Get the free LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA - in

Show details

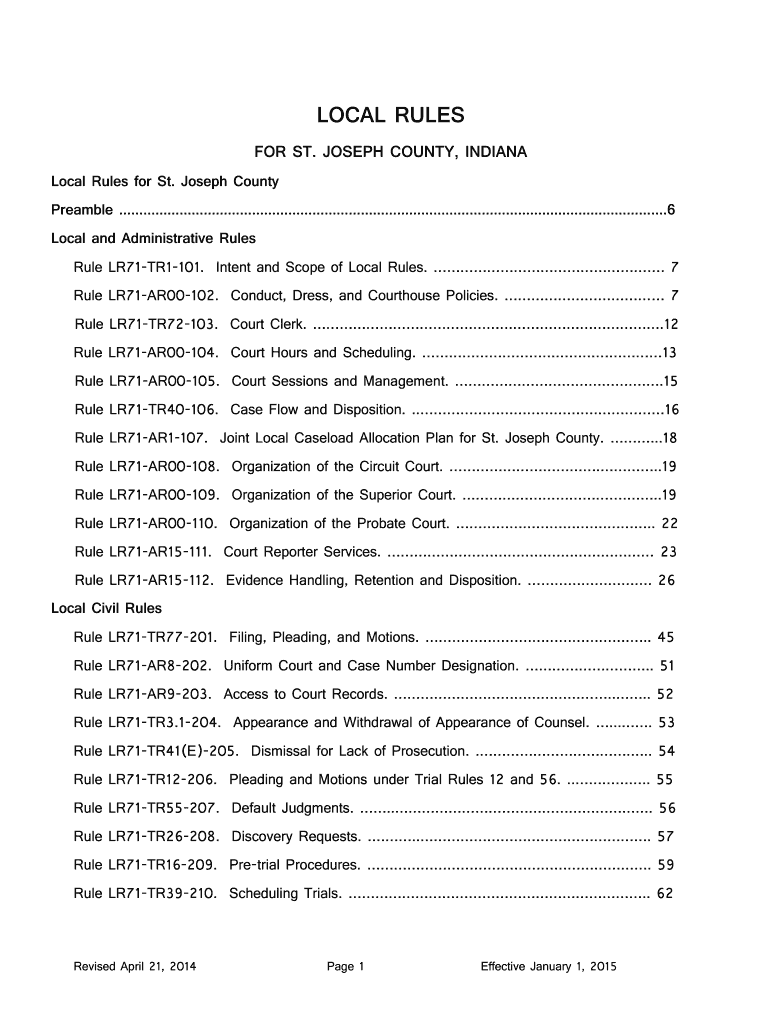

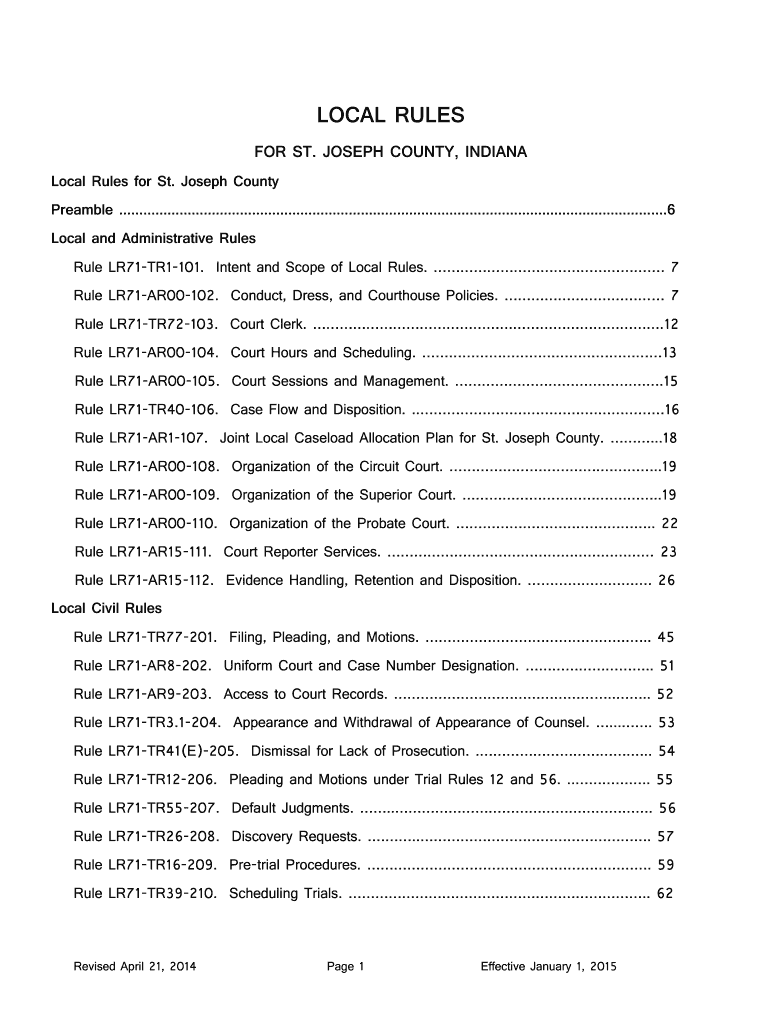

This document outlines the local court rules governing civil, criminal, family, and probate proceedings in St. Joseph County, Indiana, including guidelines for litigation conduct, case management,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local rules for st

Edit your local rules for st form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local rules for st form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local rules for st online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit local rules for st. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local rules for st

How to fill out LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA

01

Obtain a copy of the LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA from the official county website or courthouse.

02

Read through the document to familiarize yourself with the rules.

03

Identify the sections that apply to your case or situation.

04

Fill out any required forms or documents as specified in the LOCAL RULES.

05

Ensure that all information is accurate and complete.

06

Submit the filled-out forms along with any necessary filings to the appropriate court.

Who needs LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA?

01

Individuals involved in legal proceedings in St. Joseph County, Indiana.

02

Attorneys representing clients in St. Joseph County.

03

Parties seeking to understand procedural requirements for court cases.

Fill

form

: Try Risk Free

People Also Ask about

What is the sales tax in St Joseph County Indiana?

Purpose. The Circuit Court is a court of general jurisdiction consisting of one Judge elected to a six-year term and three magistrate judges appointed by the Judge. The Court has the authority to hear civil and criminal cases.

Is Indiana sales tax 7%?

Indiana's sales tax is 7%.

What is the noise ordinance in St Joseph County Indiana?

St Joseph sales tax details The minimum combined 2025 sales tax rate for St Joseph, Indiana is 7.0%. This is the total of state, county, and city sales tax rates.

How many dogs can you have in St. Joseph County, Indiana?

Joseph County no longer have a pet limit but all dogs/cats must be licensed and all dogs/cats/ferrets must have a valid rabies vaccination.

