Get the free Schedule NLD - tax illinois

Show details

This form is used to calculate the Illinois net loss deduction for tax years arising in Illinois, detailing how to carry forward or back losses to reduce taxable income.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule nld - tax

Edit your schedule nld - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule nld - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule nld - tax online

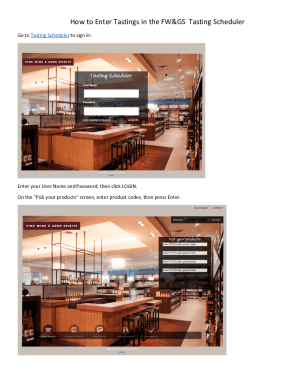

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule nld - tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule nld - tax

How to fill out Schedule NLD

01

Obtain the Schedule NLD form from the appropriate tax authority website.

02

Review the instructions accompanying the form to understand the requirements.

03

Fill out your personal identification information at the top of the form.

04

Provide details regarding the income or losses that need to be reported.

05

Complete sections related to deductions, credits, or any other relevant financial information.

06

Double-check all entries for accuracy to avoid errors.

07

Sign and date the form as required.

08

Submit the completed Schedule NLD form according to the specified submission guidelines.

Who needs Schedule NLD?

01

Individuals or entities with nonlocal income that needs to be reported.

02

Taxpayers who have claimed certain types of deductions or credits.

03

Residents filing taxes that include foreign income or investment performance.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a schedule in English?

How to create a daily schedule in 6 steps List to-do items. Before you can organize your to-dos, you first need to make a list of all the items you need to do for the day. Prioritize tasks. Note deadlines. Identify recurring events. Order items by time, priority, or deadline. Stay flexible.

Can you carry forward the nld in illinois?

What are the carry provisions of Illinois NLD? For tax years ending on or after December 31, 2021, Illinois net losses cannot be carried back and can only be carried forward for 20 tax years.

Does Illinois have reciprocity?

While you were a resident of Illinois, you are covered by a reciprocal agreement between the reciprocal state and Illinois and are not to be taxed by the other state on your wages.

What is the Nexus threshold in Illinois?

Gross receipts of $100,000 or more or 200 or more transactions in Illinois (economic nexus) Physical presence in Illinois (physical nexus).

How far forward can you carry a net operating loss?

In the U.S., a net operating loss can be carried forward indefinitely but are limited to 80 percent of taxable income.

Is the NOL limited to 100000 in Illinois?

Most recently, the NOL deduction was capped at $100,000 for the 2021-2023 tax years. H.B. 4951 continues the corporate income tax NOL limitation for tax years ending on or after Dec. 31, 2024, and before Dec. 31, 2027, although the limit is raised from $100,000 to $500,000 per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule NLD?

Schedule NLD is a form used by taxpayers to report non-litigated deductions for federal income tax purposes.

Who is required to file Schedule NLD?

Taxpayers who claim non-litigated deductions that exceed certain thresholds and are not connected to contested amounts are required to file Schedule NLD.

How to fill out Schedule NLD?

To fill out Schedule NLD, taxpayers need to provide their identification information, list the types of deductions being claimed, and attach any required documentation that supports these deductions.

What is the purpose of Schedule NLD?

The purpose of Schedule NLD is to ensure transparency and proper reporting of non-litigated deductions, enabling the IRS to process taxpayer claims accurately.

What information must be reported on Schedule NLD?

The information that must be reported on Schedule NLD includes taxpayer identification details, a breakdown of non-litigated deductions being claimed, and corresponding documentation to substantiate these claims.

Fill out your schedule nld - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Nld - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.