Get the free Report on the Feasibility of Printing Tax Increment Financing (TIF) District Informa...

Show details

This document reports on the feasibility of including Tax Increment Financing (TIF) district information on individual property tax bills in Illinois, addressing public interest in TIF transparency

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report on form feasibility

Edit your report on form feasibility form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report on form feasibility form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report on form feasibility online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit report on form feasibility. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report on form feasibility

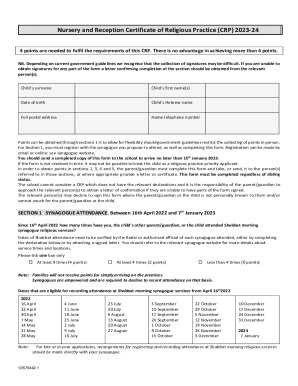

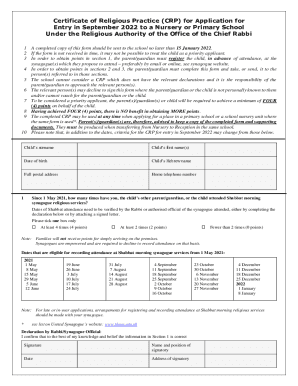

How to fill out Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills

01

Gather all necessary data regarding the TIF districts, including maps, boundaries, and financial information.

02

Determine the specific information to be included on the individual tax bills concerning the TIF districts.

03

Create a template for the tax bills that incorporates TIF district information clearly and concisely.

04

Consult with relevant stakeholders, such as finance departments and tax assessors, to ensure accuracy and compliance.

05

Prepare a draft report summarizing the feasibility of printing TIF information on tax bills, including potential impacts and benefits.

06

Review and revise the report based on feedback from stakeholders.

07

Finalize the report and prepare for distribution to applicable departments and officials.

Who needs Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills?

01

Local government officials responsible for tax assessments and budgeting.

02

Taxpayers who would benefit from understanding TIF district impacts on their tax bills.

03

Economic development agencies seeking to promote transparency in financing developments.

04

Finance departments requiring accurate records of TIF district assessments.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside to a TIF?

TIFs raise the value of the tax base, granting local and regional governments larger budgets (once the TIF is retired, i.e., when the bonds are repaid). TIF CONS: • TIFs may set different urban areas and different levels of government in competition with one another over funding.

What is the purpose of a tax incremental district?

TID = Tax Increment District • The actual physical area designated for potential development projects. expansion by using property tax revenue to fund site improvements within a specified area.

What is an example of tax increment financing?

For example, if a $5,000,000 annual tax increment is expected in a development, which would cover the financing costs of a $50,000,000 bond, only a $25,000,000 bond would be typically allowed.

Who qualifies for TIF?

TIFF is good for working with the high-resolution photos, scans, and other images that professional graphics artists use. They can also store additional data about each pixel, so they're useful for things like a GeoTIFF that tags each pixel with GPS coordinates, or for thermal or other radiometric imaging.

What does TIF stand for?

In order to qualify for Tax Increment Financing (TIFs), a project must be located in a “blighted” area with declining property values and higher concentrations of poverty.

What is a TIF report?

Tax Increment Financing, or TIF, is a geographically targeted economic development tool. It captures the increase in property taxes, and sometimes other taxes, resulting from new development, and diverts that revenue to subsidize that development.

Is a TIF a good thing?

Funding for TIF is provided in the form of a bond, secured by the developer, and paid back only by the developers increase in property taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills?

The Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills assesses the practicality of including TIF district data on property tax bills to improve transparency and inform taxpayers about the impacts of TIF financing on local taxes.

Who is required to file Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills?

Typically, this report is required to be filed by local government authorities, municipalities, or agencies that manage TIF districts and are responsible for property tax assessment.

How to fill out Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills?

To fill out the report, authorities need to gather data on TIF district boundaries, property tax revenues generated, and how those funds are allocated. They must then complete the form according to the guidelines set by the relevant oversight body, ensuring all information is accurate and comprehensive.

What is the purpose of Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills?

The purpose of the report is to evaluate whether including TIF district information on tax bills enhances transparency for taxpayers, allows them to understand how TIF financing affects their taxes, and informs decisions regarding future TIF projects.

What information must be reported on Report on the Feasibility of Printing Tax Increment Financing (TIF) District Information on Individual Tax Bills?

The report must include TIF district identification, financial data such as tax increment revenues, contributions to project funding, and the overall impact of TIF financing on local tax rates and property assessments.

Fill out your report on form feasibility online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report On Form Feasibility is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.