Get the free Exemption 113-15250-00079 - permits air idem in

Show details

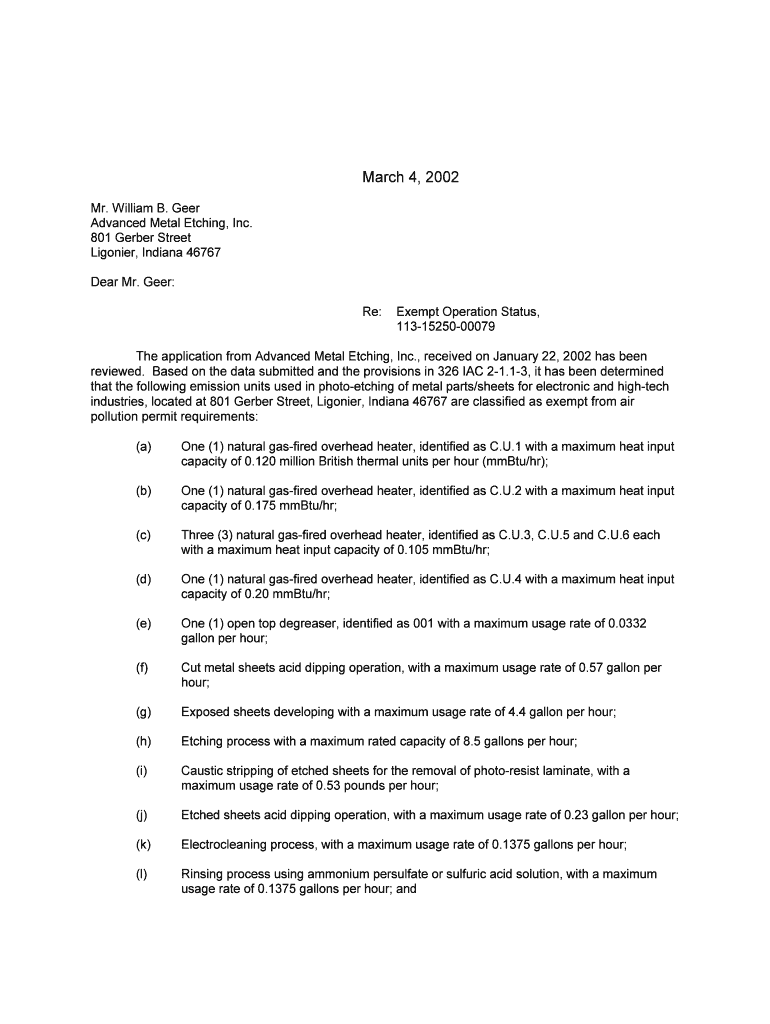

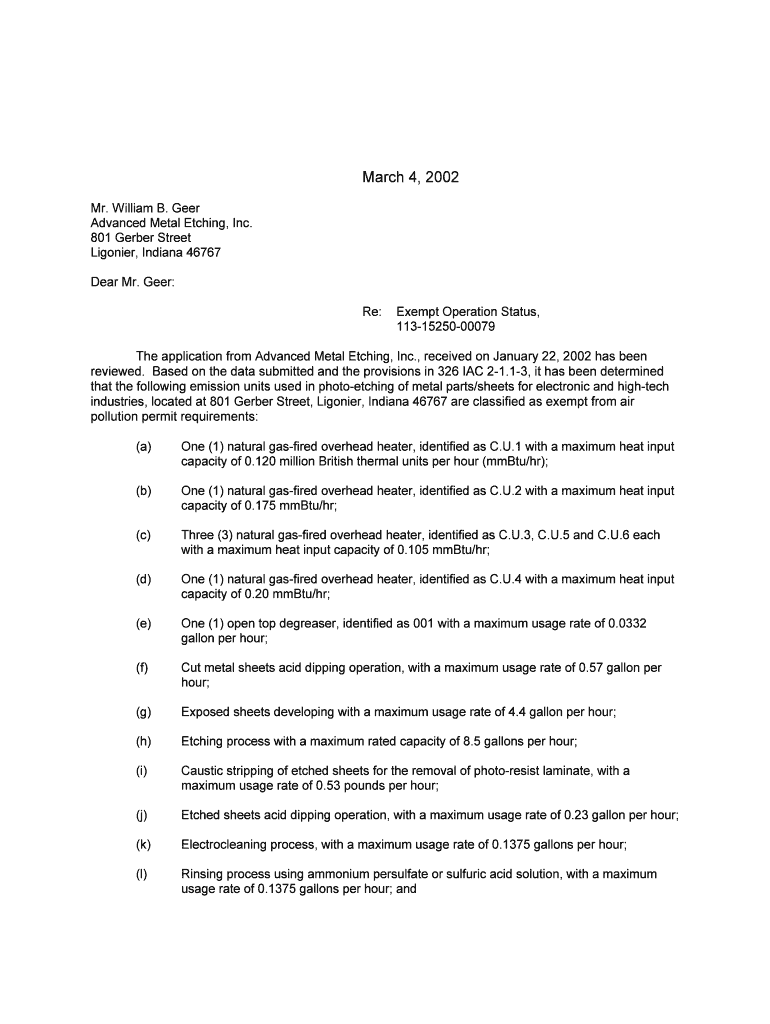

This document notifies Advanced Metal Etching, Inc. of their exemption from air pollution permit requirements based on an operational review of their emissions related to photo-etching of metal parts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign exemption 113-15250-00079 - permits

Edit your exemption 113-15250-00079 - permits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exemption 113-15250-00079 - permits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit exemption 113-15250-00079 - permits online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit exemption 113-15250-00079 - permits. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out exemption 113-15250-00079 - permits

How to fill out Exemption 113-15250-00079

01

Gather necessary documentation: Compile any required documents that support your exemption claim.

02

Enter your personal information: Fill in your name, address, and contact information in the designated fields.

03

Provide exemption details: Clearly state the reason for your request and reference Exemption 113-15250-00079.

04

Include supporting evidence: Attach any relevant evidence that validates your exemption claim.

05

Review the form: Double-check all the entered information for accuracy and completeness.

06

Submit the form: Send the completed exemption form to the specified agency or department as instructed.

Who needs Exemption 113-15250-00079?

01

Individuals or entities seeking relief from specific obligations or fees under the terms of Exemption 113-15250-00079.

02

Taxpayers who believe they qualify for the exemption due to their financial situation or specific criteria outlined in the exemption.

Fill

form

: Try Risk Free

People Also Ask about

How much can you write off in property taxes in California?

As of 2021, California property owners may deduct up to $10,000 of their property taxes from their federal income tax if they are filing as single or married filing jointly. Unfortunately, any property taxes you have paid in excess of $10,000 cannot be counted toward your deduction.

What is the 7000 property tax exemption in California?

The Homeowners' Exemption reduces your property taxes by deducting $7,000 from your property's assessed value before applying the tax rate, and given the one percent statewide property tax rate, this generally equates to $70 in property tax savings.

How to read homestead exemption?

