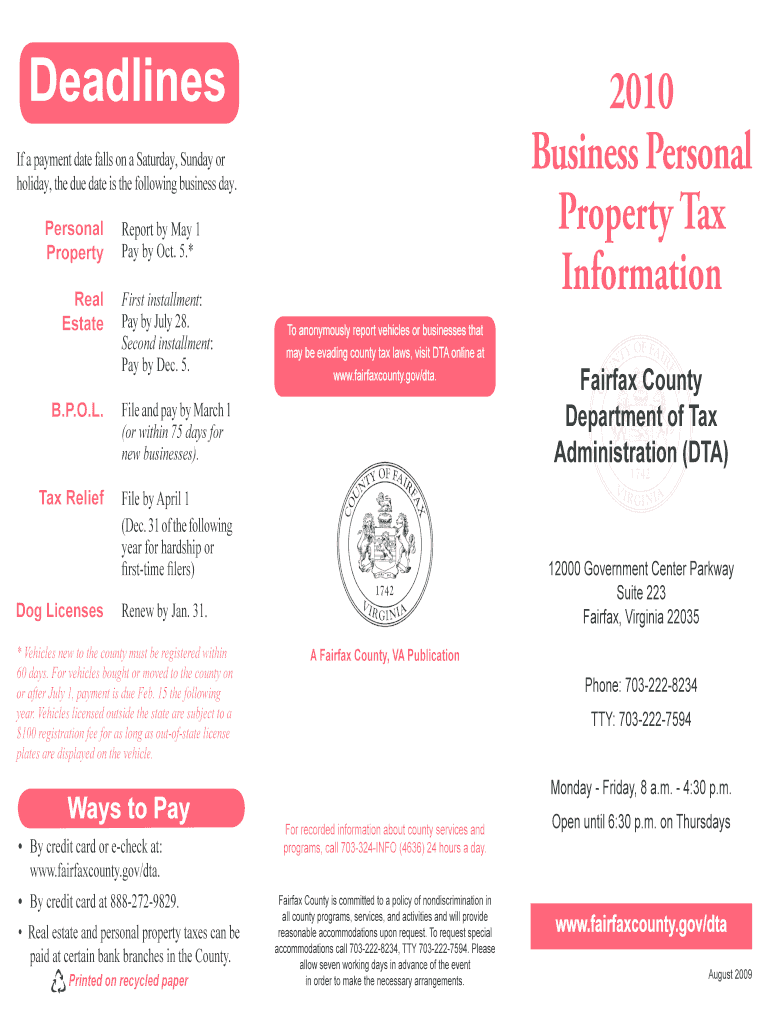

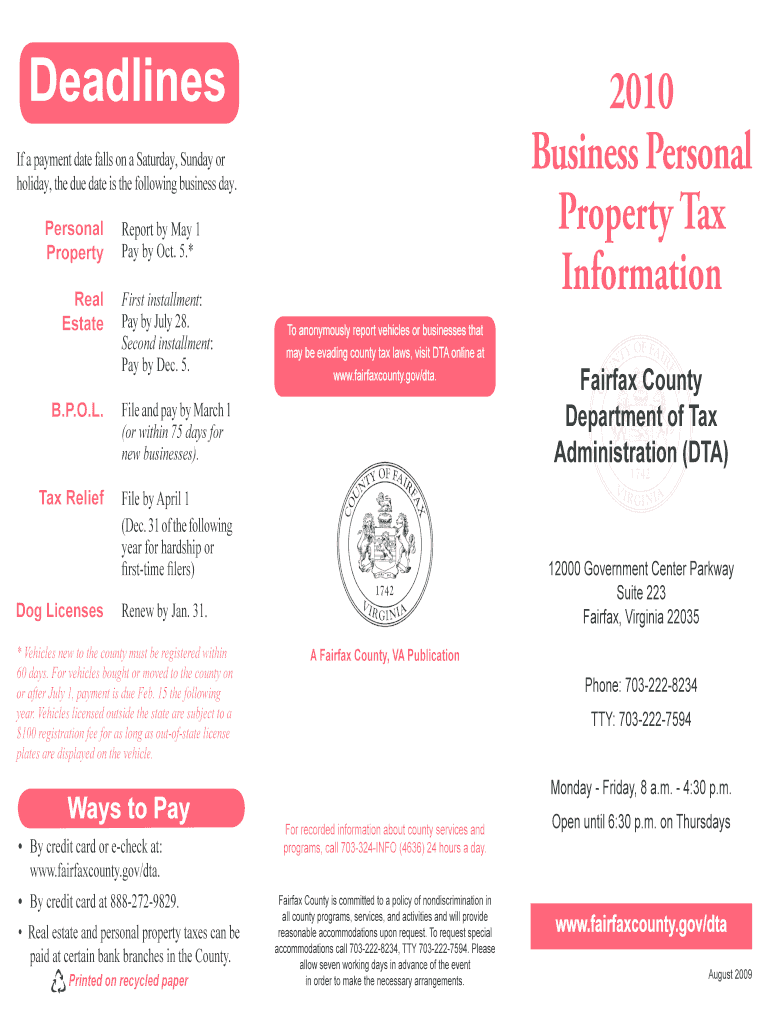

Get the free Business Personal Property Tax Information

Show details

This document provides information and deadlines for filing personal property taxes related to business assets in Fairfax County, Virginia.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business personal property tax

Edit your business personal property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business personal property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business personal property tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business personal property tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business personal property tax

How to fill out Business Personal Property Tax Information

01

Gather all necessary financial documents related to business personal property.

02

List all items that qualify as business personal property, including equipment, furniture, and inventory.

03

Determine the purchase date and original cost of each item.

04

Calculate the current value of each item, taking into account depreciation.

05

Complete the tax form by entering the relevant details for each item, including total value.

06

Review the form for accuracy before submitting.

07

Submit the completed form to the appropriate tax authority by the deadline.

Who needs Business Personal Property Tax Information?

01

Businesses that own or lease personal property used for commercial purposes must file this information.

02

Property owners who operate a company and are required to report business personal property for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Does an LLC have to pay property taxes?

LLCs must pay property taxes.

Does Illinois have business personal property tax?

These taxes resulted when the new Illinois Constitution directed the legislature to abolish business personal property taxes and replace the revenue lost by local government units and school districts.

How is business personal property tax calculated in Alabama?

Assessment level A ratio determined by the tax authority as of what percentage of market value is to be taxed. In the State of Alabama the assessment level is 20% for personal property. To illustrate: A property with a fair market value of $5,000 is to be taxed. The district tax rate is 7%.

How much can an LLC make without paying taxes?

There is no minimum income you have to meet before your small corporation is taxed. Every dollar it earns (after deductions and credits are factored in) will be taxed at 21%. Corporate tax rates also apply to limited liability companies (LLCs) who have elected to be taxed as corporations.

