Get the free Schedule K-1-T - tax illinois

Show details

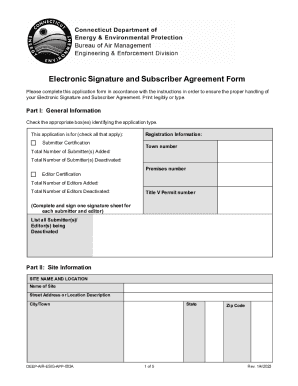

This form is used by trusts or estates to report the share of income and deductions for beneficiaries. Beneficiaries receiving this form should attach it to their Illinois Tax Return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule k-1-t - tax

Edit your schedule k-1-t - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule k-1-t - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule k-1-t - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule k-1-t - tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule k-1-t - tax

How to fill out Schedule K-1-T

01

Obtain a copy of Schedule K-1-T from the appropriate tax authority.

02

Complete your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Fill in the details about the entity you are receiving the K-1-T from, such as its name and identification number.

04

Report your share of income, deductions, credits, and other tax items as provided by the entity on the K-1-T.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the schedule to certify its accuracy.

07

Attach the completed Schedule K-1-T to your tax return, if required.

Who needs Schedule K-1-T?

01

Investors in partnerships, S corporations, estates, or trusts who receive a K-1 reporting their share of income, deductions, and credits.

02

Taxpayers who need to report their distributive share of income or loss from pass-through entities on their personal tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Are K-1 losses tax deductible?

This is a non-cash expense that the Internal Revenue Service (IRS) allows you to deduct from your taxable income, effectively creating a "paper loss." The paper loss shows up on the K-1 tax form you receive from the property and can often be used to offset your W-2 income. Let's consider a practical example.

Are schedule K-1 losses deductible?

A loss from partnership Schedule K-1 is not always deductible. Generally, losses from passive activities that exceed the income from passive activities are disallowed for the current year. If a loss is passive, it can only be used to offset passive income.

What is a Schedule k1 on your tax return?

The Schedule K-1 is the form that reports the amounts passed to each party with an interest in an entity, like a business partnership or an S corporation. The parties use the information on the K-1 to prepare their separate tax returns.

Which type of loss is not deductible?

The Tax Cuts and Jobs Act of 2017 changed the rule for casualty and theft claims so that only damages incurred during a federally-declared natural disaster are valid claims. Losses are only deductible if they are not covered by insurance.

How does Schedule K-1 affect my taxes?

How does Schedule K-1 affect personal taxes? In general, a K-1 can affect personal taxes in two ways: either by increasing a partner's tax liability or by providing them with a tax deduction. It will likely increase their total tax liability for the year if the K-1 is associated with an income.

Can K1 losses offset dividend income?

Bottom Line. The IRS permits taxpayers to apply up to $3,000 in net capital losses per year to offset other taxable income, including wages and dividend income. This can result in significant tax savings by reducing overall taxable income.

What is a schedule k-1 t?

The purpose of Schedule K-1-T(3), Pass-through Withholding Calculation for Nonresident Members, is to calculate the required tax you must report and pay on behalf of your nonresident beneficiaries that receive business or nonbusiness income from your fiduciary.

What is the penalty for failure to furnish k1?

A nominee who fails to furnish all the information required by Temporary Regulations section 1.6031(c)-1T when due, or who furnishes incorrect information, is subject to a $330 penalty for each failure. The maximum penalty is $3,987,000 ($1,329,000 for a small business) for all such failures during a calendar year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule K-1-T?

Schedule K-1-T is a form used to report income, deductions, and credits from a trust or estate to beneficiaries or shareholders.

Who is required to file Schedule K-1-T?

Trusts and estates that distribute income to beneficiaries are required to file Schedule K-1-T.

How to fill out Schedule K-1-T?

To fill out Schedule K-1-T, report the name and identification number of the trust or estate, provide the beneficiary's information, and itemize the income, deductions, and credits distributed.

What is the purpose of Schedule K-1-T?

The purpose of Schedule K-1-T is to inform beneficiaries of their share of income, deductions, and credits from the trust or estate for tax reporting purposes.

What information must be reported on Schedule K-1-T?

Schedule K-1-T must report the trust or estate's identifying information, beneficiary's details, and a breakdown of income types, deductions, and any tax credits allocated to the beneficiary.

Fill out your schedule k-1-t - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule K-1-T - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.