Homestead tax exemptions usually offer a fixed discount on taxes, such as exempting the first $50,000 of the assessed value with the remainder taxed at the normal rate. With a $50,000 homestead exemption, a home valued at $150,000 would be taxed on only $100,000 of assessed value.

What is required in order for a homeowner to receive a $7000 exemption on property tax Quizlet?

The property owner must reside in the home. Homeowners qualify for the property tax exemption of $7,000 if they reside in the home. It's a reduction in the property's assessed value.

How does the California property tax exemption work?

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

How does the new Texas homestead exemption work?

In 2023, the $100,000 Homestead Exemption was permanently codified into the Texas Constitution when voters passed Proposition 4 with 83% of voters in support. This makes the $100,000 Homestead Exemption permanent, and homeowners will receive tax relief every single year, forever.

What age in California do you stop paying property taxes?

State Property Tax Postponement Program – Seniors The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Exemption 113-15250-00079?

Exemption 113-15250-00079 is a specific tax exemption form that allows eligible individuals or entities to apply for a reduction or exemption from certain taxes.

Who is required to file Exemption 113-15250-00079?

Individuals or entities that meet the eligibility criteria set forth by the tax authority, typically those who qualify for a specific tax exemption related to their income or status, are required to file Exemption 113-15250-00079.

How to fill out Exemption 113-15250-00079?

To fill out Exemption 113-15250-00079, you must gather the required documentation, complete the form with accurate information, ensuring to provide personal identification details, financial information, and any supporting documents as instructed.

What is the purpose of Exemption 113-15250-00079?

The purpose of Exemption 113-15250-00079 is to provide a formal process for eligible applicants to claim tax exemptions that could reduce their tax liability, thus encouraging compliance with tax regulations.

What information must be reported on Exemption 113-15250-00079?

The information that must be reported on Exemption 113-15250-00079 includes personal identification details, the specific exemption being claimed, financial information, and any relevant documentation to support the claim.

Fill out your exemption 113-15250-00079 - permits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exemption 113-15250-00079 - Permits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.