Get the free Schedule G - Breakdown of Monetary Expenditures by Consultant - webapp iecdb iowa

Show details

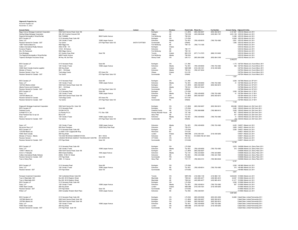

This document provides a detailed breakdown of expenses paid by a consultant on behalf of a campaign committee, including itemized expenditures and their purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule g - breakdown

Edit your schedule g - breakdown form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule g - breakdown form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule g - breakdown online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule g - breakdown. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule g - breakdown

How to fill out Schedule G - Breakdown of Monetary Expenditures by Consultant

01

Obtain the Schedule G form from the relevant regulatory authority or website.

02

Begin by entering the reporting period and identifying information at the top of the form.

03

List each consultant or vendor receiving monetary expenditures.

04

For each consultant, specify the total amount paid during the reporting period.

05

Include a brief description of the services provided by each consultant.

06

If applicable, categorize the expenses based on the type of services (e.g., legal, marketing).

07

Review the completed schedule for accuracy and completeness.

08

Submit Schedule G along with any required accompanying documentation by the due date.

Who needs Schedule G - Breakdown of Monetary Expenditures by Consultant?

01

Political committees that incur expenses for consulting services.

02

Candidates running for office who hire consultants.

03

Organizations that support political campaigns and report their expenditures.

Fill

form

: Try Risk Free

People Also Ask about

What is considered a professional fundraiser?

Professional fundraisers, known alternately as professional solicitors, fundraising counsel, or fundraising consultants, are companies and individuals in the business of providing fundraising services. Telemarketing, direct mail, and door-to-door professionals all fall under this umbrella.

What do professional fundraising fees mean?

A Professional Fundraiser is a legal term that ordinarily refers to an outside consultant that:1.) raises money, 2.) on behalf of a nonprofit, and 3.) receives compensation for his/her services. For your state's legal definition, click here.

What is a professional fundraising service IRS?

Professional fundraisers are people and companies that tax exempt entities hire to raise funds. Some fundraisers work as employees for the organizations for which they raise funds. Other fundraisers work as consultants, many independently contracted for specific fundraising activities.

What is reported on Schedule G?

Schedule G (Form 990) is used by an organization that files Form 990 or Form 990-EZ to report professional fundraising services, fundraising events, and gaming.

Who fills out the IRS Form 990?

Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations file Form 990 to provide the IRS with the information required by section 6033.

What is a professional fundraiser on 990?

A professional fundraiser can deliver services during the tax year and be properly reported on line 2b but have no gross receipts to report in column (iv). For example, an organization may retain a fundraiser to conduct a feasibility study for a capital campaign.

Where do fundraising expenses go on 990?

The fundraiser should also be reported on Part VIII of the 990 – The Statement of Revenue. Using the example above, $30,000 should be reflected on Line 1c, and $10,000 should be on Line 8a.

What is the difference between fundraising and donations?

Both fundraising and donations are essential for sustaining organizations and their missions. Fundraising involves strategic efforts to gather resources, while donations are voluntary gifts that can be spontaneous or planned. By combining these approaches, charities can maximize their impact and achieve their goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule G - Breakdown of Monetary Expenditures by Consultant?

Schedule G is a form used to report monetary expenditures made by a campaign or organization for services provided by consultants, detailing the amount spent and the nature of the services rendered.

Who is required to file Schedule G - Breakdown of Monetary Expenditures by Consultant?

Candidates, political committees, and organizations that make monetary expenditures for consulting services are required to file Schedule G as part of their financial reporting.

How to fill out Schedule G - Breakdown of Monetary Expenditures by Consultant?

To fill out Schedule G, report the consultant's name, the purpose of the expenditure, the amount paid, and the date of payment, ensuring all required fields are accurately completed.

What is the purpose of Schedule G - Breakdown of Monetary Expenditures by Consultant?

The purpose of Schedule G is to provide transparency and accountability in political financing by detailing the expenditures made for consulting services, which helps regulatory bodies monitor campaign spending.

What information must be reported on Schedule G - Breakdown of Monetary Expenditures by Consultant?

Information required on Schedule G includes the consultant's name, the date of the payment, the amount paid, the purpose of the expenditure, and any other relevant details concerning the services provided.

Fill out your schedule g - breakdown online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule G - Breakdown is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.