Get the free CollegeChoice 529 Direct Savings Plan Overview

Show details

This document outlines the benefits and information related to the CollegeChoice 529 Direct Savings Plan, which allows state employees to save for college expenses through tax-advantaged contributions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign collegechoice 529 direct savings

Edit your collegechoice 529 direct savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your collegechoice 529 direct savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing collegechoice 529 direct savings online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit collegechoice 529 direct savings. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out collegechoice 529 direct savings

How to fill out CollegeChoice 529 Direct Savings Plan Overview

01

Visit the official CollegeChoice 529 Direct Savings Plan website.

02

Click on the 'Enroll' or 'Open an Account' button.

03

Fill in the required personal information, including your name, address, and Social Security number.

04

Select your chosen investment options based on your risk tolerance and investment goals.

05

Choose the amount you wish to contribute to your account initially.

06

Provide banking information for the account that will be used for contributions.

07

Review the terms and conditions, and confirm your understanding.

08

Submit your application, and retain a copy of your confirmation.

Who needs CollegeChoice 529 Direct Savings Plan Overview?

01

Parents or guardians planning for their children's higher education expenses.

02

Individuals looking to save money for their own continuing education.

03

Grandparents or family members wishing to contribute to a child's college fund.

04

Anyone interested in taking advantage of tax benefits while saving for education.

Fill

form

: Try Risk Free

People Also Ask about

How much is $100 a month for 18 years?

The average 529 balance is $30,295 — that can make a dent in college tuition. Learn how much money people save for college using these special accounts.

What is the downside of a 529 plan?

529 plan disadvantages The plan owner can liquidate the account or change the beneficiary at any time, as the beneficiary has no legal control over the funds. Limited investment options: Often, 529 plans offer a limited range of investment options since you must choose from the portfolio your plan offers.

How much can 529 grow in 18 years?

Investment choices can be limited. Not all 529 plans are the same. You might easily trigger a penalty. 529s count against you for federal aid. Contributions and fees can be high.

What is the 529 loophole?

A 529 college savings plan is a state-sponsored investment plan that enables you to save money for a beneficiary and pay for education expenses. You can withdraw funds tax-free to cover nearly any type of college expense.

How much is $100 a month in a 529 for 18 years?

On the 2025-2026 FAFSA, students are not required to report cash gifts from a grandparent or contributions from a grandparent-owned 529 savings plan. Because of this, grandparents can now use a 529 plan to fund a grandchild's education without impacting that grandchild's financial aid eligibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CollegeChoice 529 Direct Savings Plan Overview?

The CollegeChoice 529 Direct Savings Plan is a tax-advantaged investment account designed to help families save for future education expenses. It allows contributors to invest in various portfolios to grow their savings over time, which can be withdrawn tax-free when used for qualified educational expenses.

Who is required to file CollegeChoice 529 Direct Savings Plan Overview?

Individuals or families who are opening a CollegeChoice 529 Direct Savings Plan account, as well as those who are making contributions, may need to file relevant documentation. Additionally, account holders must report account details when filing their federal tax returns.

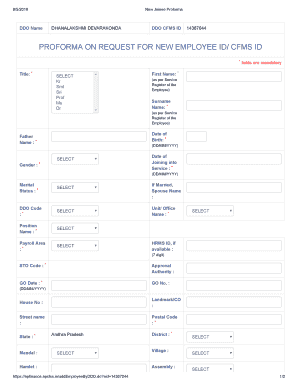

How to fill out CollegeChoice 529 Direct Savings Plan Overview?

To fill out the CollegeChoice 529 Direct Savings Plan Overview, applicants need to provide personal information such as the account owner's and beneficiary’s details, select investment options, and specify the contribution amounts. Proper documentation, including social security numbers and tax identification information, is also required.

What is the purpose of CollegeChoice 529 Direct Savings Plan Overview?

The purpose of the CollegeChoice 529 Direct Savings Plan Overview is to inform prospective participants about the plan's features, benefits, and requirements, thereby guiding them in effectively utilizing this savings tool for educational costs.

What information must be reported on CollegeChoice 529 Direct Savings Plan Overview?

The information that must be reported includes the account owner's name and Social Security number, the beneficiary's name and Social Security number, account balance, contributions made, and any withdrawals taken for qualified educational expenses. This information is necessary for tax reporting purposes.

Fill out your collegechoice 529 direct savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Collegechoice 529 Direct Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.