Get the free Schedule CR - tax illinois

Show details

This form is used by Illinois residents or part-year residents to claim a credit against their Illinois income tax for taxes paid to other states on income that is also subject to Illinois tax, thus

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule cr - tax

Edit your schedule cr - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule cr - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule cr - tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule cr - tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule cr - tax

How to fill out Schedule CR

01

Gather necessary documentation and information related to your creditable coverage.

02

Obtain the Schedule CR form from the IRS website or your tax professional.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Input the specifics of your health insurance coverage, including policy numbers and coverage dates.

05

Calculate and report your premium amounts and any applicable tax credits.

06

Review the completed Schedule CR for accuracy.

07

Attach the Schedule CR to your tax return before filing.

Who needs Schedule CR?

01

Individuals who have been enrolled in a health insurance plan and are claiming premium tax credits.

02

Taxpayers who have received a Form 1095-A, 1095-B, or 1095-C regarding their health coverage.

03

Those who need to report health coverage information related to the Affordable Care Act.

Fill

form

: Try Risk Free

People Also Ask about

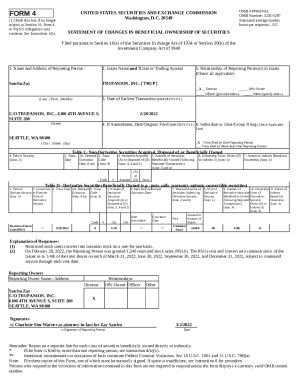

Which employers must use Schedule B?

Form 941 Schedule B is used by semiweekly schedule depositors who report more than $50,000 in payroll taxes. Businesses that incur more than $100,000 in obligations on a single day of the tax year must also file this 941 Schedule B.

What is the schedule CR in Illinois?

What is the purpose of Schedule CR? Schedule CR, Credit for Tax Paid to Other States, allows you to take a credit for income taxes you paid to other states on income you received while a resident of Illinois. You are allowed this credit only if you filed a required tax return with the other state.

What is a schedule A for taxes?

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

What is CR tax?

CR Tax means, for any tax year, the amount of Consolidated Tax Liability allocated to a Member pursuant to Article III, Section 3.2 of this Agreement.

What is schedule A vs B?

Schedule A—Itemized Deductions. Schedule B—Interest and Ordinary Dividends. Schedule D—Capital Gains and Losses. Schedule E—Supplemental Income and Loss. Schedule F—Profit or Loss From Farming.

What is the Schedule B used for?

More In Forms and Instructions Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is the difference between Schedule A and Schedule B?

You use Schedule A to itemize deductions on your tax return when your itemized deductions exceed the Standard Deduction. Taxpayers use Schedule B to report interest and dividend income when it exceeds the IRS annual threshold of $1,500 (tax year 2023, 2024, and 2025).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule CR?

Schedule CR is a tax form that allows taxpayers to claim a credit for various types of contributions, specifically related to charitable donations.

Who is required to file Schedule CR?

Taxpayers who wish to claim certain credits for charitable contributions on their tax return are required to file Schedule CR.

How to fill out Schedule CR?

To fill out Schedule CR, taxpayers need to provide information about their contributions, including the amount donated, the recipient organization, and any other required details as specified in the instructions for the form.

What is the purpose of Schedule CR?

The purpose of Schedule CR is to allow taxpayers to report and claim credits for charitable contributions made during the tax year, thus encouraging philanthropic efforts.

What information must be reported on Schedule CR?

On Schedule CR, taxpayers must report the total amount of contributions, the names and addresses of the organizations to which contributions were made, and any necessary documentation or proof of the contributions.

Fill out your schedule cr - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Cr - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.