Get the free House Bill 1001-18 - in

Show details

This document outlines amendments to the Indiana Code related to property tax deductions for homeowners who rehabilitate residential real properties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign house bill 1001-18

Edit your house bill 1001-18 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your house bill 1001-18 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit house bill 1001-18 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit house bill 1001-18. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out house bill 1001-18

How to fill out House Bill 1001-18

01

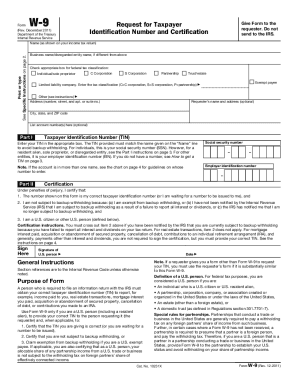

Obtain a copy of House Bill 1001-18 from the appropriate governmental website or office.

02

Read the bill carefully to understand its purpose and the information required.

03

Gather all necessary personal and financial information that may be needed for the form.

04

Begin filling out the form by entering your name and contact information in the designated sections.

05

Provide any required identification numbers, such as Social Security or tax identification numbers.

06

Complete the relevant sections of the bill, ensuring that all information is accurate and up to date.

07

Review the completed form for any errors or missing information.

08

Submit the form according to the instructions provided, either through mail or electronically.

Who needs House Bill 1001-18?

01

Individuals or entities affected by the provisions of House Bill 1001-18.

02

Taxpayers who seek benefits or adjustments related to the bill.

03

Organizations or businesses that are involved in compliance with the regulations set forth in the bill.

04

Government agencies that administer or oversee the provisions of the bill.

Fill

form

: Try Risk Free

People Also Ask about

How long is the jail time for 18 USC 1001?

shall be fined under this title, imprisoned not more than 5 years or, if the offense involves international or domestic terrorism (as defined in section 2331), imprisoned not more than 8 years, or both.

What is the US Code 10001?

10 U.S. Code § 10001 - Definition of State. In this subtitle, the term “State” includes the District of Columbia, the Commonwealth of Puerto Rico, the Islands, and Guam. (Added Pub. L.

What is the FBI 1001 charge?

False statement charges under 18 USC Section 1001 may be brought when someone makes a “false statement” to an agent or agency of the federal government in connection with a federal matter. The government can't convict a person simply for telling a lie.

What is the US Code for lying to Congress?

One statute, 18 U.S.C. § 1001, proscribes false statements in matters within the jurisdiction of a federal agency or department. A second, 18 U.S.C. § 1621, condemns perjury with respect to any matter in federal law given under oath or penalty of perjury.

What is the statute for lying to a federal agent?

ing to 18 U.S.C. § 1001, making false statements or concealing anything from a federal agent or investigator who is a member of any governmental branch is a federal crime. A “false statement” could be a material omission, a misrepresentation, or the use of a fraudulent document.

What is the U.S. Code for falsifying documents?

18 U.S.C. 1002 makes it a federal offense to possess false documents with the intent to defraud. It's a federal crime to possess or use false, forged, or counterfeit documents with intent to defraud.

What is the 1001 law?

Section 1001's statutory terms are violated if someone: "falsifies, conceals or covers up by any trick, scheme or device a material fact," "makes any false, fictitious or fraudulent statements or representations,"

How long is the jail time for 18 USC 1001?

shall be fined under this title, imprisoned not more than 5 years or, if the offense involves international or domestic terrorism (as defined in section 2331), imprisoned not more than 8 years, or both.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is House Bill 1001-18?

House Bill 1001-18 is a piece of legislation that outlines specific requirements and regulations pertaining to certain operational practices within its jurisdiction.

Who is required to file House Bill 1001-18?

Entities, organizations, or individuals specified in the bill as being subject to its regulations are required to file House Bill 1001-18.

How to fill out House Bill 1001-18?

To fill out House Bill 1001-18, one must carefully read the instructions provided, complete all required fields accurately, and ensure submission by the stated deadline.

What is the purpose of House Bill 1001-18?

The purpose of House Bill 1001-18 is to establish guidelines or improvements in governance, accountability, or procedural aspects as mandated by the legislative body.

What information must be reported on House Bill 1001-18?

Information that must be reported on House Bill 1001-18 includes specific data points as outlined in the legislation, such as financial disclosures, operational metrics, or compliance details.

Fill out your house bill 1001-18 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

House Bill 1001-18 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.