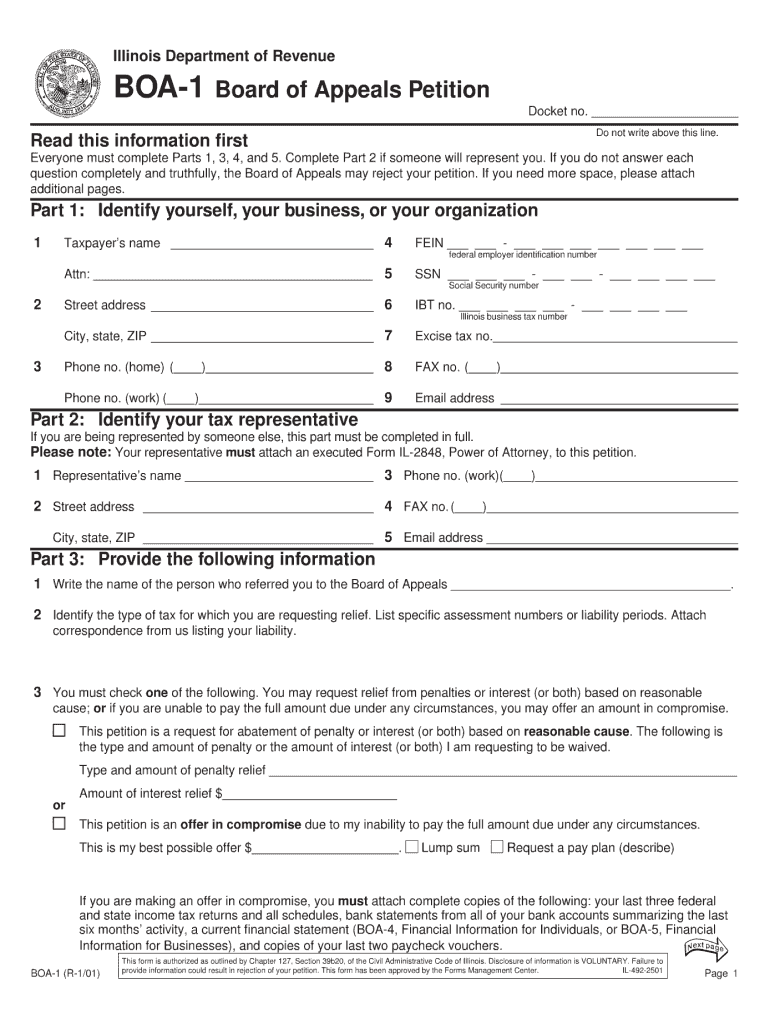

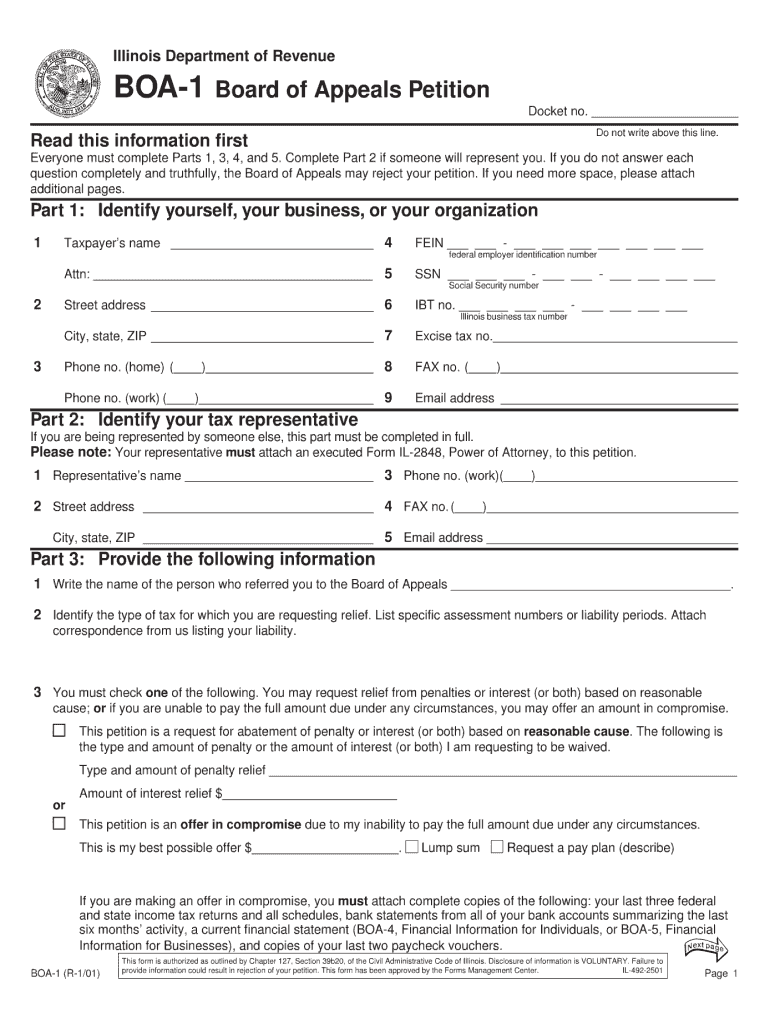

IL DoR BOA-1 2001 free printable template

Get, Create, Make and Sign IL DoR BOA-1

Editing IL DoR BOA-1 online

Uncompromising security for your PDF editing and eSignature needs

IL DoR BOA-1 Form Versions

How to fill out IL DoR BOA-1

How to fill out IL DoR BOA-1

Who needs IL DoR BOA-1?

Instructions and Help about IL DoR BOA-1

Hi this is how to file for divorce or and today we're going to go over how to file for divorce in the state of the Illinois so just to get right into it first step you're going to need to download the Illinois divorce papers now if you go right on our website click right on here you can download these papers for free some websites charge that to a hundred fifty bucks don't do it we have them all here now step two now that you have all your forms the spouse that has decided to file for divorce must complete the following forms and be sure to have them filled with the court clerk's office and the county where you reside and pay the two hundred and twenty-three dollar filing fee now the fees are always changing, so you always want to double-check with the court, but it's going to be around that range so the forms that you have to do are all right here I could go through them, but now colleges for the heck out of you but what you have to do is complete all these forms, and then you can move on to step three now step three you must inform your sprouts of the filing by sending copies of the filed documents above that you filed along with these two forms now it's very important that you deliver this form especially because your spouse wants to complete and sign these two forms as well as file them with the County Clerk court clerk's office, so your spouse is going to have the responsibility of getting these two forms completing them, and they're going to have to file these two forms on their own, so you will have to negotiate the terms of the assets and debts of both of you have by jointly filling out the filing forms together now you're gonna need to take a deep breath and meet with your spouse and negotiate these four forms otherwise they can get turned into an attorney battle and get really crazy but if you both are somewhat sane you're going to have to come to an agreement on your own with these four documents and if you're lucky enough to get through these four