Get the free SBA Personal Financial Statement

Show details

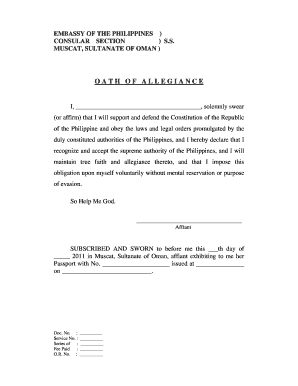

This form is required by the U.S. Small Business Administration for individuals involved in applying for a loan, detailing personal financial information including assets, liabilities, income, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba personal financial statement

Edit your sba personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

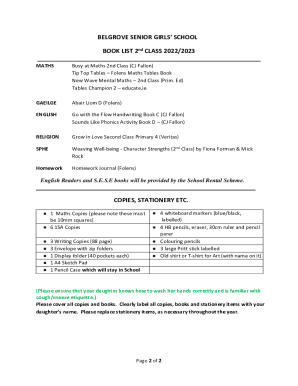

Editing sba personal financial statement online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sba personal financial statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba personal financial statement

How to fill out SBA Personal Financial Statement

01

Begin by downloading the SBA Personal Financial Statement form from the SBA website.

02

Provide your personal information, including your name, address, and contact details at the top of the form.

03

List all your assets, including cash, real estate, and investments, along with their values in the designated sections.

04

Detail your liabilities such as loans, mortgages, and credit card debts, and include their amounts.

05

Calculate your net worth by subtracting total liabilities from total assets.

06

Include any additional information required, such as business assets or affiliated company information, if applicable.

07

Review the completed form for accuracy and completeness before submission.

08

Sign and date the form to certify that the information provided is true and accurate.

Who needs SBA Personal Financial Statement?

01

Individuals seeking a loan or financing from the SBA for personal or business purposes.

02

Small business owners applying for government-backed loans.

03

Entrepreneurs preparing to present financial standing to investors or lenders.

04

Anyone needing to assess their personal financial health for planning purposes.

Fill

form

: Try Risk Free

People Also Ask about

Where to put credit card debt on personal financial statement?

Installment Account Other : Enter amount of the present balance of the debt that you owe for other installment account. Please be sure to indicate the total monthly payment in the space provided. For example, include the balances of all credit card debts in this line.

Does SBA require financial statements?

The SBA loan application process is known to be comprehensive and you'll be asked to provide several documents, including financial statements for your business. And before your loan can close, you'll need to provide that information again.

What documents are needed for an SBA loan?

Application requirements for an SBA loan often include: The last three years of business and personal tax returns. SBA application documents. Personal financial statements. Business bank statements. Business plan and projections, when applicable. Details on the loan purpose and use of funds.

What is a pfs template?

A PFS form details an individual's financial situation by showing their net worth. The form includes assets, liabilities, and net worth, which is an individual's assets less their liabilities.

What financial statements are required for SBA loan?

In your paperwork, you should include a current (dated within 90 days) financial overview statement, as well as financial statements for the past three years. These financial statements are separate from the personal financial statement, which is outlined in SBA Form 413.

What disqualifies you from getting an SBA loan?

All borrowers and guarantors applying for certain SBA loans must fill out SBA Form 413, which is intended to collect details about applicants' personal finances. The Small Business Administration and approved lenders use this form to help determine borrowers' creditworthiness and ability to repay the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBA Personal Financial Statement?

The SBA Personal Financial Statement is a form that provides a detailed overview of an individual's financial status, including assets, liabilities, and net worth, typically required when applying for a loan from the Small Business Administration.

Who is required to file SBA Personal Financial Statement?

Individuals who are applying for SBA loans, including sole proprietors, partners in a partnership, LLC members, and owners of corporations, are required to file the SBA Personal Financial Statement.

How to fill out SBA Personal Financial Statement?

To fill out the SBA Personal Financial Statement, individuals must provide detailed information about their assets and liabilities, including cash, real estate, investments, and debts. It is important to accurately list all financial interests and obligations.

What is the purpose of SBA Personal Financial Statement?

The purpose of the SBA Personal Financial Statement is to assess the financial health of the individual applying for a loan, enabling lenders to evaluate creditworthiness and the ability to repay the loan.

What information must be reported on SBA Personal Financial Statement?

The SBA Personal Financial Statement requires reporting of personal information, assets (such as cash, real estate, and investments), liabilities (such as loans and mortgages), and net worth.

Fill out your sba personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.