Get the free CAR-1 (Revised 2003) Annual County Financial Report

Show details

This document is a financial report for Martin County, outlining receipts, disbursements, cash balances, and financial assistance for the fiscal year ending in 2008.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign car-1 revised 2003 annual

Edit your car-1 revised 2003 annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your car-1 revised 2003 annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit car-1 revised 2003 annual online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit car-1 revised 2003 annual. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out car-1 revised 2003 annual

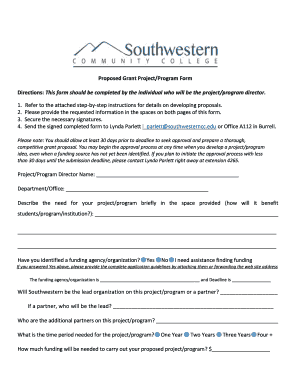

How to fill out CAR-1 (Revised 2003) Annual County Financial Report

01

Gather all financial data for the county, including revenues and expenditures for the fiscal year.

02

Download the CAR-1 (Revised 2003) template from the official site or locate a physical copy.

03

Fill out the cover page with the county's name, fiscal year, and contact information.

04

Complete the 'Revenues' section by entering all sources of income, including property taxes, grants, and fees.

05

Fill out the 'Expenditures' section with detailed spending information categorized by department or program.

06

Ensure all data entries are accurate and reflect the records maintained throughout the year.

07

Check for any required supplementary schedules and fill them out as necessary.

08

Review the report for completeness and compliance with reporting standards.

09

Sign the document as required and submit it by the deadline to the appropriate state agency.

Who needs CAR-1 (Revised 2003) Annual County Financial Report?

01

County government officials responsible for fiscal management.

02

Auditors who review county financial practices.

03

State agencies that require financial data for funding and oversight.

04

Citizens and stakeholders interested in county financial transparency.

05

Researchers and analysts studying local government finance.

Fill

form

: Try Risk Free

People Also Ask about

What is the annual comprehensive financial report?

The Annual Comprehensive Financial Report (ACFR) is the audited financial statement for the County's prior fiscal year. It is designed to fairly present the financial position as well as changes in the financial position of the County.

What is non applicability of Caro?

Applicability of CARO 2020 However, it does not apply to the following companies: One person company. Small companies (Companies with paid up capital less than/equal to Rs 4 crore and with a last reported turnover which is less than/equal to Rs 40 crore). Banking companies.

Is caro applicable to a subsidiary company?

If a private limited company, including a subsidiary of a foreign company, meets the specified criteria outlined in CARO, then it would be subject to CARO compliance during the audit of its financial statements. However, if it does not meet those criteria, then CARO may not be applicable.

What is not included in consolidated financial statements?

Exclusion of Subsidiaries In a consolidated financial statement, investments in such subsidiaries must be accounted for as per AS 13 – Accounting for Investments. Reasons for which a subsidiary isn't included in the consolidation must be disclosed in such consolidated financial statements.

Is caro applicable on CFS?

CARO 2016 did not apply to the consolidated financial statements. However, CARO 2020 contains a provision that now applies to the reporting of consolidated financial statements.

Is Caro not applicable on consolidated financial statements?

The CARO requirement shall not apply to the auditor's report on consolidated financial statements except for Para 3(xxi) i.e where any adverse remarks or qualifications are made by the auditors in their standalone companies' CARO reports, then the details of such remarks should be mentioned by the auditors of the

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CAR-1 (Revised 2003) Annual County Financial Report?

CAR-1 (Revised 2003) Annual County Financial Report is a financial document that counties in certain jurisdictions must complete and submit annually, detailing the financial activities and conditions of the county over the fiscal year.

Who is required to file CAR-1 (Revised 2003) Annual County Financial Report?

All counties that operate under the jurisdiction required by state or local laws must file the CAR-1 (Revised 2003) Annual County Financial Report.

How to fill out CAR-1 (Revised 2003) Annual County Financial Report?

To fill out the CAR-1, counties need to gather financial data, complete the required sections accurately according to the guidelines provided, and ensure all relevant financial statements and notes are included before submitting it by the designated deadline.

What is the purpose of CAR-1 (Revised 2003) Annual County Financial Report?

The purpose of CAR-1 is to provide a comprehensive overview of the county's financial position, performance, and cash flows, ensuring transparency and accountability in public finance.

What information must be reported on CAR-1 (Revised 2003) Annual County Financial Report?

The CAR-1 must report information such as the county's revenues, expenditures, assets, liabilities, fund balances, and any other financial data relevant to the county's fiscal operations during the reporting period.

Fill out your car-1 revised 2003 annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Car-1 Revised 2003 Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.