What county in Indiana has the highest tax rate?

Eighteen of the 20 highest property tax rates are in Lake and St. Joseph counties, led by the Gary-Calumet Township–Gary Schools district at 8.3101 percent. At the other end of the spectrum, 15 of the 20 lowest property tax rates are found in Steuben and Kosciusko counties, with rates below 1.5 percent.

What are the taxes in Saint John Indiana?

In St. John, you only have to pay the Indiana state sales tax (7.000%). There is no county, city or special sales tax.

What is Indiana shopping sales tax?

If your business sells goods or tangible personal property, you'll need to register to collect a seven percent sales tax. This registration allows you to legally conduct retail sales in the state of Indiana.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA?

LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA are specific regulations and procedures established by the local courts in St. Joseph County to govern legal proceedings within that jurisdiction.

Who is required to file LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA?

The LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA must be filed by the judges of the St. Joseph County courts and are applicable to attorneys and parties involved in court cases within the county.

How to fill out LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA?

Filling out LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA involves reviewing the local rules document thoroughly and submitting required forms or documents as specified, following the guidelines laid out for compliance in court proceedings.

What is the purpose of LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA?

The purpose of LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA is to provide clarity, ensure fair procedures, and facilitate the administration of justice within the local court system.

What information must be reported on LOCAL RULES FOR ST. JOSEPH COUNTY, INDIANA?

Information that must be reported includes court procedures, filing requirements, deadlines, and specific protocols relevant to various types of cases handled within the jurisdiction of St. Joseph County.

Fill out your local rules for st online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Rules For St is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.