Get the free PT 99-2 - tax illinois

Show details

This document is a recommendation for disposition regarding the real estate tax exemption status of the Assyrian Social Club, Inc. It addresses qualifications for property tax exemptions under Illinois

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pt 99-2 - tax

Edit your pt 99-2 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pt 99-2 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pt 99-2 - tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pt 99-2 - tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

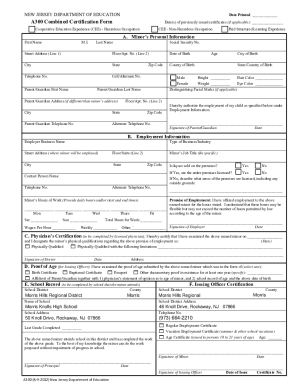

How to fill out pt 99-2 - tax

How to fill out PT 99-2

01

Obtain the PT 99-2 form from the appropriate issuing authority.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal information at the top, including your full name, address, and contact information.

04

Provide any required identification numbers, such as Social Security Number or Tax ID.

05

Complete the sections that pertain to your specific circumstances, ensuring all answers are accurate and complete.

06

Review the filled-out form for any errors or missing information.

07

Sign and date the form at the designated area.

08

Submit the form either electronically or by mail, based on the instructions provided.

Who needs PT 99-2?

01

Individuals or entities who are required to report specific information related to tax obligations or compliance.

02

Tax professionals who assist clients in filing their tax documents.

03

Businesses that need to confirm their eligibility for certain tax benefits or comply with local regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of Psalm 99?

Psalm 99, which celebrates God's majestic holiness, describes His holy reign over all creation, His holy righteousness expressed in justice, and His holy relationships with His people.

What are the praise words in psalms?

NIV The Lord is a refuge for the oppressed, a stronghold in times of trouble. NASB The Lord will also be a stronghold for the oppressed, A stronghold in times of trouble; CSB The Lord is a refuge for the persecuted, a refuge in times of trouble.

What are the words to Psalm 99?

Bible Gateway Psalm 99 :: NIV. The LORD reigns, let the nations tremble; he sits enthroned between the cherubim, let the earth shake. Great is the LORD in Zion; he is exalted over all the nations. Let them praise your great and awesome name-- he is holy.

What Psalm is God's holiness?

Psalm 96:9 – Worship the LORD in the splendor of holiness; tremble before him, all the earth!

What is Psalm 99 talking about?

Psalm 150: “Praise the Lord, Praise God in his sanctuary. Praise him in his mighty heavens. Praise him for his acts of power. Praise him for his surpassing greatness.

What is the verse 2 in Psalm 99?

2 The LORD is great in Zion; he is exalted over all the peoples. 2 The LORD sits in majesty in Jerusalem, exalted above all the nations. 2 God looms majestic in Zion, He towers in splendor over all the big names.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

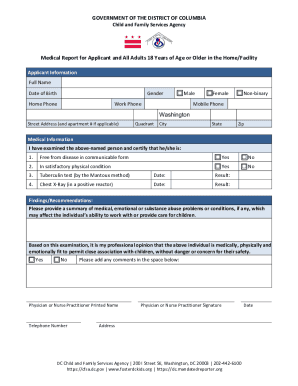

What is PT 99-2?

PT 99-2 is a form used for reporting certain tax information to the state or relevant tax authority. It typically pertains to specific tax obligations under state law.

Who is required to file PT 99-2?

Businesses and organizations that have tax obligations as defined by the state's regulations are generally required to file PT 99-2.

How to fill out PT 99-2?

To fill out PT 99-2, provide all required information including business identification details, financial data, and any specific figures requested on the form. Follow the instructions for each section carefully.

What is the purpose of PT 99-2?

The purpose of PT 99-2 is to ensure compliance with state tax laws by collecting necessary financial information from businesses and organizations.

What information must be reported on PT 99-2?

Information required on PT 99-2 may include business name, address, tax identification number, financial revenue details, and any other information specified by the tax authority.

Fill out your pt 99-2 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pt 99-2 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.