Get the free Illinois Net Loss Deduction Schedule NLD - tax illinois

Show details

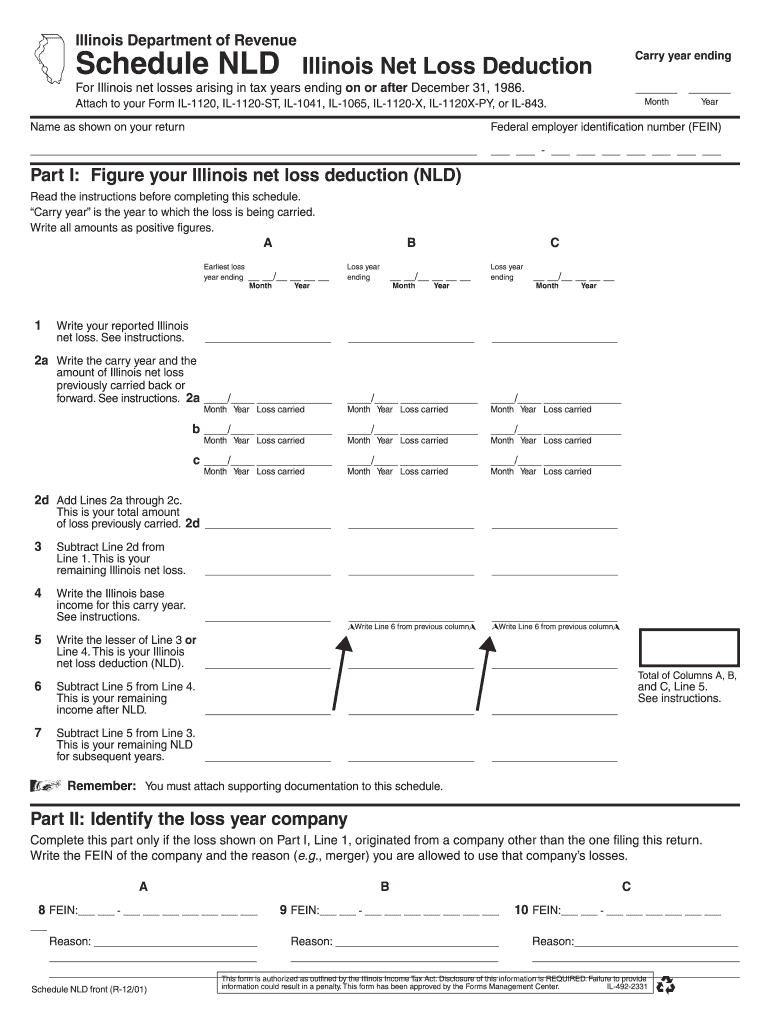

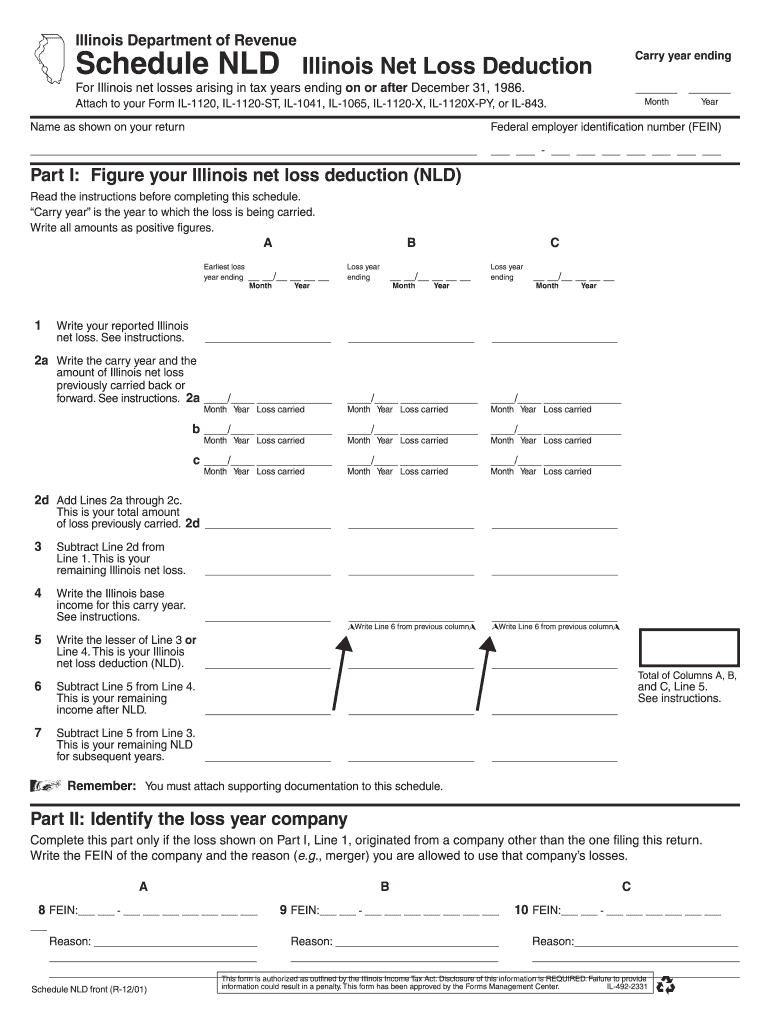

This form is used to calculate and report the Illinois net loss deduction (NLD) stemming from net losses of prior tax years, aiding in the determination of taxable income for Illinois corporate taxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois net loss deduction

Edit your illinois net loss deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois net loss deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing illinois net loss deduction online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois net loss deduction. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out illinois net loss deduction

How to fill out Illinois Net Loss Deduction Schedule NLD

01

Begin by downloading the Illinois Net Loss Deduction Schedule NLD form from the Illinois Department of Revenue website.

02

Fill out your name, address, and taxpayer identification number at the top of the form.

03

Report the net loss amount you are claiming for the tax year in the appropriate section.

04

Provide the necessary year(s) for which you are carrying the net losses back or forward, specifying the total losses applicable.

05

Complete all relevant calculations to determine the allowable deduction based on the state tax regulations.

06

Double-check the instructions document to ensure compliance with all reporting requirements.

07

Review your filled-out form for errors before submission, then mail it to the address listed in the instruction guide or e-file if available.

Who needs Illinois Net Loss Deduction Schedule NLD?

01

Individuals or businesses that have incurred a net loss in Illinois and wish to deduct that loss from their taxable income in future years need to fill out the Illinois Net Loss Deduction Schedule NLD.

02

Taxpayers who have previously reported a net loss for Illinois tax purposes and want to claim a deduction against future profits.

Fill

form

: Try Risk Free

People Also Ask about

Can you carry forward the nld in illinois?

What are the carry provisions of Illinois NLD? For tax years ending on or after December 31, 2021, Illinois net losses cannot be carried back and can only be carried forward for 20 tax years.

What is the limit on the NOL deduction in Illinois?

Corporate income tax changes Most recently, the NOL deduction was capped at $100,000 for the 2021-2023 tax years. H.B. 4951 continues the corporate income tax NOL limitation for tax years ending on or after Dec. 31, 2024, and before Dec. 31, 2027, although the limit is raised from $100,000 to $500,000 per year.

