Get the free House Bill 1410 - in

Show details

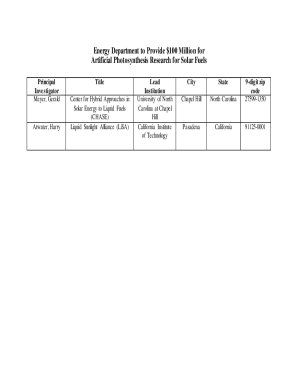

This document outlines proposed amendments to Indiana property tax laws, specifically addressing definitions, eligibility for deductions, and filing requirements related to homesteads and property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign house bill 1410

Edit your house bill 1410 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your house bill 1410 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit house bill 1410 online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit house bill 1410. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out house bill 1410

How to fill out House Bill 1410

01

Obtain a copy of House Bill 1410 from the official website or your local government office.

02

Read the bill carefully to understand its purpose and requirements.

03

Gather all necessary documents and information required for the application.

04

Fill out the application form on House Bill 1410, ensuring all sections are completed accurately.

05

Review your completed application for any errors or omissions.

06

Submit the application as per the instructions, either online or in person, depending on the guidelines.

Who needs House Bill 1410?

01

Individuals or families seeking financial assistance or benefits specified in House Bill 1410.

02

Organizations or agencies that assist vulnerable populations affected by the provisions of the bill.

03

Government officials or employees involved in the implementation of House Bill 1410.

Fill

form

: Try Risk Free

People Also Ask about

Who gets a bill first House or Senate?

Article I, Section 7, of the Constitution provides that all bills for raising revenue shall originate in the House of Representatives but that the Senate may propose, or concur with, amendments. By tradition, general appropriation bills also originate in the House of Representatives.

How does the House bill work?

First, a representative sponsors a bill. The bill is then assigned to a committee for study. If released by the committee, the bill is put on a calendar to be voted on, debated or amended. If the bill passes by simple majority (218 of 435), the bill moves to the Senate.

What is House Bill 405?

Introduced in House (01/15/2025) Keep Every Extra Penny Act of 2025. This bill excludes from gross income for federal income tax purposes overtime compensation paid for hours worked in excess of 40 hours per week (as required by the Fair Labor Standards Act of 1938).

What are the 5 steps of the lawmaking process in order?

Federal Legislative History The Legislative Process. Step 1: Introduction of Bill. Step 2: Committee Work - Hearings. Step 3: Committee Work - Markup, Amendments, Report. Step 4: Floor Debate. Step 5: Passage and Consideration in Second Chamber. Step 6: Conference Committee (if necessary) Step 7: Presidential Action.

What is House Bill 27?

Introduced in House (01/03/2025) Halt All Lethal Trafficking of Fentanyl Act or the HALT Fentanyl Act. This bill permanently places fentanyl-related substances as a class into schedule I of the Controlled Substances Act.

What requires a 2/3 majority in Congress?

The Constitution requires a two-thirds vote of the Members voting, a quorum being present, of either the House, the Senate, or both in five situations: (1) overriding presidential vetoes,1 (2) voting to convict federal officers in impeachment trials (Senate),2 (3) providing advice and consent to treaties (Senate),3 (4)

How does a bill get through the House?

First, a representative sponsors a bill. The bill is then assigned to a committee for study. If released by the committee, the bill is put on a calendar to be voted on, debated or amended. If the bill passes by simple majority (218 of 435), the bill moves to the Senate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is House Bill 1410?

House Bill 1410 is proposed legislation that addresses specific policy issues or regulatory changes within a jurisdiction, particularly related to taxation, budgeting, or other governmental operations.

Who is required to file House Bill 1410?

Individuals or entities that are impacted by the provisions of House Bill 1410, typically taxpayers, businesses, or government officials, may be required to file this bill.

How to fill out House Bill 1410?

To fill out House Bill 1410, one must provide the necessary information in the designated sections of the form, which usually includes details about the filer, relevant financial information, and any required disclosures.

What is the purpose of House Bill 1410?

The purpose of House Bill 1410 is to introduce changes to existing laws or regulations, often aimed at improving processes, addressing fiscal responsibilities, or enhancing accountability within government operations.

What information must be reported on House Bill 1410?

The information required on House Bill 1410 generally includes personal or business identification details, financial data pertinent to the bill's provisions, and any other relevant compliance information as mandated by law.

Fill out your house bill 1410 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

House Bill 1410 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.