Get the free DRG Payment Calculation Worksheet - hfs illinois

Show details

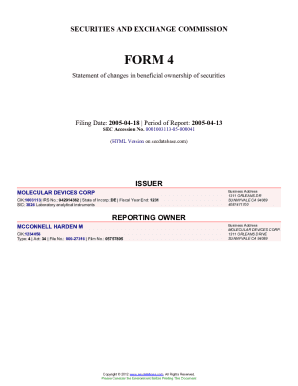

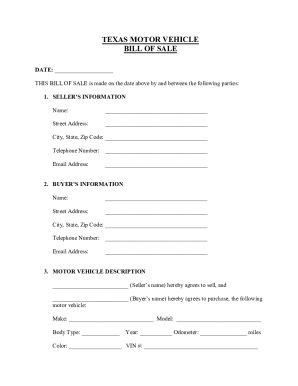

This worksheet calculates the Diagnosis-Related Group (DRG) payment for hospital admissions, detailing adjustments for transfers and outlier conditions according to specific DRG codes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign drg payment calculation worksheet

Edit your drg payment calculation worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your drg payment calculation worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit drg payment calculation worksheet online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit drg payment calculation worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out drg payment calculation worksheet

How to fill out DRG Payment Calculation Worksheet

01

Gather all necessary patient information including demographics and medical records.

02

Identify the relevant diagnosis codes (ICD-10) and procedure codes (CPT) for the patient.

03

Determine the DRG (Diagnosis-Related Group) by using the codes provided.

04

Calculate the base DRG payment using the hospital's predetermined rate.

05

Adjust the payment for factors such as geographical location and hospital-specific adjustments.

06

Include any additional payments for outlier cases or unusual circumstances.

07

Verify calculations and ensure all information is accurate before submitting.

Who needs DRG Payment Calculation Worksheet?

01

Hospitals and healthcare providers involved in inpatient services.

02

Billing departments for accurate reimbursement from insurance payers.

03

Financial analysts and healthcare administrators for budgeting and forecasting.

04

Compliance officers ensuring adherence to Medicare and Medicaid regulations.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate a DRG payment?

To figure out how much money your hospital got paid for your hospitalization, multiply your DRG's relative weight by your hospital's base payment rate. Here's an example with a hospital that has a base payment rate of $6,000 when your DRG's relative weight is 1.3: $6,000 X 1.3 = $7,800.

How do you calculate a DRG payment?

To figure out how much money your hospital got paid for your hospitalization, multiply your DRG's relative weight by your hospital's base payment rate. Here's an example with a hospital that has a base payment rate of $6,000 when your DRG's relative weight is 1.3: $6,000 X 1.3 = $7,800.

What is the formula for calculating MS DRG?

The hospital base rate, also known as the standard payment amount, varies by hospital and is influenced by factors such as geographic location and whether the hospital is teaching or non-teaching. To calculate the payment, the MS-DRG relative weight is multiplied by the hospital's base rate.

How are DRGs priced?

To calculate payments, the assigned DRG weight is multiplied by a standardized payment amount and adjusted for the hospital's area wages, teaching status, and percent of poor patients.

How is DRG weight calculated?

The DRG relative weights are estimates of the relative resource intensity of each DRG. These weights are computed by estimating the average resource intensity per case for each DRG, measured in dollars, and dividing each of those values by the average resource intensity per case for all DRG's, also measured in dollars.

How is a particular MS DRG payment rate calculated for a specific hospital?

The formula used to calculate payment for a specific case multiplies an individual hospital's payment rate per case by the weight of the DRG to which the case is assigned.

What is included in the DRG system calculation?

The DRG is based on your primary and secondary diagnoses, other conditions (comorbidities), age, sex, and necessary medical procedures. The system is intended to make sure that the care you need is the care you get, while also avoiding unnecessary charges.

How do you figure out DRG?

Determining a DRG One component is the principal diagnosis for the patient submission to the hospital. Another critical question is whether any surgical procedure was done in the hospital. Beyond that, hospital staff will look for any evidence of secondary diagnoses or secondary conditions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DRG Payment Calculation Worksheet?

The DRG Payment Calculation Worksheet is a form used to calculate the payment amount for inpatient hospital services based on Diagnosis Related Groups (DRGs).

Who is required to file DRG Payment Calculation Worksheet?

Hospitals and healthcare providers that receive reimbursement for Medicare inpatient services are required to file the DRG Payment Calculation Worksheet.

How to fill out DRG Payment Calculation Worksheet?

To fill out the DRG Payment Calculation Worksheet, providers must enter patient information, diagnosis codes, procedure codes, and relevant financial data as guided by the instructions specific to the worksheet.

What is the purpose of DRG Payment Calculation Worksheet?

The purpose of the DRG Payment Calculation Worksheet is to determine the appropriate payment for inpatient hospital services by accurately reflecting the cost and resource utilization related to each patient's care.

What information must be reported on DRG Payment Calculation Worksheet?

The information that must be reported includes patient demographic details, diagnosis and procedure codes, length of stay, resource utilization, costs, and any other pertinent financial information required for calculation.

Fill out your drg payment calculation worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Drg Payment Calculation Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.