Get the free 2010 Application for Equalization of Real Property Assessment

Show details

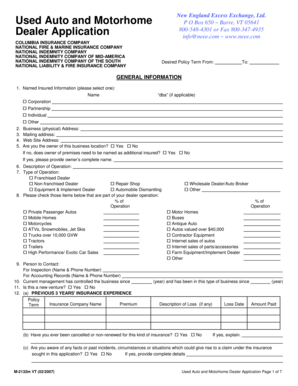

This document serves as a checklist and application form for property owners in Fairfax County wishing to appeal their real estate assessments to the Board of Equalization (BOE). It outlines the requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2010 application for equalization

Edit your 2010 application for equalization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 application for equalization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2010 application for equalization online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2010 application for equalization. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2010 application for equalization

How to fill out 2010 Application for Equalization of Real Property Assessment

01

Obtain the 2010 Application for Equalization of Real Property Assessment form from your local assessment office or website.

02

Fill out the property owner's name and contact information at the top of the form.

03

Indicate the property address for which you are seeking equalization.

04

Provide details about the property's current assessment value as indicated on your latest assessment notice.

05

Explain the reason for your request for equalization, providing any relevant evidence or particulars to support your claim.

06

Attach any additional documentation, such as photographs, comparisons to similar properties, or evidence of discrepancies in valuation.

07

Sign and date the application form to certify that the information provided is true and accurate.

08

Submit the completed application to the appropriate assessment office by the deadline specified in the instructions.

Who needs 2010 Application for Equalization of Real Property Assessment?

01

Property owners who believe their property's assessment value is unfairly high compared to similar properties.

02

Individuals seeking to challenge their property tax assessment based on errors or discrepancies.

03

Owners of residential or commercial properties looking for a reduction in their assessment for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I fight property tax increases in Georgia?

You may file an appeal either with the Georgia Tax Tribunal or in the appropriate superior court within 30 days from the issued date on the official assessment.

What is the best reason to protest property taxes?

Here are five reasons you might want to consider a property tax protest: Property Values Can Be Overvalued. Property Descriptions Can Have Inaccuracies. Comparable Value Discrepancies are Grounds for a Property Tax Protest. Economic Hardships. Legal Changes.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

How to win a property assessment appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

What is the success rate of property tax appeals?

– 40% to 60% of appeals result in a reduction in assessed value, with potential tax savings ranging from 10% to 15%.

How often are property tax appeals successful?

– 30% to 60% of U.S. properties are over assessed, making millions of Americans eligible to file property tax appeals. – 40% to 60% of appeals result in a reduction in assessed value, with potential tax savings ranging from 10% to 15%.

What is the best way to win a property tax appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

What is the equalization rate for property taxes?

The equalization rate simply defines the relationship of a property's assessed value to its full value. For example: An equalization rate of 0.80 means that a property is assessed at 80 percent of its full value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2010 Application for Equalization of Real Property Assessment?

The 2010 Application for Equalization of Real Property Assessment is a formal request submitted by property owners to challenge and request a review of the assessed value of their real property to ensure it is in line with the fair market value.

Who is required to file 2010 Application for Equalization of Real Property Assessment?

Property owners who believe that their property has been assessed at a value higher than its fair market value, or those who want to contest the assessment decision, are required to file the 2010 Application for Equalization of Real Property Assessment.

How to fill out 2010 Application for Equalization of Real Property Assessment?

To fill out the 2010 Application for Equalization of Real Property Assessment, property owners must complete the application form, providing necessary information such as property details, the current assessed value, the desired value, supporting evidence, and any relevant documentation.

What is the purpose of 2010 Application for Equalization of Real Property Assessment?

The purpose of the 2010 Application for Equalization of Real Property Assessment is to ensure that property assessments are fair and equitable, allowing property owners to contest assessments they believe are inaccurate, thus potentially reducing their property tax burden.

What information must be reported on 2010 Application for Equalization of Real Property Assessment?

The information that must be reported on the 2010 Application for Equalization of Real Property Assessment includes the property owner's name, the property description, the current assessed value, the value being contested, reason for the contest, and any supporting documents or evidence justifying the request.

Fill out your 2010 application for equalization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2010 Application For Equalization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.