What are the tax benefits of an LLC owning property?

Setting up an LLC can make you eligible for extra deductions, such as a 20% income tax deduction. In addition, you can deduct expenses related to your real estate business, such as renovations, insurance, mortgage interest, and any other business costs you incur while buying, selling, and managing properties.

Does an LLC pay property taxes?

LLCs must pay property taxes.

Does NY have business personal property tax?

If your business or organization owns a lot of equipment, you might decide to move your business to New York, where only real property (like land and the structures attached to it) are subject to taxation.

What is the disadvantage of putting a property in an LLC?

Cost and Complexity One disadvantage of setting up an LLC for rental property ownership is the associated costs. Establishing an LLC requires filing fees, which vary significantly from state to state. Additionally, there may be ongoing costs such as annual report fees and franchise taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Personal Property Tax Information?

Business Personal Property Tax Information refers to the data collected regarding the tangible assets owned by businesses, such as machinery, equipment, furniture, and fixtures, that are subject to local property taxation.

Who is required to file Business Personal Property Tax Information?

Businesses that own personal property used for business purposes are required to file Business Personal Property Tax Information with their local tax authority.

How to fill out Business Personal Property Tax Information?

To fill out Business Personal Property Tax Information, businesses typically need to provide details of their personal property, including descriptions, acquisition dates, purchase prices, and current values, in accordance with the form provided by the local tax authority.

What is the purpose of Business Personal Property Tax Information?

The purpose of Business Personal Property Tax Information is to assess property taxes on the personal property owned by businesses, ensuring that such assets are taxed appropriately and contribute to local government revenue.

What information must be reported on Business Personal Property Tax Information?

The information that must be reported includes a detailed list of all business personal property, including its type, quantity, location, cost, and additional relevant financial data needed to calculate the tax liability.

Fill out your business personal property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Personal Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.