documents, and you get you go through, and you make it an agreement you all sign them then you can move on to step five and follow the documents with the clerk's office, and now you're allowed to make a court date after you've been given the court date you must send a notice of hearing very important to your spouse to officially notify him or her so after that it's peas and carrots go to your court hearing date with the judgment bring four copies of that judgment and the judgment decree of dissolution of marriage those four will most likely be signed by the judge at the end of the hearing as long as you've done these steps correctly, and you have to file the form, and now you are completely divorced in the state of Illinois now the only requirements either party must be a resident of Illinois for at least three months both spouses must be separated for at least six months which means that they both cannot have the same address how long does it take now I know here you might be saying oh I...

People Also Ask about

Does the Illinois Department of Revenue use a collection agency?

How long does it take to get your Illinois state refund back?

What is going on with the IRS 2022?

Why would I be getting a letter from the Illinois Department of Revenue?

Why would Dor send me a letter?

When should I expect my tax refund direct deposit 2022?

What does the Illinois Department of Revenue do?

What are the collection laws in Illinois?

When can I expect my Illinois state tax refund 2022?

Why would I get a letter from the Illinois Department of Revenue?

How to contact Illinois tax Department?

How many letters is the IRS sending out 2022?

Why would IRS send me a letter 2022?

Should I be worried if I get a letter from the IRS?

When should I expect my Illinois State refund?

Where is my IL 2022 refund?

How long does it take for state tax refund direct deposit Illinois?

What is MyTax Illinois used for?

How long are Illinois tax refunds taking 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL DoR BOA-1 for eSignature?

Can I create an electronic signature for signing my IL DoR BOA-1 in Gmail?

How do I complete IL DoR BOA-1 on an iOS device?

What is IL DoR BOA-1?

Who is required to file IL DoR BOA-1?

How to fill out IL DoR BOA-1?

What is the purpose of IL DoR BOA-1?

What information must be reported on IL DoR BOA-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.