Does Illinois have reciprocity?

While you were a resident of Illinois, you are covered by a reciprocal agreement between the reciprocal state and Illinois and are not to be taxed by the other state on your wages.

Is the NOL limited to 100000 in Illinois?

Most recently, the NOL deduction was capped at $100,000 for the 2021-2023 tax years. H.B. 4951 continues the corporate income tax NOL limitation for tax years ending on or after Dec. 31, 2024, and before Dec. 31, 2027, although the limit is raised from $100,000 to $500,000 per year.

How far forward can you carry a net operating loss?

In the U.S., a net operating loss can be carried forward indefinitely but are limited to 80 percent of taxable income.

What is the Nexus threshold in Illinois?

Gross receipts of $100,000 or more or 200 or more transactions in Illinois (economic nexus) Physical presence in Illinois (physical nexus).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Illinois Net Loss Deduction Schedule NLD?

The Illinois Net Loss Deduction Schedule NLD is a tax form used by taxpayers in Illinois to report net losses from previous years that can be carried forward to offset taxable income in future years.

Who is required to file Illinois Net Loss Deduction Schedule NLD?

Taxpayers who have incurred net operating losses in prior years and wish to deduct those losses from their current year taxable income must file the Illinois Net Loss Deduction Schedule NLD.

How to fill out Illinois Net Loss Deduction Schedule NLD?

To fill out the Illinois Net Loss Deduction Schedule NLD, taxpayers need to provide information regarding their net losses from previous years, including the amount of the losses and the years they occurred, and calculate the amount available for deduction in the current tax year.

What is the purpose of Illinois Net Loss Deduction Schedule NLD?

The purpose of the Illinois Net Loss Deduction Schedule NLD is to allow taxpayers to reduce their taxable income by using reported net operating losses from prior years, effectively lowering their state tax liability.

What information must be reported on Illinois Net Loss Deduction Schedule NLD?

The information that must be reported on the Illinois Net Loss Deduction Schedule NLD includes the amount of net losses being deducted, the tax years in which those losses were incurred, and any limitations or calculations that apply to the deduction.

Fill out your illinois net loss deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Net Loss Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.