Get the free RG-1-X Amended Gas Tax Return - tax illinois

Show details

This document is used to file an amended gas tax return with the Illinois Department of Revenue, detailing gas use and revenue tax calculations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rg-1-x amended gas tax

Edit your rg-1-x amended gas tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rg-1-x amended gas tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rg-1-x amended gas tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rg-1-x amended gas tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rg-1-x amended gas tax

How to fill out RG-1-X Amended Gas Tax Return

01

Obtain the RG-1-X Amended Gas Tax Return form from the relevant authority's website or office.

02

Fill out the identification section with your name, address, and gas tax account number.

03

Specify the reporting period for which you are amending the return in the designated area.

04

Provide details of the original amounts reported for fuel purchases, sales, and any adjustments.

05

Enter the corrected amounts in the appropriate fields, ensuring to explain any differences.

06

If applicable, attach any supporting documentation for adjustments or corrections.

07

Sign and date the form to certify the accuracy of the information provided.

08

Submit the completed RG-1-X form to the designated tax authority by the required deadline.

Who needs RG-1-X Amended Gas Tax Return?

01

Businesses and individuals who have previously submitted a gas tax return and need to correct errors or adjust reported amounts.

02

Taxpayers who have received notices from the tax authority regarding discrepancies in their previous gas tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Is my gas bill tax deductible?

When Are Utility Expenses Deductible? Utility bills can be deducted when they are considered both ordinary and necessary for your business operations. These include expenses related to electricity, gas, water, and other essential services.

How do I claim gas on my tax return?

The Form SCGR-1 and all related schedules must be completed and submitted to our office within three (3) years from the date of gasoline purchase before a refund can be considered. Schedules A and B/C are required with all claims for refund. Schedule D is required for claims utilizing the inventory method.

Is it better to claim mileage or gas receipts?

Writing off mileage by the standard IRS mileage method requires less documentation and hence is simpler. However, if you own a vehicle that has a high road tax, or uses a lot of fuel, writing off the gas and other expenses can give you a higher tax deduction and actually cover your business mileage costs.

How can I claim gas on my taxes?

You can deduct gas in one of two ways: Actual expenses. Keep your receipts and detailed records of your gas purchases. Standard mileage rate.

Should you keep receipts for gas?

Yes, you should keep your gas receipts if you plan to claim tax deductions related to vehicle expenses. Here are some key points to consider: Business Use: If you use your vehicle for business purposes, you can deduct gas expenses. Keeping receipts helps substantiate your claims. Standard Mileage Rate vs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

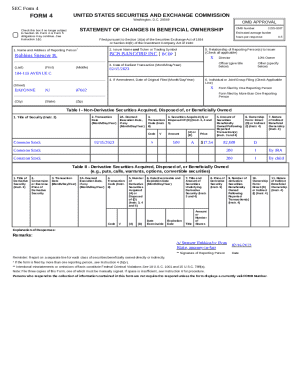

What is RG-1-X Amended Gas Tax Return?

The RG-1-X Amended Gas Tax Return is a form used by businesses and individuals to correct previously filed gas tax returns in order to accurately report and settle gas tax liabilities.

Who is required to file RG-1-X Amended Gas Tax Return?

Any business or individual who has previously filed a gas tax return and needs to make corrections to that return is required to file the RG-1-X Amended Gas Tax Return.

How to fill out RG-1-X Amended Gas Tax Return?

To fill out the RG-1-X Amended Gas Tax Return, you need to provide your identification information, indicate the period for which you are amending the return, and specify the corrections being made to the original return. Make sure to include any relevant supporting documents.

What is the purpose of RG-1-X Amended Gas Tax Return?

The purpose of the RG-1-X Amended Gas Tax Return is to allow taxpayers to amend their previously submitted gas tax returns to correct any errors or omissions, ensuring that the gas tax liabilities are accurately reported.

What information must be reported on RG-1-X Amended Gas Tax Return?

The RG-1-X Amended Gas Tax Return requires reporting of the taxpayer's identification details, the tax period being amended, the corrections to the previously reported values, and any additional information needed to support these changes.

Fill out your rg-1-x amended gas tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rg-1-X Amended Gas Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.