Get the free PROPERTY TAX BULLETIN NO. 20

Show details

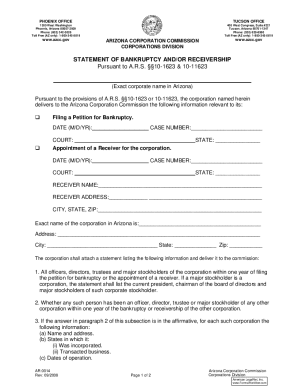

This bulletin explains the important features of the Farmland Tax Law, focusing on land valuation based on its current use as farmland, requirements for classification, provisional classification,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax bulletin no

Edit your property tax bulletin no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax bulletin no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax bulletin no online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax bulletin no. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax bulletin no

How to fill out PROPERTY TAX BULLETIN NO. 20

01

Obtain a copy of PROPERTY TAX BULLETIN NO. 20 from your local tax authority or website.

02

Read the instructions carefully to understand the requirements for completion.

03

Gather all relevant information such as property details, owner information, and tax assessment data.

04

Fill out each section of the bulletin, ensuring that all required fields are completed.

05

Double-check the accuracy of the information provided.

06

Sign and date the form as required.

07

Submit the completed bulletin to the appropriate tax authority by the specified deadline.

Who needs PROPERTY TAX BULLETIN NO. 20?

01

Property owners seeking to understand their tax obligations.

02

Individuals or businesses requiring guidance on property tax assessments.

03

Tax consultants and professionals assisting clients with property tax matters.

04

Local government agencies managing property tax records and assessments.

Fill

form

: Try Risk Free

People Also Ask about

What is the $7000 property tax exemption in California?

Property taxes are based on the assessed value of your property. The Homeowners' Exemption reduces your property taxes by deducting $7,000 from your property's assessed value before applying the tax rate, and given the one percent statewide property tax rate, this generally equates to $70 in property tax savings.

What is the property tax rule 321?

The presumption that the assessor has properly performed his or her duties is not evidence and shall not be considered by the board in its deliberations. (c) The assessor has the burden of establishing the basis for imposition of a penalty assessment.

What is the property tax loophole in California?

19 would narrow California's property tax inheritance loophole, which offers Californians who inherit certain properties a significant tax break by allowing them to pay property taxes based on the property's value when it was originally purchased rather than its value upon inheritance.

What is the IRS property tax deduction rules?

As of 2021, California property owners may deduct up to $10,000 of their property taxes from their federal income tax if they are filing as single or married filing jointly. Unfortunately, any property taxes you have paid in excess of $10,000 cannot be counted toward your deduction.

How do I write a property tax protest?

Your letter should include strong evidence to support your claim. This is where your research pays off. Supporting Evidence: Attach copies of comparative sales data, appraisal reports, and photographs. These documents serve as the backbone of your argument.

At what age do you stop paying property tax in California?

The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement. For more details on this program, please visit the State Controller's website.

What is property tax rule 203?

Title to property remains with a seller until he has completed delivery by making the property available for disposition by the buyer at the f.o.b. point. Retention of security interest by a seller shall be disregarded for purposes of determining situs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROPERTY TAX BULLETIN NO. 20?

PROPERTY TAX BULLETIN NO. 20 is a document issued by the tax authority to provide guidelines and information regarding property tax regulations and requirements.

Who is required to file PROPERTY TAX BULLETIN NO. 20?

Property owners and taxpayers who meet specific criteria set forth by the tax authority are required to file PROPERTY TAX BULLETIN NO. 20.

How to fill out PROPERTY TAX BULLETIN NO. 20?

To fill out PROPERTY TAX BULLETIN NO. 20, taxpayers should carefully follow the instructions provided in the bulletin, including entering accurate information related to property ownership, assessment values, and any applicable exemptions.

What is the purpose of PROPERTY TAX BULLETIN NO. 20?

The purpose of PROPERTY TAX BULLETIN NO. 20 is to inform property owners of their tax obligations, provide necessary forms, and ensure compliance with local property tax laws.

What information must be reported on PROPERTY TAX BULLETIN NO. 20?

The information that must be reported on PROPERTY TAX BULLETIN NO. 20 includes property identification details, ownership information, assessed value, and any exemptions or deductions claimed.

Fill out your property tax bulletin no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Bulletin No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.