Get the free Individual Consumer Investment Fund Application - in

Show details

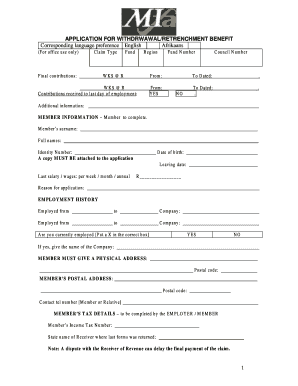

This document is an application form for individuals seeking financial assistance to attend conferences or events through the Consumer Investment Fund (CIF). It requires accompanying documentation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual consumer investment fund

Edit your individual consumer investment fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual consumer investment fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual consumer investment fund online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit individual consumer investment fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual consumer investment fund

How to fill out Individual Consumer Investment Fund Application

01

Read the instructions carefully before starting the application.

02

Gather all necessary documentation, including your identification and income statements.

03

Fill out the personal information section with your name, address, and contact details.

04

Provide information about your financial status, including assets and liabilities.

05

Specify the purpose for which you are seeking the investment fund.

06

Review the application for accuracy and completeness.

07

Sign and date the application form.

08

Submit the application through the designated method (online, by mail, etc.).

Who needs Individual Consumer Investment Fund Application?

01

Individuals seeking financial assistance for investment opportunities.

02

Consumers who want to invest in projects that require additional funding.

03

People looking to enhance their financial stability through investments.

Fill

form

: Try Risk Free

People Also Ask about

How do people start investment funds?

Decide what type of investment account you want, which is often based on the goal you are investing for. Open an investment account at an online broker. Choose your investments. Low-cost index funds are a good choice for many investors.

Can I create my own investment fund?

Starting an investment fund of your own can be a profitable, useful step in building an investment business. However, an investment manager has many issues to consider up front before beginning the marketing and fundraising process.

What is an example of a personal fund?

Examples of personal funds are an emergency fund to tackle unexpected expenses like car repairs, sudden loss of job, or medical emergencies; a vacation fund to finance a vacation or any leisure activity; an education fund for education-related expenses that usually include tuition fees, books, and other educational

How does a private investment fund work?

A private fund is an entity created to pool money from multiple investors that is not required to be registered or regulated as an investment company under the Investment Company Act. Private funds can differ, however, in how they pool money and how they deploy that money.

What is a personal investment fund?

A personal investment company(PIC) is a private company that is used for long-term financial investments. Wealthy investors can use PICs to hold cash, securities, and other assets, allowing the investor to receive higher post-tax profits that can then be reinvested.

What is meant by personal investment?

an amount of money that is invested in something by a person, rather than by a company or organization, or these investments as a whole: His favored personal investments are real estate and precious metals. His plan is to encourage more personal investment with tax breaks.

Do you need a license to start an investment fund?

The investment fund industry is highly regulated, and depending on the type of fund you wish to start and the jurisdiction in which you plan to operate, you will need to obtain the necessary financial licenses.

How does an investment fund work?

When you invest in a fund, your and other investors' money is pooled together. A fund manager then buys, holds and sells investments on your behalf. All funds are made up of a mix of investments – this is what diversifies or spreads your risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual Consumer Investment Fund Application?

The Individual Consumer Investment Fund Application is a form used by individuals to apply for investments in funds designed for consumer investments, allowing them to participate in investment opportunities tailored to consumer needs.

Who is required to file Individual Consumer Investment Fund Application?

Individuals who wish to invest in consumer-focused funds are required to file the Individual Consumer Investment Fund Application as part of the onboarding process.

How to fill out Individual Consumer Investment Fund Application?

To fill out the Individual Consumer Investment Fund Application, applicants need to provide personal information, financial details, investment objectives, and any relevant qualifications or disclosures required by the fund.

What is the purpose of Individual Consumer Investment Fund Application?

The purpose of the Individual Consumer Investment Fund Application is to assess the suitability of potential investors for consumer investment opportunities and to collect necessary information for compliance and investment decision-making.

What information must be reported on Individual Consumer Investment Fund Application?

Required information may include personal identification details, financial status, investment experience, risk tolerance, and specific investment goals to understand the applicant's profile.

Fill out your individual consumer investment fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Consumer Investment Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.