Get the free Schedule UB/NLD Unitary Illinois Net Loss Deduction - tax illinois

Show details

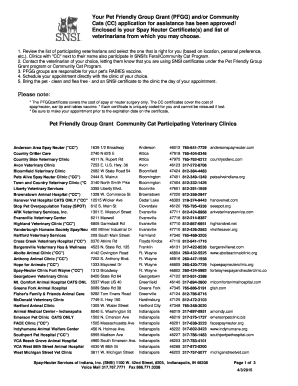

This document is used by unitary business groups to claim an Illinois net loss carryforward deduction on combined income tax returns. It provides a structured way to calculate net losses, allowable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule ubnld unitary illinois

Edit your schedule ubnld unitary illinois form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule ubnld unitary illinois form via URL. You can also download, print, or export forms to your preferred cloud storage service.

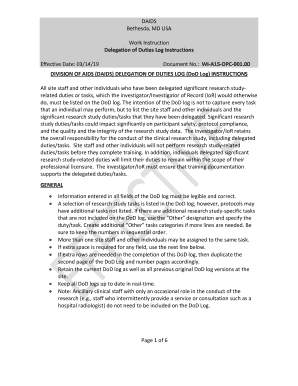

Editing schedule ubnld unitary illinois online

Follow the steps below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule ubnld unitary illinois. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule ubnld unitary illinois

How to fill out Schedule UB/NLD Unitary Illinois Net Loss Deduction

01

Gather all necessary financial documents related to your business.

02

Calculate your unitary net income for the applicable tax year.

03

Determine your net loss that can be applied from previous years.

04

Complete the top section of Schedule UB/NLD with your business information.

05

In the appropriate section, report your unitary net income.

06

Enter the amount of your net loss deduction in the specified field.

07

Ensure all calculations are accurate and consistent with your financial statements.

08

Review the completed schedule for any missing information or errors.

09

File Schedule UB/NLD along with your Illinois income tax return.

Who needs Schedule UB/NLD Unitary Illinois Net Loss Deduction?

01

Businesses operating in Illinois that have incurred net losses in prior years.

02

Taxpayers who are part of a unitary group and want to claim a net loss deduction.

03

Companies seeking to reduce their Illinois taxable income using previous net losses.

Fill

form

: Try Risk Free

People Also Ask about

What does unitary mean in business?

Unitary business . The term is applied to a flow either between multiple entities that are related through common ownership or within a single legal entity, and without regard to whether each entity is a sole proprietorship, a corporation , a partnership, or a trust.

What is the limit on the NOL deduction in Illinois?

Corporate income tax changes Most recently, the NOL deduction was capped at $100,000 for the 2021-2023 tax years. H.B. 4951 continues the corporate income tax NOL limitation for tax years ending on or after Dec. 31, 2024, and before Dec. 31, 2027, although the limit is raised from $100,000 to $500,000 per year.

What is required for a unitary business?

A taxpayer is engaged in a unitary business (or a single business within the meaning of Reg. 25120(b)) when its activities within the state contribute to or are dependent upon its activities without the state. A unitary business exists when there is unity of ownership, unity of operation and unity of use.

What is a unitary business group?

Generally, a unitary business group is a group of related persons whose business activities or operations are interdependent. More specifically, a unitary business group is two or more persons that satisfy both a control test and one of two relationship tests.

Can you carry forward the nld in illinois?

What are the carry provisions of Illinois NLD? For tax years ending on or after December 31, 2021, Illinois net losses cannot be carried back and can only be carried forward for 20 tax years.

What is a unitary business group in Illinois?

Unitary business activity can ordinarily be illustrated where the activities of the members are: (1) in the same general line (such as manufacturing, wholesaling, retailing of tangible personal property, insurance, transportation or finance); or (2) are steps in a vertically structured enterprise or process (such as

What is a unitary filer in Illinois?

members that derive business income solely from Illinois are required to file as a unitary group.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule UB/NLD Unitary Illinois Net Loss Deduction?

Schedule UB/NLD Unitary Illinois Net Loss Deduction is a form used by corporations in Illinois to report and claim a deduction for net losses incurred by unitary business groups and to adjust the taxable income for Illinois corporate income tax purposes.

Who is required to file Schedule UB/NLD Unitary Illinois Net Loss Deduction?

Corporations that are part of a unitary business group in Illinois and that have incurred a net loss are required to file Schedule UB/NLD to claim a deduction for these losses when calculating their Illinois Corporate Income Tax.

How to fill out Schedule UB/NLD Unitary Illinois Net Loss Deduction?

To fill out Schedule UB/NLD, a corporation must provide detailed information about the net losses of the unitary business group, including the calculation of the loss, the year in which the loss occurred, and any adjustments necessary to determine the amount of the loss that is available for deduction.

What is the purpose of Schedule UB/NLD Unitary Illinois Net Loss Deduction?

The purpose of Schedule UB/NLD is to allow corporations in unitary business groups to report and claim deductions for net losses, thereby reducing their taxable income and the amount of Illinois corporate tax owed.

What information must be reported on Schedule UB/NLD Unitary Illinois Net Loss Deduction?

Information that must be reported includes the total net loss from prior years, the year in which the loss was incurred, the calculation of the available net loss for deduction, and any adjustments made to calculate the loss deduction for the current tax year.

Fill out your schedule ubnld unitary illinois online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Ubnld Unitary Illinois is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.