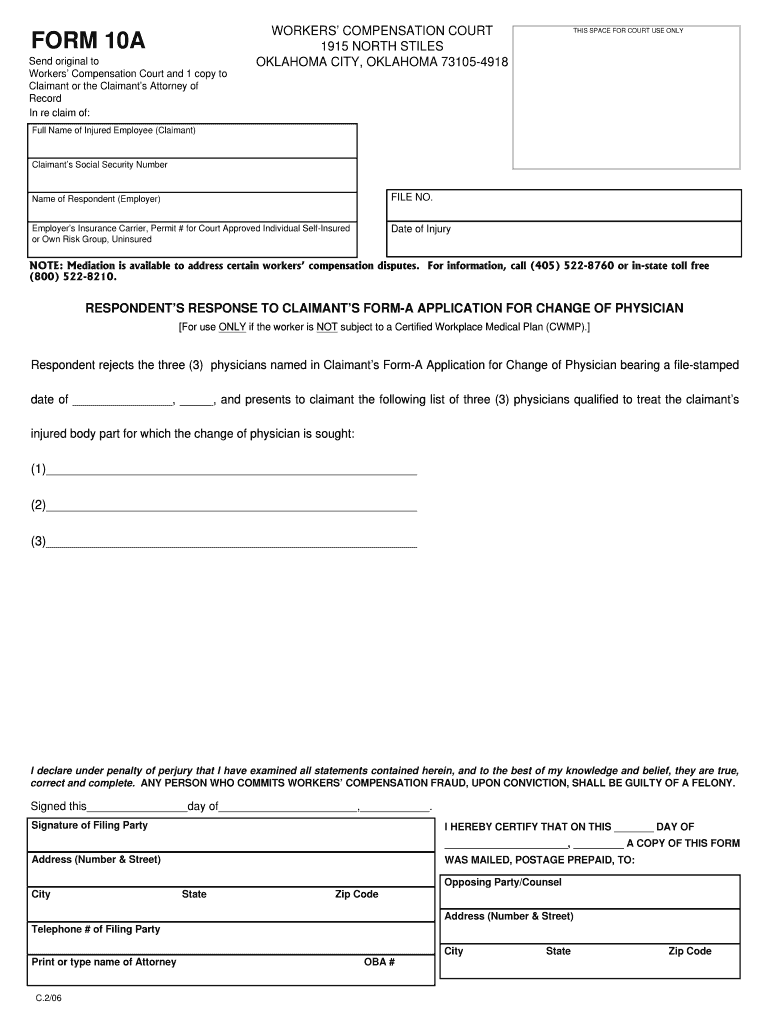

This form is used by the respondent (employer or insurance carrier) to provide a list of approved physicians when an injured employee requests a change of physician.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10a

Edit your form 10a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 10a online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 10a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10a

How to fill out Form 10A

01

Obtain a copy of Form 10A from the relevant authority or website.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal details, including full name, address, and contact information.

04

Provide the purpose for which you are filling out the form.

05

Include any relevant identification numbers or references as required.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the form to the appropriate office or submit it online if applicable.

Who needs Form 10A?

01

Individuals applying for certain licenses or permits.

02

People seeking government assistance or benefits.

03

Applicants for specific registrations, such as business or property.

04

Anyone needing to provide documentation for legal or official purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the point of RITA taxes?

The RITA reimburses an eligible transferred employee substantially all of the additional Federal, State, and local income taxes incurred as a result of receiving taxable travel income. Travel W-2 wages/income and withholdings are reported to the IRS.

What is Ohio Form 10A?

Form 10A. Application for Municipal Income Tax Refund. Form. Form 32 EST-EXT. Estimated Income Tax and/or Extension of Time to File.

What happens if you don't pay RITA in Ohio?

A penalty may be imposed on unpaid income tax, including unpaid estimated income tax, equal to 15% of the amount not timely paid. A penalty may be imposed on unpaid employer withholding tax equal to 50% of the amount not timely paid.

Who is subject to Ohio municipal income tax?

The tax is paid by residents of a city or vil lage that has imposed a municipal income tax as well as nonresidents who work in such a municipality. The tax also applies to businesses that have earned net profits within the municipality.

How to file form no 10?

Step 1: Go to the e-Filing portal and click login. Step 2: On Login Page enter your user ID and password. Step 3: On your Dashboard, Go to e- File menu > Income Tax Forms > File Income Tax Forms. Step 4: On the page- File Income Tax Forms -'Persons with Business/Professional Income -select the option-Form-10IEA.

Who has to file RITA taxes in Ohio?

Resident individuals who are 18 years of age and older must file an annual return, even if no tax is due. Non-resident individuals who have earned income in a RITA municipality that is not subject to employer withholding must file an annual return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 10A?

Form 10A is a document used in India for the registration of a trust or a society under the Income Tax Act, specifically to obtain a tax exemption.

Who is required to file Form 10A?

Form 10A must be filed by charitable or religious trusts and non-profit organizations seeking recognition under section 12A of the Income Tax Act.

How to fill out Form 10A?

To fill out Form 10A, applicants need to provide details such as the name of the trust or society, its objectives, registration details, and the names of the trustees along with their identification.

What is the purpose of Form 10A?

The purpose of Form 10A is to enable organizations to apply for tax exemption, allowing them to receive donations without the burden of taxation.

What information must be reported on Form 10A?

Information required includes the name of the institution, its date of establishment, aims and objectives, registration under relevant laws, and details about the governing body.

Fill out your form 10a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.